NEW YORK (CNN/Money) -

Treasury prices rose Wednesday thanks to weaker-than-expected economic numbers and the announcement by U.S. officials that terrorists will probably try to attack the United States in the coming months.

An upbeat two-year note sale also gave the Treasury market a lift.

The dollar was mixed against the euro and the yen.

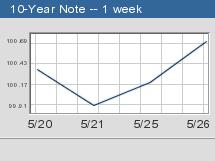

The benchmark 10-year note added 16/32 of a point in late trading, or $5 on a $1,000 note, to 100-22/32. The yield on the 10-year sank to 4.66 percent from 4.73 percent late Tuesday.

The 30-year bond jumped 20/32 of a point to 100-3/32 to yield 5.37 percent, down from 5.41 late yesterday. Bond prices and yields move in opposite directions.

The two-year note rose 6/32 to yield 2.44 percent, and the five-year note climbed 13/16 to yield 3.79 percent.

The government's $25 billion auction of two-year Treasury notes drew solid demand Wednesday and gave bond prices a lift.

The notes were sold at a high yield of 2.538 percent, with a 2.32 ratio of bids offered over those accepted. The last two-year note sale drew bids for 2.11 times the amount on offer.

Security concerns also pushed investors into safe-haven bonds after U.S. Attorney General John Ashcroft said intelligence reports indicate that al Qaeda intends to attack the United States as early as this summer.

Weak readings on durable goods orders and new homes sales boosted bonds and pressured the dollar.

The data could mean that inflation is not growing as quickly as expected, which is positive news for bond investors as higher inflation erodes the fixed return on Treasurys.

April orders for U.S. durable goods posted the largest drop in 20 months, the government reported Wednesday, coming in well below economists' forecasts.

New home sales sank 11.8 percent in April, the biggest monthly decline in 10 years, and the supply of new homes hit its highest level since 1980, suggesting higher mortgage rates were crimping demand.

While the weaker-than-expected data gave Treasurys a lift, currency traders worried that the numbers may keep the Federal Reserve from raising short-term interest rates soon.

Higher rates would boost yields of U.S.-based assets, making them more appealing to global investors who must buy dollars if they want to invest.

In currency trading, the dollar slipped against the euro and rose against the yen.

The euro bought $1.2106 late in New York, up from $1.2097 late Tuesday.

The dollar bought ¥111.90, up from ¥111.76.

|