NEW YORK (CNN/Money) -

The Dow industrials tumbled for the fifth session in a row Tuesday, while the technology-heavy Nasdaq closed just below breakeven, after hitting a two-month low earlier in the session.

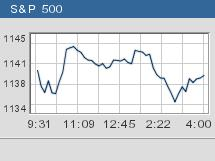

The Dow Jones industrial average (down 43.25 to 10566.37, Charts) fell 0.4 percent, while the Standard & Poor's 500 (down 1.90 to 1139.09, Charts) index lost 0.1 percent. It was the first time the two indexes had closed lower for five consecutive sessions since the period ended January 22, 2003, according to Ned Davis Research.

The Nasdaq composite (down 2.08 to 2005.44, Charts) closed just below unchanged.

Five weeks of declines on the Nasdaq led to another day of selling Monday. By early Tuesday, the battered composite had erased all of its gains for the year and then some. The composite managed to bounce off those lows by the close, but failed to find any real momentum.

The Dow, meanwhile, struggled for direction, before turning weaker in the afternoon.

"You're seeing some selling on the Dow, but I think that's just some catch up after the last few weeks of declining on the Nasdaq," said Charles Lemonides, chief investment officer at Value Works. "Overall, the market is pretty mixed."

"We've had a pullback and I think we could see 2 or 3 percent more to this pullback over the next few sessions, but I wouldn't expect anything big across the board," he added.

Wednesday brings the January read on existing home sales, which is forecast to have fallen to a 6.27 million unit annual rate in January from a 6.47 million unit annual rate in February. Lemonides said that the report could be influential to stock trading Wednesday in terms of what it says about consumer activity, particularly in light of Tuesday's weak consumer confidence report.

After leading the stock rally of 2003, the Nasdaq has seen some profit taking in the last few weeks as investors have sought to get out of some of last year's big gainers and find what they hope are stocks that have more room to rise, analysts said. That process seemed to temporarily abate Tuesday.

"It's not that sellers are rushing to dump stocks, it's more of a buyer's strike right now," said Barry Ritholtz, a market strategist at Maxim Group.

In particular, Ritholtz said, mutual fund inflows in December and January jumped to levels not seen since 2000, a sign that many investors were trying to pile in at the end of last year's rally. While he doesn't foresee a big decline now, "we had an upward move for eight to 12 months, and at some point the market needs to consolidate."

On the move

Pressuring the blue chips, aerospace and defense issues continued to fall one session after the U.S. Defense Department said it was canceling the Army's Comanche chopper, a $38 billion helicopter project that is being developed jointly by United Technologies (UTX: down $1.97 to $91.83, Research, Estimates) and Boeing (BA: down $0.40 to $43.22, Research, Estimates).

Procter & Gamble (PG: down $1.79 to $101.78, Research, Estimates) and Walt Disney (DIS: down $0.79 to $25.96, Research, Estimates) also traded lower. In the tech stock retreat of the last few weeks, many consumer names had benefited from a rotational shift, and some of those stocks now saw declines.

Influential technology issues, including Cisco Systems (CSCO: up $0.30 to $23.05, Research, Estimates), managed to edge higher, enabling the Nasdaq to stave off much in the way of losses.

In addition, the biotech sector was active and mostly higher.

Guidant (GDT: up $4.50 to $67.95, Research, Estimates) and Johnson & Johnson (JNJ: up $1.13 to $54.18, Research, Estimates) both rallied after saying that they have teamed up to promote J&J's drug-coated stent.

Meanwhile, shares of rival Boston Scientific (BSX: down $0.03 to $41.27, Research, Estimates) fell even after the company said late Monday that it expects sales to double by 2006. Boston Scientific is currently awaiting regulatory approval to market its own version of the drug-coated stent.

Another bright spot was Home Depot (HD: up $0.61 to $35.99, Research, Estimates), which reported earnings of 42 cents a share, up from 30 cents a year earlier and 3 cents a share above forecasts.

On Monday, rival Lowe's (LOW: down $0.47 to $56.20, Research, Estimates) reported higher-than-forecast earnings, but the stock edged lower as investors took a sour stance on the company's weaker-than-forecast February same-store sales.

Among the decliners, chip design software maker Synopsys (SNPS: down $4.55 to $29.88, Research, Estimates) tumbled on the Nasdaq after the company posted weaker quarterly results and said it would buy Monolithic System Technology (MOSY: up $5.97 to $12.97, Research, Estimates) for $432 million in cash and stock. Monolithic, which licenses memory technology, soared 85 percent.

Calpine (CPN: down $0.42 to $5.31, Research, Estimates) slipped in active NYSE trading after the power producer said it was forced to cancel plans to refinance around $2.3 billion in debt of one of its units due to weak demand.

Market breadth was mixed to negative. On the New York Stock Exchange, losers and winners were nearly even as 1.51 billion shares changed hands. On the Nasdaq, decliners edged advancers by eight to seven as 2.04 billion shares traded.

Also weighing on trade Tuesday: the morning's consumer confidence report. Consumer confidence fell to 87.3 in February from 96.8 last month as consumers reacted to ongoing weakness in the job market. The report initially added to the selloff, but soon got overshadowed by the bounce.

Treasury prices rose fractionally, with the 10-year note yield slipping to 4.02 percent from 4.03 percent late Monday. The dollar fell modestly versus the yen and euro.

NYMEX light crude oil futures rose 23 cents to settle at $34.58 a barrel. COMEX gold rallied $5.50 to settle at $404.80 an ounce.

Asian stocks declined Tuesday. European markets closed mostly lower.

|