NEW YORK (CNN/Money) -

Technology stocks closed in the minus column Tuesday as investors worried that a robust retail sales report meant an earlier-than-expected rise in interest rates.

The tech-laced Nasdaq composite index lost 35.40 points, or 1.7 percent, to close at 2,030.08.

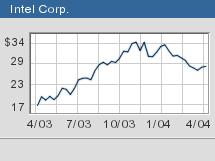

Tech watchers also kept an eye on an important earnings report from the world's largest chipmaker, Intel Corp. (INTC: Research, Estimates).

After the closing bell Tuesday, the chip giant reported a sharply higher quarterly profit as the microchip producer benefited from stronger computer demand, but Intel missed Wall Street's earnings and sales targets.

For the first quarter, Santa Clara, Calif.-based Intel said it earned $1.7 billion, or 26 cents a share, on revenue of $8.1 billion. In the same period a year earlier, Intel reported a profit of $915 million, or 14 cents a share, on revenue of $6.75 billion.

Shares of Intel rose to $27.80 on the INET electronic brokerage system from a close at $27.67 in regular Nasdaq trade, then dipped to $27.41.

The Philadelphia Semiconductor index fell 9 points, or 1.7 percent, to 506.25, while the American Stock Exchange Computer Hardware index lost 5.82 points, or 3.4 percent, to 165.85.

Shares of Apple Computer (AAPL: down $1.11 to $26.93, Research, Estimates) fell amid news that some buyers of its popular iPod Mini digital music players were reporting problems with the headphone jacks.

The Macintosh computer maker also said it plans to trim the price on one of its entry-level Macintosh computers by $100 to $999 and upgraded the microprocessors and other components on the eMac line.

Bad news in Iraq and fears there could be more bombings such as those in Madrid last month actually meant great news to homeland security stocks.

Blue-chip stock General Electric Co. (GE: Research, Estimates) said last month it plans to buy bomb-detection equipment maker InVision Technologies Inc. (INVN: down $0.07 to $49.55, Research, Estimates) for about $900 million.

The move has also sparked hopes for smaller public companies that may soon be bought for more than their current trading prices, sending shares higher.

Shares of Spectrum (SSPI: up $2.12 to $3.87, Research, Estimates) finished 120 percent higher after the maker of equipment to process voice and data signals said it won a contract to provide systems for a ground-based mobile warfare system.

The stock has soared 190 percent since national security advisor Condoleezza Rice's testimony on April 8.

Viisage Technology Inc. (VISG: up $2.55 to $13.25, Research, Estimates), a maker of identity software, was up 24 percent, while shares of Irvine Sensors (IRSN: up $0.87 to $4.20, Research, Estimates), a developer of miniaturized sensors and cameras, rose 26 percent.

|