NEW YORK (CNN/Money) -

eBay reported robust second-quarter sales and earnings that beat Wall Street expectations. But the company's guidance for the third quarter and remainder of the year disappointed Wall Street, causing the stock to plunge after-hours.

The San Jose, Calif.-based online auction giant posted net income of $190.4 million, or 28 cents a share, compared to earnings of $107 million, or 16 cents a share a year ago.

Excluding one-time items, eBay reported earnings of 29 cents a share. Analysts had been expecting earnings of 27 cents a share, according to Thomson First Call.

Sales came in at $773.4 million, up 52 percent from a year ago and ahead of consensus estimates of $769.3 million.

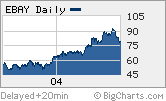

Shares of eBay (EBAY: Research, Estimates) fell nearly 5.5 percent in after-hours trading after dropping $3.35, or 4.2 percent, to $76.60 in trading on the Nasdaq Wednesday.

The stock is still up nearly 20 percent year to date, but it has pulled back sharply from its highs in recent weeks. eBay has fallen 17 percent since the beginning of July on worries about sluggish retail sales and valuation concerns. eBay trades at 64 times 2004 earnings estimates.

Good, but not good enough

Although the company raised guidance for the remainder of 2004, investors seemed to be underwhelmed, because eBay's new targets are below consensus estimates. In other words, Wall Street wanted more.

|

|

| Despite strong 2Q results, eBay's recent slide may continue. |

eBay said that for the full year, sales could come in as high as $3.185 billion while earnings, excluding charges, would be about $1.17 a share. In April, the company said it expected sales to be as high as $3.15 billion and that earnings would be about $1.13 a share.

But analysts were expecting sales of $3.21 billion and earnings of $1.19 a share.

And for the third quarter, eBay said that sales would be $770 million while profits on a pro forma basis would be 25 cents a share. That's also below the consensus estimates of $777 million in revenue and earnings of 27 cents a share, excluding charges.

| Related stories

|

|

|

|

|

"The guidance is disappointing relative to where the Street was already heading into these results," said Derek Brown, an analyst with Pacific Growth Equities."It's important to remember that eBay's history is one of fairly sizable outperformance with commensurate increases to future guidance."

Overall though, it's hard to find anything really wrong with eBay's performance. The company did particularly well internationally, with international net transaction revenues increasing 76 percent from last year. More than 40 percent of eBay's total revenues came from outside the United States.

The company also said that new listings were up 48 percent from a year ago, a sign that buyers and sellers are still not running out of things to sell on the site. And gross merchandise volume, the value of all things sold on eBay, was $8 billion, up 42 percent from the same period last year.

Hit by the seasonal retail slowdown

But Safa Rashtchy, an analyst with Piper Jaffray, said that one minor negative was that eBay's transaction processing unit, PayPal, reported flat sequential sales growth. U.S.-based transaction revenue was down slightly on a sequential basis as well.

During a conference call with analysts, eBay CEO Meg Whitman conceded that the company has grown to a point where it will fall victim to the same cycles that affect other consumer-oriented companies in the second and third quarters, which are usually not as strong as the first and fourth quarters.

"There's no question that seasonal trends are becoming more pronounced as eBay becomes more mainstream," said Whitman.

Rashtchy said this was not a major cause for concern. But investors might have been counting on eBay to remain immune from the typical mid-year slowdown in consumer spending.

"It's still a good quarter but it seems like seasonality is hitting eBay more seriously than in the past," said Rashtchy. "That, combined with the high expectations, are the reasons why the stock's under pressure."

eBay's results dragged down shares of other Internet stocks after the bell Wednesday. Online media company Yahoo! (YHOO: Research, Estimates), which also reported strong second quarter results earlier this month but was punished nonetheless, declined 2 percent. Amazon.com (AMZN: Research, Estimates), which will report its second quarter results after the bell Thursday, fell more than 3 percent. Overstock.com (OSTK: Research, Estimates) also dropped about 3 percent.

In separate news, eBay said that it had agreed to settle a patent infringement lawsuit brought against it and PayPal by AT&T last year. eBay did not disclose the terms but said it would not have a material impact on its financial results.

Analysts quoted in this story do not own shares of eBay and their firms have no investment banking ties with the company.

|