NEW YORK (CNN/Money) -

U.S. stocks, which have shown signs of weakness in recent sessions after a year-long rally, may face some resistance on Friday as investors will try to digest a mid-quarter outlook from tech bellwether Intel Corp. and Friday's jobs report.

Intel (INTC: Research, Estimates), the world's largest chipmaker, disappointed some on Wall Street after the closing bell Thursday by narrowing its range of expected revenues for the first quarter to the downside.

The chipmaker said it expects first-quarter revenue to fall within a range of $8.0 billion to $8.2 billion, from its previous range of $7.9 billion to $8.5 billion.

In after-hours trading, Intel's mid-quarter report pushed its shares lower to $29.39 from their Thursday close of $29.65 on Nasdaq.

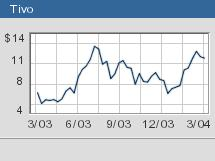

Shares of TiVo (TIVO: Research, Estimates), however, rose sharply in after-hours trading as the TV recording technology company reported a narrower fourth-quarter loss, driven by strong demand for subscriptions to its video recording service.

TiVo shares rose to $12.10 on the INET electronic brokerage system from a close of $11.46 in regular Nasdaq trading.

Shares of Mandalay Resort Group (MBG: Research, Estimates) also rose after the casino operator said fourth-quarter profit rose sharply, driven by strong hotel and convention center business at its Las Vegas properties.

Net earnings jumped to $22.8 million, or 35 cents a share, from $4.2 million, or 6 cents a share, a year earlier, the owner of the Mandalay Bay, Luxor and other mega resorts said in a statement.

In addition, Hasbro (HAS: Research, Estimates) said it will raise its quarterly dividend to 6 cents per share from 3 cents per share.

The nation's second-largest toy company, based in Pawtucket, R.I., said the dividend will be payable on May 17 to shareholders of record at the close of business on May 3.

|

YOUR E-MAIL ALERTS

|

Follow the news that matters to you. Create your own alert to be notified on topics you're interested in.

Or, visit Popular Alerts for suggestions.

|

|

|

Defense contractor Raytheon (RTN: Research, Estimates) said late Thursday it has won a U.S. Air Force contract worth up to $423.9 million for radar spares and repairs, the Defense Department said Thursday.

Separately, Raytheon's Missile Systems unit received a $175.9 million U.S. Navy contract for about 225 Tomahawk Block 4 cruise missiles and related work, the Pentagon said.

Most investors will focus on Friday's monthly employment report for February as the job market has been a weak spot in the economic recovery.

The high-anticipated jobs report, due at 8:30 a.m. ET, will help shape expectations about the Federal Reserve and its intentions on interest rates. It is expected to show 125,000 new jobs in February, according to Briefing.com.

-- from staff and wire reports

|