NEW YORK (CNN/Money) -

If it's Monday, another massive hurricane must be bearing down on the United States.

|

|

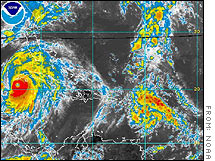

| Ivan bears down on the western tip of Cuba in this satellite image from midday Monday. |

Hurricane Ivan, expected to hit the Florida panhandle this week, is the third straight big hurricane in a month, and some economists warn the national economy will feel the pain from the barrage of storms, the worst in 40 years -- though the pinch is likely to be short-lived.

So far, the damage from the first two hurricanes -- Charley, which hit on Aug. 13, and Frances, which hit on Sept. 5 -- has amounted to several dozen deaths and possibly up to $14 billion in insured property damage. Uninsured costs have already topped $20 billion, according to some experts.

The last time three storms hit Florida in such a short stretch of time was 1964 when hurricanes Cleo, Dora and Isabelle slammed the state.

If Ivan's impact is similar to that of Charley or Frances, the combined punch of the three storms could be as heavy as the costliest hurricane of all time, 1992's Andrew, which did some $20 billion in insured damage, adjusted for inflation, and some analysts believe the pain could spread throughout the U.S. economy.

After all, it's not as if these tempests are touching down in a wasteland. The Gulf of Mexico, which Ivan is expected to blast with full fury, is home to about a quarter of all U.S. oil and natural gas production.

And Florida, which has borne the brunt of the recent storms, is the fourth-biggest state in the nation as measured by population, economic output and worker payrolls.

|

| |

|

|

|

|

Tom Paylor, a meteorologist for Weather Predict, talks about how the company provides custom, detailed weather forecasts for businesses. Tom Paylor, a meteorologist for Weather Predict, talks about how the company provides custom, detailed weather forecasts for businesses.

|

Play video

Play video

(Real or Windows Media)

|

|

|

|

|

"A three-storm hit in Florida will be felt" nationwide, said David Kotok, chief investment officer of Cumberland Advisors, adding the impact will show up in the third and fourth quarters. "In 2005 and 2006, the rebuilding will add substantially to national growth," he said. "In 2004 we are going to pay for the shock."

Kotok listed several possible effects of Ivan, including a drain on Florida's treasury and a hit to the bottom line for insurance companies. Already, several firms in a wide variety of other sectors have blamed hurricanes for earnings woes, including:

- Walt Disney (DIS: Research, Estimates), operator of Disney World and a host of other parks and resorts in Florida

- Retailers Wal-Mart (WMT: Research, Estimates), Federated Department Stores (FD: Research, Estimates) and Haverty Furniture (HVT: Research, Estimates)

- Restaurant chain operators Outback Steakhouse (OSI: Research, Estimates) and Chico's FAS (CHS: Research, Estimates)

- Auto retailers AutoNation (AN: Research, Estimates) and CarMax (KMX: Research, Estimates)

- Newspaper publisher E.W. Scripps (SSP: Research, Estimates)

- Safety products maker Federal Signal (FSS: Research, Estimates)

- Hospital administrator Health Management Associates (HMA: Research, Estimates)

It's easy to be skeptical about such claims, since some companies will find any excuse for bad numbers -- remember when Shrek ate retail sales?

"It appears as if every company doing business in the Southeast will jump on the Hurricane Frances, Charley and Tropical Storm Gaston bandwagons for their weaker third-quarter performance," said Rich Yamarone, director of economic research at Argus Research.

A reason to raise premiums?

Though insurers such as American International Group (AIG: Research, Estimates), Allstate (ALL: Research, Estimates), St. Paul Travelers (STA: Research, Estimates) and Chubb (CB: Research, Estimates) have had to shell out big bucks to pay claims, some industry watchers hope they'll be able to use the hurricanes as an excuse to boost premiums in the future -- a theory investors seem to have accepted, since the S&P insurance index is up some 6.5 percent since Charley hit Florida, outperforming the broader market.

| Related stories

|

|

|

|

|

But there's no question that smaller insurance firms will suffer real damage, as will companies doing business in tourism, retail and agriculture, to name a few crucial industries.

Paul Nolte, director of investments at Hinsdale Associates, said he may temporarily unload shares of St. Joe Co. (JOE: Research, Estimates), a real estate developer that's the biggest landowner in Florida -- with most of its holdings in the panhandle, right in the path of Ivan.

And oil and natural gas prices, already at high levels, jumped again Monday as oil companies shut down facilities in the Gulf of Mexico to prepare for the storm. Higher energy prices hit all businesses and act as a tax on consumers, draining discretionary income that might have been spent on other things.

The good news, however, is that the oil disruption probably will be short-lived, the total impact to the national economy is likely to be small, and rebuilding from the storms will soon actually fuel buying and building, giving a boost to economic activity.

"Hurricanes Charley and Frances are likely to lower third-quarter GDP slightly, in our view, because of reduced sales and production, as well as the transportation disruption," Sam Stovall, chief investment strategist at Standard & Poor's, wrote in a recent note to clients.

"Yet the rebuilding of affected areas will likely raise production in the fourth and first quarters."

"Overall, we think the effect on GDP is likely to be positive, since the rebuilding should more than offset the short-term disruption," he added, referring to gross domestic product, the broadest measure of the nation's economy.

|