NEW YORK (CNN/Money) -

Abercrombie & Fitch's sequel to those racy quarterlies is free, far tamer than its predecessor, and you don't have to be over 18 to get one.

But some advocacy groups argue the publication, titled young, is still too PG-13 rated for their taste.

Abercrombie spokesman Tom Lennox described the summer publication as a "photo essay."

"Unike the quarterly, young is a collection of black and white photographs of models wearing our brand clothes and there's no editorial content in it at all," Lennox said.

According to Lennox, the retailer quietly began distributing the publication in April to a limited list of its former quarterly subscribers.

The almost clandestine nature of the young launch is somewhat uncharacteristic of the retailer that's well-known for openly courting controversy with its "sex sells" style of marketing campaigns.

At the same time, it's not entirely surprising, given the backlash the retailer faced last year that eventually forced it to pull the plug on the A&F quarterlies that featured nude "teenage-looking" models in highly suggestive poses.

A new leaf?

So with young, is Abercrombie (ANF: Research, Estimates) telling the world that it's cleaning up its act?

|

|

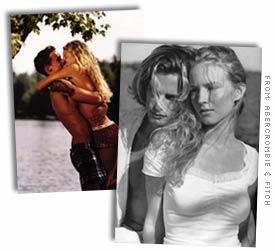

| The picture on the left is from A&F's 2003 winter quarterly. On the right is a "tamer" black&white picture from the new "young" issue. |

Not quite, said Lennox. "The A&F Quarterly was very creative and we had those out since 1997. It was just time for us to move in another direction," he said. "We do want to appeal to a wider consumer base but the brand will continue to be marketed as fun, sexy and with a definite edge."

To prove that point, the retailer ruffled feathers once again by selling a T-shirt this year bearing the slogan "It's all relative in West Virginia."

Meanwhile, advocacy groups such a Citizens for Community Values (CCV) say that while the new publication is "much improved" over the past, it's still unacceptable to them.

"The young book is the first response from the Abercrombie after they ended the quarterly. But we find that they're still pushing the envelope," said Phil Buress, president of CCV.

Buress takes issue with the fact that it contains some photographs of young people wearing skimpy clothes "posing provocatively."

"A clothing retailer is supposed to sell clothes. We think it is irresponsible to use sex to sell to teenagers," said Buress.

For its part, Abercrombie said the plans for young are still evolving. "We don't want to tip our hand on this," said Lennox. "It could evolve into a quarterly and it may feature editorial content down the road."

Analysts side with Abercrombie

An "older" issue with Abercrombie, however, has been its inability to grow sales. The retailer last year posted a 10-month losing streak in comparable sales -- or sales at stores open at least a year.

The retailer broke that protracted downtrend early this year, posting marginal comparable sales increases in both January and February and flat April same-store sales versus expectations for a decline.

The New Albany, Ohio-based retailer runs a total of 706 stores, including 170 Abercrombie stores and 177 Hollister Co. stores around the country.

J.P. Morgan analyst Brian Tunick, who has an "overweight" rating on the company, says he's increasingly convinced that Abercrombie is becoming a top-line growth story once again.

The retailer earlier this month posted a 16-percent increase in net income on a 19-percent rise in sales to $412 million for the quarter, led by gains at its Hollister division.

"The good news continue to be the fact that with growth in its Hollister division, a fast-growing Internet business, a new concept coming in the third quarter and flattish comps (sales compared to last year) in the core adult business, healthy top-line growth should be sustainable," Tunick said. "Also, Abercrombie's men's business is finally beginning to show some life after three years of negative comparable sales."

About the new concept, Abercrombie's Lennox said the company is currently developing a new "lifestyle" brand and expects to debut the concept in August.

Tunick thinks the concept will target an older consumer than the retailer's current brands. "We believe this concept will have similar price points and target the same demographics as Banana Republic and J. Crew," he said.

Shares of Abercrombie are up about 57 percent year-to-date and are trading around their 52-week high.

--Tunick does not personally own shares of Abercrombie & Fitch and his firm does not have an investment banking relationship with the company.

|