NEW YORK (CNN/Money) -

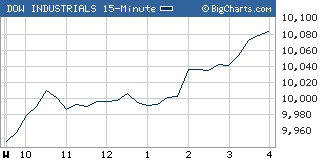

Stocks rose for the fourth straight session Wednesday, pushing the Dow industrials back above 10,000, as investors scooped up beaten-down shares and took the latest jump in oil prices in stride.

Whether the rally will spread to a fifth straight session was unclear. S&P and Nasdaq futures pointed to a slight drop at the open Thursday, when fair value is taken into account.

The Dow Jones industrial average (up 110.32 to 10,083.15, Charts) gained 1.1 percent, ending above the psychological barrier of 10,000 for the first time since Aug. 4.

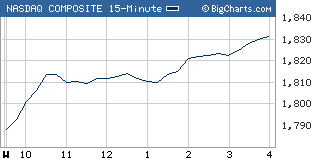

The Nasdaq composite (up 36.12 to 1,831.37, Charts) jumped 2 percent Wednesday and the Standard & Poor's 500 (up 13.46 to 1,095.17, Charts) index gained 1.2 percent.

All three gauges started lower as oil prices jumped and Web search engine Google said it had cut the size of its IPO.

But stocks managed to bounce back and build on the gains that started last Friday.

Stocks closed last Thursday at new 2004 lows, with the Nasdaq at its lowest level in nearly a year. That drop seemed to mark a bottom for the market, at least for now, and the major indexes have been pushing off it since.

"The optimist would say we're in the early stage of a broad rally, the pessimist would say this is a dead-cat bounce and markets are going to head lower as oil heads toward $50 a barrel," said Michael Sheldon, chief market strategist at Spencer Clarke.

"What we've seen the past few days has been encouraging, but what I need to see over the next few weeks is better volume, and better market internals, which would point to the potential for a more sustained and broad-based rally," he added.

By "market internals," Sheldon said he meant a higher ratio of gainers to losers and other technical signals of strength.

Market breadth was positive, with advancers beating decliners by more than three to one on the New York Stock Exchange, where 1.28 billion shares traded, and by eleven to four on the Nasdaq, where 1.55 billion shares changed hands.

After the close, the Securities and Exchange Commission said it gave the final OK to Google's initial public offering, paving the way for Google to start trading as soon as Thursday. For a detailed look at Google's road to its IPO, click here.

Nortel Networks (NT: up $0.21 to $3.60, Research, Estimates) is expected to report revised earnings for the first half of 2004 early Thursday, following a probe of its accounting going back to 2001.

A number of economic reports are due Thursday, as well.

The weekly jobless claims report, due before the open, is expected to show that 335,000 Americans filed new claims for unemployment last week, up from 333,000 the previous week.

The index of leading economic indicators, due shortly after the start of trade, is expected to have fallen 0.1 percent in July, after falling 0.2 percent the previous month.

Due at midday, the Philadelphia Fed, a regional manufacturing index, is expected to fall to 30.8 in August after hitting 36.1 in July.

Stock movers

Technology led the advance, and within technology, chip and chip gear makers were among the session's leading gainers

The Philadelphia Semiconductor Index (up 12.77 to 388.41, Charts), or the SOX, gained 3.4 percent.

Intel (INTC: up $0.68 to $22.22, Research, Estimates) added 3.3 percent and Texas Instruments (TXN: up $0.81 to $19.81, Research, Estimates) jumped about 4.3 percent.

Other techs popped, too, including Dow component Hewlett-Packard (HPQ: up $0.63 to $17.53, Research, Estimates), up 3.7 percent.

Network Appliance (NTAP: up $2.31 to $19.75, Research, Estimates) soared 13.3 percent after the computer data storage gear maker reported earnings that rose from a year ago and topped estimates, due to strong demand for its products, and big sales in Asia.

That gave a lift to competitors including EMC (EMC: up $0.59 to $10.49, Research, Estimates), which gained about 6 percent.

The broader market rose Monday and Tuesday on a combination of upbeat corporate news, benign economic data and bargain-hunting after several weeks of selling. Stocks also made modest gains Friday.

"The market's been soft for seven to eight months now," said David Briggs, head of equity trading at Federated Investors.

"There have been decent corrections, particularly in technology," he added. "I like the fundamentals and valuations are reasonable. I think we'll see the market bottom out in August or September, if it hasn't already in some sectors."

Light crude oil for September delivery settled at a record $47.27 a barrel, up 52 cents, after earlier hitting a new trading high at $47.39.

Prices jumped after a new round of violence in Iraq put the country's main export pipeline in jeopardy, amping up global supply fears.

Treasury prices fell, pushing the 10-year note yield up to 4.24 percent from 4.19 percent late Tuesday. Bond prices and yields move in opposite directions.

In currency trading, the dollar was flat versus the euro and fell against the yen.

COMEX gold fell 10 cents to settle at $406.60 an ounce.

-- Staff writer Katie Benner contributed to this story

|