NEW YORK (CNN/Money) -

Treasury prices dipped Thursday after a surprising drop in first-time jobless claims provided more evidence the labor market was improving, which could speed the day when the Federal Reserve raises interest rates.

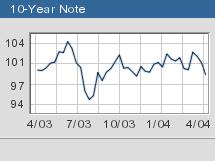

At about 3:30 p.m. ET, the benchmark 10-year note fell 7/32 of a point to 98-14/32 to yield 4.19 percent, up from 4.15 percent late Wednesday, and the 30-year bond dropped 10/32 to 105-3/32 to yield 5.03 percent, up from 5 percent even late a day before.

The two-year note stood unchanged at 99-10/32 to yield 1.86 percent and the five-year note lost 3/32 of a point to 99-19/32 with a yield of 3.21 percent.

The central bank has made it clear it would like to see several months of solid job gains before it begins to tighten monetary policy. Some think the recent strides in employment could be the foundation for such a move.

"The lower-than-expected number of new jobless claims shows that the labor market is continuing to improve," Gary Thayer, chief economist at A.G. Edwards and Sons, told Reuters. "It suggests that the economy is strong and that companies are feeling more comfortable about hanging on to workers."

The government said first-time jobless claims fell to 328,000 in the week ended April 3 from 342,000 in the prior week. Economists had forecasted a slighter dip to 340,000.

In addition, the government reported that inventories at American wholesalers surged by a larger-than-expected 1.2 percent in February, the biggest jump since 1999, but were still unable to keep up with sales that rose 1.3 percent.

Economists said the unexpectedly robust rise in February wholesale stocks, as well as upward revisions for January, could boosts forecasts for first-quarter economic growth.

In the final three months of 2003, the economy grew at a 4.1 percent annual rate and many analysts expect the first quarter of 2004 to post a similar growth rate.

"The drop in the (weekly) jobless claims number was key to the market's early weakness," Ralph Axel, senior vice president and fixed-income strategist at HSBC Securities, told Reuters.

Axel said that especially after the stronger-than-expected March U.S. payrolls report, the significance of that report was "at the forefront" for market participants.

The market is debating whether the strong March payrolls data were part of a trend or an outlier, and whether the latest drop in first-time jobless claims argued that apparent labor market strength in March was not a one-time occurrence but indicative of a stronger trend in employment.

While these data typically do not move the financial markets, February wholesale inventories were so much stronger than expected that it, too, put early pressure on bond prices.

"Overall, the new data were very positive for the economy and bad for bonds," Axel said.

In the currency market, the dollar gained against the euro and Japanese yen as investors bid the U.S. currency higher amid the lure of higher rates in some securities, such as certificates of deposit.

The euro bought $1.2080, down from $1.2173 late Wednesday, and the dollar bought ¥106.32, up from ¥105.34 late in the prior session.

-- Reuters contributed to this story.

|