WASHINGTON (CNN) - The former chief executive officer of Computer Associates was indicted by a federal grand jury in New York Wednesday for allegedly participating in a massive fraud conspiracy and an elaborate cover up of a scheme that cost investors hundreds of millions of dollars.

|

|

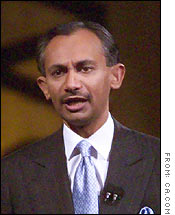

| Sanjay Kumar giving a speech in July, 2003 |

Meanwhile the company, under new management, reached an agreement with the Security and Exchange Commission to pay $225 million in compensation to shareholders victimized by the criminal conduct. It also agreed to institute corporate reforms and to cooperate with ongoing federal investigations.

Former CEO and chairman of the board Sanjay Kumar was indicted in Brooklyn along with his former head of worldwide sales, Stephen Richards.

A third executive, former senior vice president and general counsel Stephen Woghin, pleaded guilty in Brooklyn Wednesday for his role in the fraud scheme.

Prosecutors said the long-running accounting fraud scheme featured what came to be known by Computer Associates employees as a "35-day month" because company books were routinely kept open until revenues exceeded projected goals.

"The defendants cooked the books by simply keeping them open beyond the end of a fiscal quarter for however long it took to meet the analysts earning estimates," said Deputy Attorney General James Comey. Comey said by the time the "house of cards" collapsed, about $2.2 Billion in revenue was booked prematurely.

| Related links

|

|

|

|

|

Comey was joined by top FBI and SEC officials for announcement of the charges and settlement at a Justice Department news conference. Comey heads the Bush Administration's Corporate Fraud Task Force.

Comey noted that for the first time in a major corporate fraud case, prosecutors decided to defer prosecution against the corporation itself. The government promised to drop charges against CA after 18 months if the new management team met a series of strict requirements for corporate reform.

"I view this as sort of a model," Comey told reporters.

"We have no interest in swinging at a wrong door and knocking down thousands of innocent employees," he said. The deputy attorney general said if the company demonstrates it has a culture "that can be saved and contribute to society" there was no reason to further punish the corporation.

|