NEW YORK (CNN/Money) -

Frances was a category 2 storm when it made landfall on Florida's coast and it has now been downgraded to a category 1 storm, but damage estimates remain unchanged from Friday when the storm was still a category 3 hurricane.

|

|

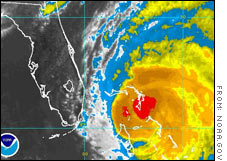

| Hurricane Frances as it approached the Florida coast Friday. |

The upper range of the loss forecast, estimated by Risk Management Solutions, is $20 billion, which would rival the losses from the most expensive storm in U.S. history -- Hurricane Andrew, the 1992 hurricane that caused $20 billion in insured damage, adjusted for inflation.

Risk Management Solutions does catastrophe modeling and estimates for the insurance industry.

But that high-end estimate is far below the $35 billion top range that RMS was forecasting Thursday afternoon.

And the lower end of the loss estimate range also dropped significantly, to $2 billion, from $10 billion in Thursday's forecast. A storm causing $10 billion in insured damages would be the second most costly storm in U.S. history, while a storm causing only $2 billion wouldn't make the top 10 list.

Frances was downgraded to a category 3 hurricane late Thursday night, the middle of the five categories that measure a storm's strength. It still has winds of almost 115 m.p.h., but that's down from the 145 m.p.h. winds it packed Thursday. (Click here for CNN.com's storm coverage)

The higher estimate Thursday judged the risk of the storm coming ashore further south in the Palm Beach-Fort Lauderdale-Miami area, which is far more densely populated and developed.

The hurricane is moving slowly and is expected to pound the central Florida coast with high winds and rain for a considerable period of time.

The storm would be the second major hurricane to hit Florida in less than a month. Hurricane Charley hit Florida Aug. 13 from the Gulf Coast, causing an estimated $6.8 billion in insured damages. That initial loss estimate puts Charley as the nation's second most costly for now.

Charley could drive up Frances costs

Hemant Shah, CEO of RMS, said Thursday that the population density where the storm hits is the most important factor in determing insured losses. The lower end of the cost estimate assumes the storm weakens further to a category 2 storm, while it would need to strengthen to a category 4 storm and hit a more highly developed part of Florida than its current track to end up causing $10 billion in damage.

The current path of the storm would take it over exposed property values equal to about 6 percent of total exposure in the state, comparable to property value of the area where Hurricane Charley made landfall last month.

If Frances ends up even near the upper end of the current loss estimate, it could be the most costly event since 1994's Northridge, Calif., earthquake, which had inflation-adjusted insured losses of about $15 billion.

Shah said that the fact that Charley recently hit Florida could drive up the repair costs from Frances, due to a shortage of contractors and building materials. Those cost increases are not included in the current loss forecasts. The estimate is also for damage to Florida only. Cost of losses in the Bahamas, or on the U.S. Gulf Coast, were not included in these initial estimates.

One of the things that increased the cost of Andrew was that it continued across Florida, regained its hurricane strength winds over the Gulf of Mexico, and then hit the U.S. Gulf Coast.

Another catastrophe modeling firm, AIR Worldwide, said Thursday it was too soon to give its projection on possible costs of Frances. But it agreed that the storm has the potential to top Andrew's insured losses record.

Shah said his estimate does not account for flood losses, which are generally not covered by private insurance companies, or damage to public infrastructure, damages less than deductibles, which are generally considerable for Florida hurricane coverage, as well as indirect costs of business disruptions.

"Economic damages could be considerably greater than these estimates," he said.

|