NEW YORK (CNN/Money) -

Stocks slumped Thursday, dragged down by record-high oil prices and a selloff in the drug sector, ahead of Friday's key jobs report.

After the close, the third-quarter earnings reporting period unofficially kicked off with results from Dow component Alcoa (AA: down $0.08 to $34.08, Research, Estimates).

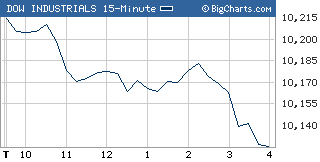

The Dow Jones industrial average (down 114.52 to 10,125.40, Charts) tumbled 1.1 percent and the broader Standard & Poor's 500 (down 11.40 to 1,130.65, Charts) index lost 1 percent.

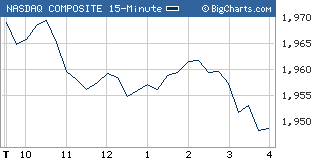

The Nasdaq composite (down 22.51 to 1,948.52, Charts) sank 1.1 percent, snapping a seven-session winning streak.

Drugmakers took another beating in the wake of Merck (MRK: Research, Estimates)'s recall of its Vioxx arthritis treatment last week and Chiron (CHIR: down $1.81 to $36.51, Research, Estimates)'s scrapping of about half the nation's flu-vaccine. These events sparked broader worries about drug safety and the chances of increased oversight from regulators.

The third straight record close for oil added to the pressure, as did jitters about Friday's jobs report, the most anticipated market news of the week.

The September payrolls report is due about an hour before the start of trading Friday. Employers likely added around 150,000 jobs in September, according to economists surveyed by Briefing.com, versus 144,000 in August. Analysts predict the unemployment rate held steady at 5.4 percent.

But the payroll number, always tricky to predict, could easily end up missing estimates this month, analysts said, due to the impact of the hurricanes that have swept the southeast.

"The hurricane impact could be anywhere between 50,000 and 100,000 jobs," said Gary Wolfer, senior portfolio manager at Univest Wealth Management and Trust.

"We could still see a higher-than-expected September number, even with the hurricane impact," he added. "But what's going to be nearly as important to the market is whether the July and August numbers are revised upward, and we return to the period of job growth we saw earlier in the year."

A stronger-than-forecast September report or upward revisions for prior months could encourage investors but won't necessarily do much to lift the market out of its recent funk, analysts said.

"The market is at or near the top of its trading range," said Joe Sunderman, director of trading at Schaeffer Investment Research. "So it would need to be a really strong (payrolls) number to get the market continued on its bullish ways. Right now, I just don't think that pattern is going to happen."

Later Friday, President Bush and the Democratic nominee, Sen. John Kerry, are to meet in the second of three scheduled debates.

Here come the numbers

After the close Thursday, Alcoa (AA: down $0.08 to $34.08, Research, Estimates) reported earnings of 32 cents a share, a penny shy of already reduced expectations, though net inched higher from a year ago. Alcoa had warned last month that results would disappoint.

Also after the close, Advanced Micro Devices (AMD: up $0.14 to $14.11, Research, Estimates) reported earnings of 12 cents per share, in line with estimates and an improvement from a quarterly loss a year earlier.

Dow component General Electric (GE: down $0.43 to $33.95, Research, Estimates) reports early Friday, with analysts forecasting 38 cents a share, down from 40 cents a year earlier. But the company is also expected to issue more bullish statements about 2005 earnings for GE and growth for the economy.

Next week brings a bigger batch of influential earnings, with some 40 S&P 500 companies due to report.

Thursday's market

While stocks managed to rally Wednesday despite rising oil prices, oil came back to haunt the market Thursday.

U.S. light crude for November delivery jumped another 65 cents to settle at $52.67 a barrel on the New York Mercantile Exchange, its third straight closing high. Oil, which touched $53 earlier in the session, has been hitting new highs almost daily on worries over supply disruptions ahead of the U.S. winter heating season.

"I think the record-high oil prices are still weighing on the market," Sunderman added. "Also, the Merck news is now spilling over to Pfizer, J&J and the blue chips."

Pfizer (PFE: Research, Estimates) slumped 3.8 percent and was the Dow's biggest decliner. Pfizer makes a drug that competes with Vioxx, and medical experts and analysts have speculated that the problems with Vioxx could extend to the whole class of similar drugs.

Johnson & Johnson (JNJ: down $1.83 to $55.92, Research, Estimates) tumbled 3 percent, and the Amex Pharmaceutical (Charts) index sank 2.7 percent.

Drug stocks weren't alone Thursday. Declines were broad-based, with 24 out of 30 Dow issues declining.

September retail sales were mostly uninspiring. Wal-Mart Stores (WMT: down $0.43 to $53.55, Research, Estimates) said sales at stores open a year or more rose 2.4 percent, the low end of its previous range. Target (TGT: up $0.03 to $47.13, Research, Estimates) reported gains of 5.6 percent, above its forecast.

Market breadth was negative. On the New York Stock Exchange, decliners beat advancers by more than two to one as 1.44 billion shares changed hands. On the Nasdaq, losers beat winners by a similar margin on volume of 1.75 billion shares.

Released before the start of trading Thursday, the weekly jobless claims report showed a bigger-than-expected drop in new claims for unemployment. But the report was largely overshadowed by speculation about Friday's bigger monthly report.

Treasury prices fell, pushing the 10-year note yield up to 4.25 percent from 4.21 percent late Wednesday. Prices and yields move in opposite directions.

In currency trading, the dollar fell versus the yen and euro.

|