NEW YORK (CNN/Money) -

Blue chips gained, and the broader market held the unchanged line Monday as investors took in stride the weekend warning that terrorists might attack financial targets.

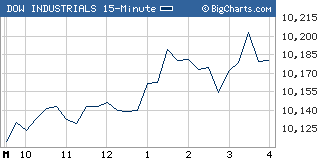

The Dow Jones industrial average (up 39.45 to 10,179.16, Charts) and the Standard & Poor's 500 (up 4.90 to 1,106.62, Charts) index both gained around 0.4 percent.

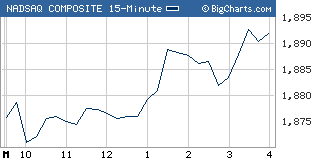

The Nasdaq composite (up 4.73 to 1,892.09, Charts) ended the session with gains of around 0.25 percent, recovering from a morning decline.

Stocks had fallen in the morning on weekend reports that Citigroup, Prudential and the New York Stock Exchange were among the targets at risk of a potential al Qaeda attack. The Department of Homeland Security, citing intelligence from multiple sources, issued the warning and raised the terror alert level in New York, New Jersey and Washington, D.C.

Citigroup (C: up $0.23 to $44.32, Research, Estimates) and other financials tumbled in the morning, as did a number of technology shares on the Nasdaq. But the declines were mild in comparison to expectations, and the market began a recovery in the late morning, highlighted by strength in blue chips. That continued throughout the afternoon.

A strong earnings report and forecast from Dow component Procter & Gamble helped support the blue-chip average, while the Nasdaq was able to stabilize thanks to a bounce in semiconductors and other key sectors.

The lack of a major sell-off seemed to confirm the stabilization phase the market has been in very recently. After a troubling July, in which stocks tumbled on a mix of worries about higher oil prices and dwindling second-half corporate profits, the major indexes managed a rise last week.

"I think the takeaway from today has got to be extremely positive, in light of what came out over the weekend," said Robert T. Mikkelsen, senior managing director of equity capital markets at Advest Inc. "The fact that the markets really shrugged it off very well says a lot about the underlying tone."

After the close, Priceline.com (PCLN: up $0.05 to $23.73, Research, Estimates) reported second-quarter earnings of 32 cents per share, a penny more than expected and up from 20 cents a year ago.

However, the company issued third-quarter guidance that was short of expectations, saying it expects to earn between 25 cents and 30 cents per share, versus expectations for a profit of 31 cents per share. Shares fell in after-hours trade.

Earnings reports are due before the open from Coach (COH: Research, Estimates), Martha Stewart Living Omnimedia (MSO: Research, Estimates), Qwest (Q: Research, Estimates) and Tyco (TYC: Research, Estimates).

Economic reports are due before the open on personal income and spending for June.

Personal income is expected to have risen 0.3 percent in June, after rising 0.6 percent in May. Personal spending is expected to have fallen 0.1 percent in June after rising 1.0 percent in May.

Reports are also due during the session on auto and truck sales.

Over the next few days, "the immediate impact of the terror threat will fade, and I think the market focus will turn to the monthly jobs report due Friday," said Mark Bryant, senior vice president at Brean, Murray & Co.

What moved?

Supporting the Dow was Procter & Gamble (PG: up $1.19 to $53.34, Research, Estimates), which gained 2.3 percent after reporting fiscal fourth-quarter earnings of 50 cents per share, up from 34 cents a year earlier and two cents more than expected, thanks to strong beauty-product and health-care sales. The company also issued a bullish forecast for the current quarter and fiscal 2005.

Other Dow gainers included 3M (MMM: up $1.19 to $83.55, Research, Estimates) and Intel (INTC: up $0.52 to $24.90, Research, Estimates). All in all, 25 out of 30 Dow components gained.

On the New York Stock Exchange, Cox Communications (COX: up $5.58 to $33.16, Research, Estimates) rallied more than 20 percent in active trade, after its parent company Cox Enterprises announced a $7.9 billion proposal to buy all outstanding shares and take the cable TV provider private.

That served to spark other cable providers, including Comcast (CMCSA: up $1.35 to $28.75, Research, Estimates) and Cablevision Systems (CVC: up $1.87 to $19.34, Research, Estimates). Cablevision was mentioned as a potential buyout target, as well.

In addition to the usual technology suspects weighing on the Nasdaq, for-profit colleges tumbled. Corinthian Colleges (COCO: down $8.43 to $10.29, Research, Estimates) lost 45 percent and topped the Nasdaq's most-actives list after the company cut its fiscal fourth-quarter and full-year earnings forecast, citing weaker revenue and higher costs.

Corinthian dragged down sector mates including Career Education (CECO: down $4.21 to $29.60, Research, Estimates), which lost close to 13 percent.

Market breadth was mixed. On the New York Stock Exchange, advancers beat decliners three to two on volume of 1.27 billion shares. On the Nasdaq, losers topped winners by nine to seven on volume of 1.54 billion shares.

Manufacturing zooms

The morning's economic news was mixed.

The Institute for Supply Management's manufacturing index rose to 62 in July from 61.1 in June, as had been expected.

But construction spending fell 0.3 percent in June, after rising a downwardly revised 0.1 percent in May. Economists were predicting an unchanged reading.

NYMEX light crude oil futures closed at a new all-time high of $43.82 a barrel Monday, up 2 cents from Friday's close, which was also an all-time high.

Among other commodities markets, COMEX gold added 70 cents to settle at $394.40 an ounce.

Treasury prices rose, pushing the 10-year note yield down to 4.45 percent from 4.47 percent late Friday. The dollar declined against the yen and was little changed against the euro.

|