NEW YORK (CNN/Money) -

Roger Grace bought some vintage magazines sight unseen, wasn't happy with the product that arrived on his doorstep, and complained loudly and publicly.

Miffed, seller Tim Neeley (aka "Crackerpopp") fired back, calling Grace "dishonest" and suggesting he be banned from doing business.

Does this angry exchange sound familiar? It is -- and it's now at the heart of a high-stakes legal battle that challenges the business model that made eBay an Internet wunderkind. The core question: when deals go awry, is the online auction service responsible?

"Online auction sites have been a fairly active area of dispute," said Jonathan Zittrain, a Harvard Law School professor and co-founder of the school's Berkman Center for Internet & Society. On the question of liability generally, he said, the law "is still unclear."

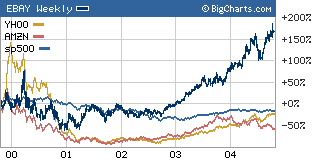

If eBay or its main rivals, including Yahoo! (down $0.11 to $35.09, Research) and Amazon.com (down $0.14 to $33.83, Research), are found liable by courts for sham deals or users attacking each other in "feedback" forums on company sites, observers say the whole online auction model could be turned on its head.

eBay and the others might be forced to engage in a level of policing that could slow dealmaking and, in turn, reduce the fees auctioneers pocket.

"What eBay has done so successfully is to build a variety of devices that make buyers and sellers feel confident in trading on their systems," said Joel Reidenberg, a Fordham University School of Law professor and expert on information technology law.

"Should they have immunity for the (user) feedback mechanism, the PayPal (payment) mechanism or other confidence-inspiring measures that they are establishing?" said Reidenberg. "That's not at all clear."

Mostly hands-off

eBay's spectacular ride has been built largely on a hands-off approach to what happens, good or bad, on its site. It's one reason eBay goes to great lengths to portray itself as a "marketplace" and a "trading platform."

|

|

| The eBay juggernaut appears unstoppable. Could court rulings halt the stampede? |

Company officials reject the term that everyone else uses, "auction site," largely because of potential legal consequences -- that term suggests that eBay is more than a passive player for activity on its site.

That's not to say eBay (down $0.66 to $95.25, Research) has turned a blind eye to the around-the-clock wheeling and dealing it supports. The company has a formidable anti-fraud staff that works with government investigators and polices the site, looking for sales of fraudulent, illegal or distasteful items. A few years ago, for instance, eBay halted sales of what appeared to be pieces of New York's destroyed World Trade Center.

Yet eBay's anti-fraud measures underscore the fine line it is walking. On one hand, eBay calls itself as a neutral platform -- more flea market than auction house. On the other, the more self-policing it does, the harder it is to maintain a specter of neutrality.

And despite all the proactive steps, eBay and its competitors have often been hauled into court. High-end merchandiser Tiffany & Co., for instance, sued eBay in New York federal court in June for allegedly allowing counterfeit Tiffany jewelry to be sold on its site.

Perhaps the best-known case to date involves Yahoo!, which has been fighting for four years a court order forcing the company to block all sales of Nazi items to French citizens.

Mostly, however, courts have backed eBay and other online service providers on questions of liability. When it comes to defamation on a site, judges have pointed to the 1996 Communications Decency Act, which gives Internet services providers broad immunity for user comments posted on their sites.

Rethinking the law of the Internet

The case that Roger Grace brought against eBay -- which the California Supreme Court agreed earlier this month to take up -- could signal an unwelcome turning point for Web marketplaces.

Grace wants eBay to pay for refusing his demand to remove another user's claim that Grace was "dishonest."

A California appeals court ruled last summer for eBay, but on grounds that were hardly reassuring. The court found that eBay was not responsible for the character attack on Grace because of its shrewd user agreement -- which effectively absolves eBay from responsibility for comments users post about each other on the company's site.

But it did not buy eBay's claim to immunity under federal law.

The California Supreme Court, which is dealing with a similar question of liability in another case on its schedule, agreed Oct. 15 to take up the case of Grace v. eBay. A ruling isn't expected until next year.

Jennifer Granick, executive director of Stanford Law School's Center for Internet & Society, said a California Supreme Court ruling against eBay would mark a "big step back" from past judicial rulings that have absolved Internet services from having to police their users.

Fordham's Reidenberg agreed. "Early on, the view was, 'Let's make online players unaccountable,'" he said. "This case now says, 'Wait a minute. Is that right? Let's rethink'."

|