NEW YORK (CNN/Money) -

Wall Street will try to welcome the second quarter on a more positive note Thursday as the first quarter of 2004 ended on the downside for both the Dow and the Nasdaq.

Investors will get briefed on monthly auto sales, the producer price index and construction spending, but most will also keep an eye on Friday's monthly employment report, looking for an upturn in hiring that would sustain the economy's recovery.

Economists expect the crucial jobs report to show 123,000 new jobs created in March, after adding a surprisingly low 21,000 last month.

Worries about the stubbornly weak jobs market and high oil prices have contributed to bearish sentiment in recent weeks and emerged as a political headache for President Bush as he seeks re-election.

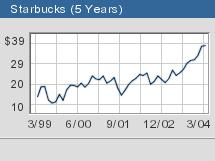

After the closing bell Wednesday, Starbucks Corp. (SBUX: Research, Estimates) shares rose after the coffee chain operator reported sales at company-operated stores open at least a year rose 12 percent in March from a year ago.

Shares of Starbucks rose to $38.03 on the INET electronic brokerage from their Nasdaq close of $37.87.

The March sales increase marked the fifth straight month of double-digit gains, and was nearly double Starbucks' official forecast of monthly gains in the range of 3 percent to 7 percent.

Bed Bath & Beyond Inc. (BBBY: Research, Estimates) shares declined despite the company's posting of a 37 percent rise in quarterly earnings that topped Wall Street expectations.

Shares of Bed Bath & Beyond fell to $41.75 on INET from their Nasdaq close of $41.90.

SuperGen Inc. (SUPG: Research, Estimates) stock fell sharply after it said that patients taking its drug to treat a group of blood disorders progressed more slowly to leukemia or death in a late-stage trial than patients who did not receive the treatment.

|

YOUR E-MAIL ALERTS

|

Follow the news that matters to you. Create your own alert to be notified on topics you're interested in.

Or, visit Popular Alerts for suggestions.

|

|

|

Shares of SuperGen, a biotechnology company, fell more than 26 percent to $9.45 in active trade on INET, down from their close of $12.80 on the Nasdaq.

After the close, SuperGen said it plans to seek U.S. marketing approval of the medicine, Dacogen, based on data from the trial, which involved 170 patients in North America. But it also said more side effects were seen in patients taking its drug.

American Eagle Outfitters Inc. (AEOS: Research, Estimates) stock rose after the retailer said its comparable sales so far in March were up 7.8 percent because of improved sales in its men's and women's divisions and strong operating margins.

Shares of American Eagle, which sells casual clothing, rose to $28.45 on INET, up from their close of $26.95 on the Nasdaq. The retailer also pegged first-quarter earnings of 25 cents to 30 cents a share, above Wall Street's average view of 16 cents, according to Reuters Research, a unit of Reuters Group Plc.

-- from staff and wire reports

|