NEW YORK (CNN/Money) -

Microsoft Corp. reported strong gains in sales and profits for the latest quarter Thursday thanks to robust sales of software for personal computers and servers, but the stock fell Friday morning on disappointment over its outlook.

The Redmond, Wash.-based company, the world's biggest software maker, said net income rose to $2.7 billion, or 25 cents a share, in its fiscal fourth quarter ended June 30, from $1.5 billion, or 14 cents, a year earlier.

This year's figure includes the cost of Microsoft's restricted stock program as well as a tax benefit. Backing those items out, Microsoft's profit was 28 cents a share, a penny below Wall Street's expectations of 29 cents. The company posted earnings of 23 cents a year ago, excluding charges.

Microsoft reported sales of $9.3 billion in the quarter, a 15 percent increase from $8.1 billion a year ago and ahead of the consensus estimate of $9.1 billion.

The news came as Wall Street was still buzzing about the company's plan, announced Tuesday, to return $75 billion to shareholders over four years through a stock buyback program, one-time special payout and increased dividend.

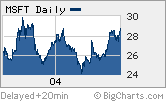

Shares of Microsoft (MSFT: Research, Estimates) sank more than 2 percent Friday morning on mixed guidance for the company's fiscal first quarter of 2005, which ends in September.

Still, the stock has shown signs of breaking out lately after being stuck in a narrow range for the past 2-1/2 years. Microsoft gained nearly 6 percent this week thanks to the announcement of the cash management plan. So in some respects, the earnings news is a bit anticlimactic.

"The stock has run up a bit recently. This might just be people taking money off the table," said Robert Lund, an analyst with independent research firm Weikko Securities.

Sales higher than expected...but so are costs

Microsoft said that earnings, excluding the cost of restricted stock for employees, would be about 30 cents a share in its fiscal first quarter. Wall Street had been expecting 32 cents, according to First Call.

The company did provide bullish sales guidance though, saying it expected sales for the quarter of $8.9 billion to $9 billion. The consensus estimate was $8.8 billion.

| More about Mr. Softee

|

|

|

|

|

Michael Cohen, director of research with Pacific American Securities, said it was encouraging to see strength across all of Microsoft's major operating segments.

In particular, Microsoft's server and information worker software segments, two of its largest, both reported sales gains above 20 percent.

So Cohen said it did not appear that demand is waning for technology but that it was confusing to see higher-than-expected sales not filtering down to the bottom line.

"It seems that Microsoft is doing well across all its businesses. However, its profitability is being called into question," he said.

For the full year, Microsoft raised its sales forecasts, but that merely brought its targets in line with what Wall Street had been expecting. Microsoft said sales in fiscal 2005 would be $38.4 billion to $38.8 billion. The midpoint is a hair below Wall Street's prediction of $38.64 billion.

And the company trimmed its profit outlook. Microsoft said full-year earnings in 2005 would be $1.21 to $1.24 a share, excluding the restricted stock costs. Analysts were forecasting $1.34 a share.

"This could be a little bit of conservativeness on Microsoft's part. Wall Street was already above their guidance," said Alan Davis, an analyst with McAdams Wright Ragen. "But investors would have liked to see more on the bottom line. Operating costs were a little bit higher than expected. That was the negative."

Davis added that a drop in interest income appeared to drag down earnings as well and that the prospect of lower interest income going forward was probably a factor in the reduced guidance for the fiscal first quarter and full year as well. Since Microsoft is now planning to distribute a large portion of its cash to shareholders, it will have a lower amount of money parked in interest-generating securities.

To that end, Microsoft chief financial officer John Connors said during a conference call with analysts that the company did shift some of its cash into shorter-term investments that are more liquid in anticipation of the announcement of the cash management plan.

Growth isn't gangbusters

Microsoft posted fiscal 2004 sales of $36.8 billion, a 14 percent increase from fiscal 2003. Earnings, excluding legal settlement costs, restricted stock charges and the tax benefit, came in at $1.25 for the year.

So another problem for investors could be that Microsoft is still not expected to generate significant earnings or sales growth next year. Based on its new targets, the company is predicting a sales increase of about 4.5 to 5.5 percent and a slight earnings decline.

Connors added during the conference call that the company expects corporate spending to remain strong in the second half of this year but that soon afterwards, the company would run into tough year-over-year comparisons in the first half of 2005. In addition, Connors said that consumer spending will probably slow.

As such, Microsoft is expecting PC shipment growth in fiscal 2005 of about 7 to 9 percent, down from growth in the mid-teens this fiscal year.

The issue of slowing growth has nagged the stock for the past few years. In fact, some have argued that Microsoft has matured and therefore needed to give back as much of its cash to shareholders as it could to rejuvenate the stock.

Microsoft finished the fourth quarter with $60.6 billion in cash, up from $56.4 billion at the end of March.

But another crucial point seemed to indicate that Microsoft has better days ahead, at least from a sales perspective. Unearned revenue, a key measure of sales that Microsoft expects to book in the future from software license renewals, was $8.17 billion, up more than $650 million from the prior quarter.

That reversed a three-quarter decline that had worried Wall Street. In addition, the increase was a bit larger than Wall Street was expecting; several analysts were hoping for an increase of $300 million to $400 million.

Lund said that this was noteworthy because many other large software companies had issued second-quarter earnings warnings due to lackluster demand.

"There had to be higher-than-expected software renewals. Given that other software firms said companies are opting not to renew their licenses, this is a big positive," Lund said.

Analysts quoted in this story do not own shares of Microsoft and their firms have no investment banking ties to the companies.

|