NEW YORK (CNN/Money) -

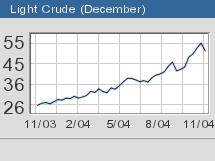

Oil prices traded sharply lower Monday, briefly taking light crude below $50 on speculation that a U.S. election win for Sen. John Kerry could ease the geopolitical friction that helped fuel this year's record-breaking rally.

Light crude for December delivery fell as low as $49.40 a barrel before settling at $50.13 a barrel, down $1.63, or 3.2 percent. U.S. crude has spent nearly a month above $50, peaking a week ago at $55.67.

In London, Brent lost $1.92, or nearly 4 percent, to close at $47.06 a barrel.

Energy analysts said a win for Kerry in Tuesday's U.S. election could mean lower crude prices than if President Bush is re-elected. Opinion polls put the two neck and neck.

"Under a Kerry administration we'd likely have a much more interventionist SPR (Strategic Petroleum Reserve) policy," said Jamal Qureshi, market analyst at PFC Energy in Washington, D.C.

"And when you look out a bit further, Bush is more likely to be aggressive in the Middle East, particularly in Iran," he said.

The Bush administration continues to add oil to the SPR, despite high prices.

Kerry says he would stop filling the SPR at current prices, to keep more crude on the market. That difference is important for the world oil market now suffering a shortage of light, sweet crude, which makes up about 40 percent of the SPR.

Manufacturing

PFC is forecasting an average U.S. crude price of $43 a barrel in 2005 should Kerry win, compared to $48 a barrel in the event Bush triumphs. It sees $52 on average in the first quarter 2005 under Bush compared to $45 under Kerry.

PFC says a Bush win could stoke nervousness about U.S. policies in the oil-producing Middle East, while Kerry is seen as more likely to work through conventional diplomatic channels.

A Kerry victory could also mean more financing for renewable energy sources and could trigger a push for tighter mileage standards for gas-guzzling sport utility vehicles.

The senator backs a 10-year, $30 billion energy package that includes $10 billion to build cleaner coal-fired power plants and $10 billion to help U.S. automakers retool to build more fuel-efficient cars.

Traders also are wary of economic data indicating that higher energy costs are eating into economic performance, curtailing oil-demand growth.

A Reuters survey released on Monday showed growth in manufacturing slowed from the eurozone to Japan in October.

The surveys of manufacturers around the world showed a fall in manufacturing for the eurozone, the world's second-largest economic bloc, signaling the slowest growth in 10 months.

"Primarily, we suspect this is an oil price-induced global downturn that is hitting export growth," said Chris Williamson, chief economist at NTC Research, which compiles the data for Reuters. "Secondly, there has been some evidence of demand cooling in China."

China's surprise decision last week to raise interest rates is thought unlikely to have a major impact on fuel demand by the world's second biggest user, partly because retail prices remain heavily subsidized.

Also undermining oil on Monday was last week's improvement in U.S. Gulf of Mexico output from September's Hurricane Ivan. Production rose nearly 100,000 barrels a day (bpd) last week to more than 80 percent of the normal 1.7 million barrels daily.

In addition, producer Shell said on Monday it would delay engineering work on its 150,000 bpd Gulf of Mexico Mars platform from November until the first quarter of 2005.

-- Reuters contributed to the story

|