NEW YORK (CNN/Money) -

Technology shares rallied Thursday on Nokia and Texas Instruments' profit forecasts, while blue chips drifted amid another surge in oil prices.

After the close, the corporate news was decidedly more negative: Dow component Alcoa warned that earnings would miss estimates and EDS said that it would lay off a substantial number of workers over the next two years as part of a cost-saving plan.

Nasdaq and S&P futures point to a flat opening for the market Friday, when fair value is taken into account.

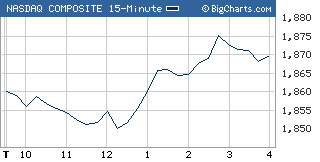

The Nasdaq composite (up 19.01 to 1,869.65, Charts) rallied 1 percent.

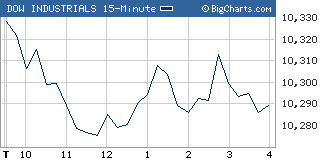

The Dow Jones industrial average (down 24.26 to 10,289.10, Charts) fell about 0.2 percent, and the Standard & Poor's 500 (up 2.11 to 1,118.38, Charts) index gained around 0.2 percent.

Investors cheered strong guidance from Nokia (NOK: up $1.06 to $13.77, Research, Estimates) and took a could-have-been-worse attitude about the mixed forecast from Texas Instruments (TXN: up $1.94 to $20.77, Research, Estimates).

Higher-than-expected earnings from National Semiconductor (NSM: up $1.48 to $13.48, Research, Estimates) provided support, too, with investors overlooking the company's cautious comments about profits going forward.

"I think it's a long overdue, oversold rally in technology," said Art Hogan, chief market analyst at Jefferies & Co. "Since Intel came out with its midquarter report, tech has been sliding and the other indices have been doing fine. Today the Nasdaq is having its moment in the sun."

A number of telecom and tech stocks managed gains on the news.

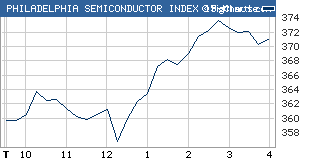

Chip stocks made particularly strong gains, having struggled of late amid a profit warning from Intel and other signs of a tech spending slowdown. The Philadelphia Semiconductor (up 18.92 to 370.98, Charts) index, or the SOX, jumped nearly 5.4 percent.

"TI wasn't as bad as predicted. We priced in the worst-case scenario, and it wasn't the worst," Hogan added. "We're realizing that, yeah, spending on IT (information technology) is slowing, but it's not stopping."

After the close, aluminum producer Alcoa (AA: Research, Estimates) warned that third-quarter results will miss expectations due to a variety of problems, including plant shutdowns, a fire and a strike. Earnings are now forecast to be in the range of 30 cents to 35 cents, versus analysts' expectations for earnings of 50 cents.

Also after the close, the CEO of Electronic Data Systems (EDS: Research, Estimates) said that the company is likely to cut around 20,000 jobs over the next two years as part of a broader plan to slash $3 billion or so in costs.

Also after the close, a federal judge threw out the government's request to block Oracle's attempted hostile takeover of rival PeopleSoft, saying U.S. antitrust authoritities had not proven their case.

PeopleSoft (PSFT: Research, Estimates) shares rallied almost 15 percent in very active after-hours trade. Oracle (ORCL: Research, Estimates) shares gained 1 percent.

Reports are due before the open Friday on producer prices and the trade balance.

The producer price index, which measures wholesale inflation, is expected to have risen 0.2 percent in August after rising 0.1 percent in July, according to a consensus of economists surveyed by Briefing.com. The so-called core PPI, which excludes food and energy, is expected to rise 0.1 percent after rising 0.1 percent in July.

July's trade balance likely contracted to $51.6 billion from $55.8 billion in June, according to a survey of economists.

Oil prices surge

Prior to the tech surge, stocks seesawed through most of the session, as investors were pulled between upbeat corporate news and the surge in oil.

The daily fluctuations of crude oil have had less of an impact on stock prices lately. Nonetheless, worries remain about the longer-term impact of higher energy prices on corporate profits and consumer spending.

Oil prices soared more than 4 percent, after the government reported that U.S. oil inventories fell more than expected last week and Hurricane Ivan raised concerns of supply disruptions.

Light crude for October delivery rose $1.84 to settle at $44.61 a barrel on the New York Mercantile Exchange.

While the day's advance was solid, September is typically a difficult one for stocks.

Adding to the usual historical tendency for weakness are: the continued rise in oil prices, worries about terrorism and the ongoing actions in Iraq, and uncertainties surrounding the upcoming presidential election.

"I think there was some relief at the end of the Republican convention that there was not a terrorist event and that set a positive tone for the market," in the first few days of the month, said John Davidson, president and CEO of PartnersRe Asset Management.

"I think people are starting to focus more now on third-quarter earnings and preannouncements," he added.

He said market participants were also continuing to react to Wednesday's mostly upbeat comments from Fed Chairman Alan Greenspan before the House Budget Committee. Stocks had fallen Wednesday on bets that Greenspan's testimony implied interest rates are set to rise at the next Fed meeting on Sept. 21.

What moved?

Investors focused on the positive in news out of several tech and telecom issues.

Texas Instruments issued a mixed mid-quarter report late Wednesday. The biggest maker of chips used in cell phones lowered its third-quarter revenue range and boosted its earnings range. Shares rose 10 percent.

National Semiconductor reported fiscal first-quarter earnings of 31 cents per share during the session Thursday, up from a year earlier and more than expected. The company also echoed Intel and others by warning that weaker demand would hurt sales in the current quarter. Shares rose 12 percent.

Chip gear maker KLA-Tencor (KLAC: up $1.63 to $38.79, Research, Estimates) said that orders in the current quarter will come in at the low end of estimates. Yet shares rose more than 4 percent.

No. 1 mobile phone company Nokia boosted its current-quarter earnings and forecast Thursday, citing solid demand for its phones.

The news was a welcome reversal from recent bearish forecasts from the cell phone maker, and investors boosted the shares 8 percent.

Shares of cell phone makers and makers of chips for phones rallied. Ericsson (ERICY: Research, Estimates), RF Micro Devices (RFMD: up $0.72 to $5.94, Research, Estimates) and JDS Uniphase (JDSU: up $0.23 to $3.27, Research, Estimates) were all among the gainers.

Jobless claims dip

Providing additional support was the weekly jobless claims report, released early Thursday. The number of Americans filing new claims for unemployment fell to 319,000 last week from an upwardly revised 363,000 the previous week. Economists surveyed by Briefing.com expected claims to fall to 345,000.

Wholesale inventories rose 1.3 percent in July after rising 1.1 percent in June. Economists surveyed by Briefing.com were expecting inventories to rise 0.6 percent.

Market breadth was positive, and volume continued to improve from late-summer levels. On the New York Stock Exchange, winners beat losers three to two as 1.36 billion shares changed hands. On the Nasdaq, advancers beat decliners nearly two to one as 1.66 billion shares traded.

COMEX gold fell $1 to settle at $400.40 an ounce.

Treasury prices fell, pushing the yield up to 4.19 percent from 4.16 percent late Wednesday. Bond prices and yields move in opposite directions.

In currency trading, the dollar rose versus the yen and fell versus the euro as of 5:45 p.m. ET.

|