NEW YORK (CNN/Money) -

The market is obsessing over Intel...and with good reason.

There's precious little in the way of major economic or corporate data during the dog days of summer. Not to mention the fact that many investors are at the beach.

So the semiconductor leader's mid-quarter update Thursday is one of the few notable events during this funereally quiet week.

But even if Wall Street were a-buzz with activity, Intel's update would still be a crucial one to watch.

Techs are at a critical point. After an insanely strong 2003, stocks have ebbed this year on fears that sales and profit growth are starting to slow.

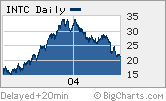

Intel (INTC: Research, Estimates) is a perfect illustration of this. The stock more than doubled in 2003 but is down 33 percent year-to-date, making it the worst performer in the Dow Jones Industrial Average. The past few months have been particularly brutal. Shares have plunged nearly 23 percent since the beginning of July.

An upbeat report from Intel could help reassure investors that tech spending for the remainder of this year is going to be solid. That's because Intel is the largest manufacturer of chips used in personal computers and servers.

"People are interested in hearing what back to school trends are occurring because that sets up the holiday season," said Patrick Ho, an analyst with Moors & Cabot. "Whatever Intel says is likely to have a big impact on the state of overall tech demand."

No major change to sales outlook expected...

Intel told Wall Street in July that it was expecting sales to be between $8.6 billion and $9.2 billion. The current consensus estimate is the midpoint of this range: $8.9 billion.

But many analysts expect Intel to tighten its forecast and keep the $8.9 billion target intact, i.e. narrowing its sales range to $8.8 billion to $9 billion, as opposed to lifting its guidance.

|

|

| What a difference a year makes: Intel surged in 2003 but has been the worst stock in the Dow this year. |

It seems unreasonable to expect Intel to raise its sales target. After all, Intel is already pointing to a very healthy sales increase in the third quarter. If Intel hits the $8.9 billion sales target, that would represent an increase of 10.6 percent from the second quarter and 13 percent gain from a year ago.

Adam Parker, an analyst with Bernstein, points out in a report this week that a 10.6 percent sequential sales increase is above average for Intel. The company typically reports sales gains of about 8 percent to 9 percent from the second quarter to the third quarter.

Demand for Intel's core products -- microprocessors, chipsets and motherboards -- appears to be strong. PC market leader Dell, a big Intel customer, is doing extremely well. IBM has also reported healthy gains in its hardware division. Even HP, which is having problems eking out a profit in its PC business, has indicated that demand is fairly strong.

...but concerns about margins and inventory linger

So the problem for Intel isn't sales. It is profit margins and inventory levels. Wall Street will be keeping a close eye on what Intel says about gross margins, which measure how profitable a company is after subtracting the cost of sales.

| Related stories

|

|

|

|

|

Intel's gross margins dipped below 60 percent in the second quarter. What's more, Intel said in July that it expects gross margins for the third quarter to be about 60 percent. And for the full year, Intel said it expects gross margins to be about 60 percent, lower than earlier forecasts of 62 percent.

So the hope is that Intel does not lower its gross margin outlook further. If it does, that could give more ammunition to the argument that the current chip boom period is coming to a close.

"Intel's gross margins tie into the chip cycle. When the cycle starts to peak, margins at Intel peak," said Apjit Walia, an analyst with RBC Capital Markets.

But even though overall sales growth is expected to be robust for the company, gross margins may take a hit because of higher sales of flash memory chips for communications devices, which are less profitable than Intel's microprocessors.

In addition, there are fears that Intel may cut prices on some of its chips in an effort to reduce its inventory levels. The company reported a 15 percent increase in inventory in the second quarter, furthering concerns about a looming chip glut. Intel reported an 11 percent inventory gain in the first quarter.

"To work out some of the inventory, I think there may be some more aggressive pricing tactics to get rid of it," said Ho.

Selling chips at a lower than desirable price is not a good sign since it would probably hurt competitors such as Advanced Micro Devices and Texas Instruments if they counter with price cuts of their own. But it's a necessary evil.

"When companies cut prices, it always hurts the whole environment. But you have to work through inventory. Intel doesn't want to take a charge to write it off," said Walia.

Intel usually doesn't comment on earnings per share guidance. Analysts expect the company to report a profit of 30 cents in the third quarter, up from 25 cents a share a year ago. But depending on what Intel says about its gross margins, that number could change.

To that end, the consensus earnings estimate for the third quarter was 32 cents a share when Intel reported second quarter results in July.

Analysts quoted in this story do not owns shares of Intel and their firms have no investment banking ties with the company.

|