|

|

|

|

|

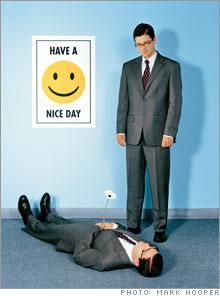

| The chances of dying young |

FEAR

Chance an American worker will die before 65: 13%

|

REAL DANGER

Chance a worker will be disabled for an extended time before 65: 28%

|

WHAT TO DO

Get disability coverage. Sign up for all that your employer offers before shopping for an individual policy.

|

Note: Workers 35 to 65

Source: Society of Actuaries

|

|

|

|

|

NEW YORK (MONEY Magazine) -

There are few things quite so dreadful as the prospect of our own impending demise. As Woody Allen put it, "I don't want to achieve immortality through my work. I want to achieve it through not dying."

Alas, that's impossible, so it's not surprising that three quarters of the 1,000 Americans surveyed by MONEY/ICR said that they worried about protecting their family in the event of their death.

Roughly half of us are worried enough to buy life insurance. Yet we're far less likely to protect against the far more likely possibility that we'll be sidelined for an extended time by injury or illness.

More than twice as many of us will be disabled during our career as will die before we retire. Yet only 28 percent of working Americans have any kind of long-term disability insurance.

This neglect can cost you and your family -- big-time. Half of those declaring bankruptcy do so because of health problems or medical bills, according to research by Harvard law professor Elizabeth Warren. Even scarier: Three quarters of those bankrupted by medical bills actually had health insurance. It just wasn't enough, especially for those whose illness cost them their job.

What to do

Make sure you have adequate insurance in case life puts you on the disabled list. Don't assume that Social Security disability payments and any base package your employer offers will suffice, especially if you make more than $100,000.

Ideally, you'll want:

- A pay out of 60 percent of your gross compensation, and coverage that lasts until age 65 or 67.

- "Own occupation" coverage, which pays out if you can't do your current job. "Any occupation" coverage pays out only if you're unable to work at all.

- A 60- to 90-day waiting period before benefits begin. This will lower your premiums.

If your employer offers a supplemental plan at group rates, buy it. Individual policies aren't cheap.

A 40-year-old male office worker buying a $5,000-a-month policy would pay about $245 a month for coverage to age 67 with rates that never go up. (Five years of coverage would start at about $95 a month.) Women pay a bit more, because they tend to live longer after becoming disabled than men do.

Fear No. 2: The stock market crashes

_______________________

Worried about life insurance? Read our Money 101 Guide to life insurance for the basics.

|