NEW YORK (CNN/Money) - Upstart extreme sports are getting all grown up.

|

|

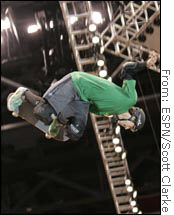

| ESPN's X-games are the leader in what has become a crowded extreme sports field on television. |

The X-Games, the made-for-TV event that started it all, celebrates its Xth year on the air this weekend with the first live broadcasts of the summer edition of the competition on ESPN and ABC. The Staples Center in Los Angeles will be packed with fans watching athletes perform tricks on skateboards, bikes, inline skates and motorcycles.

But while the X-Game once had the extreme sports space all to itself, today extreme sports are bursting out all over.

There's Fuel, a new all-extreme sports digital cable channel from Fox. NBC and Clear Channel are planning to launch an extreme sports tour next spring. And the Gravity Games, NBC's former extreme sports offering, have found a new home on the Outdoor Life Network, the cable channel whose best known sports offering is the Tour de France.

The question now is whether the sports have grown faster than viewer interest can realistically support.

The idea of skateboarding or inline skating as a competition sport might strike older viewers as laughable. After all, the sports themselves are even younger than many of their youthful participants.

But network executives aren't laughing. In fact, Fox Sports chairman David Hill predicted earlier this year that skateboard legend Tony Hawk would be the most important U.S. athlete of the next decade.

There are two simple reasons for the interest in such sports: no expensive rights fees, and a television audience of young males turned off by more mainstream team sports.

"It does really well with 12- to 34-year olds, and the sweet spot is even younger, 12- to 17," said ESPN spokesman Josh Krulewitz. "The median viewership age is right around 27. Nothing else we have is even in the 20s."

| SportsBiz

|

|

| Click here for SI.com sports coverage

|

|

|

|

ESPN's NFL football has a median viewership age of 42, meaning half of viewers are older and half are younger than that. Its Major League Baseball coverage's median age is 48, while golf is 55.

Despite the enthusiasm, the viewership is still more niche than powerhouse. Last year's best rating for the Summer X-Games on ABC was a 2.2 on Aug. 17 -- that's barely half the rating the network got for the final game of the little-watched Stanley Cup finals between Calgary and Tampa Bay.

"It's not as much about the quantity of viewers, it's about quality," said C.J. Olivares, vice president of programming & marketing for Fuel. "If you're trying to be efficient reaching 13- to 24-year olds, we're going to be a very efficient place to reach them."

Olivares says Fuel, though not yet profitable, has consistently topped viewership and advertising targets in its first 13 months on the air. The network is also projecting rapid growth for at least the next 18 months.

Plenty of product or nearing saturation?

Olivares insists that both supply and demand of extreme sports are more than enough to support all the different broadcasters now crowding into the field.

Others aren't so sure.

"I don't think everyone will make the cut because I don't think they all have resources behind them to be successful," said NBC spokesman Kevin Monaghan.

The Sporting Goods Manufacturers Association estimates that 19 million Americans age 6 and older participate in inline skating, putting it ahead of all team sports other than basketball, as well as more established individual sports like tennis, skiing or ice skating.

Participation and viewership interest are not necessarily as related you might expect. Inline skating falls just behind darts in participation, and no one is suggesting that darts would make compelling television (at least on this side of the Atlantic).

But extreme sports seem to have achieved a cultural impact other games would kill to have.

"In every just about every school in the country there are young boys wearing baggy cargo pants and skaters' shoes from a skate co, and they may not skate at all," said Olivares. "They have adopted the lifestyle."

So even if we're approaching the point of extreme sports overload, we're probably not there yet.

"You only know whether you're there after saturation happens," said television sports consultant Neal Pilson. "At this point, there seems to be sufficient sponsor support."

That's not to say extreme sports are about to become the nation's pastime. "I don't see it turning into Major League Baseball or NFL football," said Pilson. "But it's still a growing segment of televised sports that works well as an economic unit."

That means that today's extreme sports fans will probably get a chance to take their own kids to the events someday, where they will bore them with talks about the sports' golden era and great stars of their youth.

|