NEW YORK (CNN/Money) -

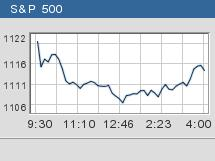

Stocks fell sharply Thursday but ended off their worst levels of the session as investors fretted about rising interest rates, oil prices and Friday's monthly employment report.

A big jump in interest rates could choke off the economic recovery and put a serious dent in corporate profits and stock prices.

The Nasdaq composite lost 1 percent, while the Dow Jones industrial average and the Standard & Poor's 500 index both lost nearly 0.7 percent. All three indexes had been weaker in mid-afternoon trading.

Stocks fell throughout the session on worries about rates. While those worries remained, the selling pressure eased by the close.

General worries about rising rates have left markets rangebound and jittery for several weeks, but the pressure intensified this week after the Federal Reserve held short-term rates steady Tuesday at a more than 40-year low, -- at the same time indicating rates will rise sometime this year. The central bank also said the risks of inflation and deflation, when prices are falling too rapidly, were balanced.

"Stocks are really feeling the brunt of the expectation of higher rates," said Peter Green, a technical market analyst at MKM Partners. "The market is down not only because of the change in language in the Fed statement, but because the Fed was not clear about the timing of the rates, and the market wanted more certainty."

Right now, fed funds futures contracts indicate a 100 percent likelihood that rates will rise by 25 basis points at the August meeting. But Fed watchers say rates could rise perhaps as soon as at the June 30 meeting, or by more than 25 basis points.

Investors have been scouring every bit of economic data for clues that might push the Fed to move. They'll be looking especially closely at Friday's jobs report for April for some sense of a timeline.

Due before the start of trading Friday, the monthly employment report is expected to show that businesses added about 165,000 jobs to their payrolls in April, according to a consensus of economists surveyed by Briefing.com, after adding 308,000 new jobs the previous month. The unemployment rate is expected to hold steady at 5.7 percent.

However, it is unclear what kind of reaction the market will have should the report miss, meet or beat expectations.

"We're in that dreadful point in investor psyche where bad news is bad news and good news is bad news," said Art Hogan, chief market analyst at Jefferies & Co.

Due Friday after the open is the March reading on wholesale inventories. Its expected to have risen 0.5 percent after rising 1.2 percent in February. However, the March indicator is bound to be overshadowed by the more timely jobs report.

Thursday's trouble

The weekly jobless claims report showed that new claims for unemployment fell last week to 315,000 from an upwardly revised 340,000 the previous week. Economists surveyed by Briefing.com expected a drop to 335,000.

While a drop in jobless claims is a positive, investors also seemed to take it as a sign that Friday's monthly employment report will be particularly strong. If that's the case, that could mean the Fed will start pushing short-term rates higher sooner rather than later.

"The Fed said rates are going higher, which was no surprise," Hogan added. "But when you're in an interest rate rising environment, all the smatterings of what would be considered good news look like a confirmation that rates will rise."

Also released Thursday morning was the initial read on first-quarter business productivity, which rose at a 3.5 percent rate versus a revised 2.5 percent pace in the fourth quarter, in line with expectations. However, the unit labor costs component rose, signaling that inflation is indeed moving back up.

Oil prices played a role in Thursday's selloff. Light crude oil futures fell 20 cents to settle at $39.37 a barrel, just below 13-year highs of $39.97 hit Thursday morning.

But the fact that oil stocks are not responding much to higher oil prices and seem to have peaked is a worry, as oil stocks are usually among the last groups to tap out, said MKM's Green.

"The fact that they are tapping out now suggests that the rally has passed," he said. "Even though the economic numbers have been getting stronger, the stock market is looking out six months from now and telling me that the economic recovery is going to have a slower period."

What moved?

Most Dow stocks fell, with 25 of 30 of the industrials losing ground. Home Depot (HD: down $0.90 to $34.36, Research, Estimates) and General Motors (GM: down $1.29 to $46.27, Research, Estimates) were particularly weak.

On the Nasdaq, 8 of the 10 most heavily-weighted issues tumbled, including Amgen (AMGN: down $0.60 to $57.78, Research, Estimates) and Yahoo! (YHOO: down $0.80 to $52.36, Research, Estimates), both down more than 1 percent.

In corporate news, April retail sales were mixed, as had been expected. Wal-Mart Stores (WMT: down $1.28 to $54.58, Research, Estimates) shares weakened after the leading retailer said that sales at stores open a year or more, or same-store sales, rose 4.4 percent, essentially in line with its forecast.

Dow component Citigroup (C: down $1.12 to $47.51, Research, Estimates) lost 2.3 percent after saying late Wednesday that the Securities and Exchange Commission is probing its accounting for its Argentina business during 2001 and 2002, when the company took a large charge related to the country.

Calpine (CPN: down $0.25 to $3.90, Research, Estimates) lost 6 percent and topped the New York Stock Exchange's most-active list after the power producer reported a wider quarterly loss, hurt by low electricity profit margins, because of mild weather and higher costs from new power plants.

Gemstar-TV Guide International (GMST: down $0.90 to $4.76, Research, Estimates) fell 16.6 percent after warning that its 2004 earnings would miss estimates because of high legal costs and other expenses. The warning overshadowed its first-quarter results, in which it posted a narrower loss.

Market breadth was negative. On the NYSE, losers beat winners by more than four to one as nearly 1.5 billion shares changed hands. On the Nasdaq, decliners beat advancers by about seven to three as 1.75 billion shares traded.

COMEX gold fell $5.40 to settle at $388.40 an ounce.

Treasury prices inched lower, with the 10-year note yield rising to 4.60 percent. The dollar rose versus the yen and euro.

|