|

Apple's remarkable comeback story

The once-troubled computer maker, turning 30, has found new life as a mobile music company. Still, challenges loom.

NEW YORK (CNNMoney.com) - Apple Computer is turning 30 but its meteoric rise in the music business makes it look more like it's 17. Meanwhile, Microsoft (Research) turns 31 this year but feels much more middle aged: it's wealthy, yes, but moving less swiftly, with a tendency to be a couple of years behind when it comes to stuff like the Internet.

"Apple has struck a cultural nerve, especially with Generation X and Gen Y, while Windows and PC are viewed in essence as 'My parents' computer'," said Tim Bajarin, president of technology research firm Creative Strategies. The Apple of today is a far cry from the company co-founded by Steve Jobs and fellow college dropout Steve Wozniak on April Fool's Day in 1976. Their first product was a build-it-yourself computer kit and later the Apple II, a machine widely credited with popularizing the home computer. But Apple's (Research) 30th birthday won't be all cake and punch. Two of its top executives are calling it quits Friday, the day before Apple turns 30 on April 1. Avie Tevanian, Apple's top software developer, is stepping down to "pursue other interests"; his resignation coincides with the previously announced departure of Jon Rubinstein, head of the company's red-hot iPod division. Apple lawyers were also in court Wednesday facing off against Apple Corps, the company that controls the Beatles' business interests, over the use of the Apple name to sell music online. Despite those problems, Apple has grown remarkably in the past five years, and that growth spurt comes from its utter dominance in the portable music business. Thanks largely to the iPod, and Apple's iTunes music store, Apple stock has soared from $7.44 at the start of 2001 -- the year the iPod was introduced -- to a high of about $86 in mid-January. The stock has since retreated back near $60. That's a far cry from 10 years ago, when Apple was hemorrhaging money and the company was struggling to right its flagship brand of Macintosh computers. "Apple had plastic surgery and liposuction and a boob job," joked Daniel Morgan, a portfolio manager at Synovus Investment Advisers, who said Apple's makeover into a consumer electronics company is why the company rebounded so successfully from its mid-90s slump. Morgan owns shares of Apple personally and in the funds he manages. Morgan noted that Apple almost single-handedly created the market for MP3 players by creating a seamless user experience -- which helped spark its transformation from its roots as a maker of small, colorful computers. The iPod, which claims almost a 73 percent share of the market for portable music players, is the driving force for Apple's cultural, and financial Renaissance. It also accounts for nearly 40 percent of Apple's sales, according to analysts. Jobs, ousted, returns

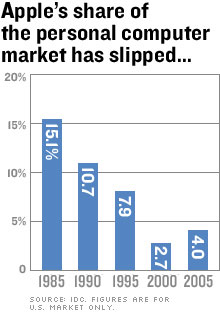

Indeed, Apple at 30 is a far healthier company than Apple at 20. Ten years ago, Apple was steadily losing market share with its Macs, which had kept it among the top 3 computer makers during the 1980s. Apple commanded a 16 percent share of the PC market in 1986, making it No. 2 behind IBM, according to Daniel Daoud, an analyst at market researcher IDC, and it still held about 10.7 percent of the market as late as 1990 -- five years after Jobs was ousted from his CEO post by the board. The Macintosh brand kept it afloat through the early 1990s even as its market share slid further starting two years after Jobs' ouster. Apple then went through a string of CEOs as it struggled to broaden the Mac's appeal from a core user base of professional graphic designers, and released such duds as the Newton, its brick-sized personal digital assistant. Apple's stock sank to $3.30 in July 1997, and the company reported a net loss of $708 million in its second quarter that year. Those losses came as rivals like Dell and almost every other computer company except Apple was riding the tech boom of the late 1990s. After Jobs returned that year, Apple started releasing a string of new products, including the colorful iMacs, complete with a splashy, prime-time ad campaign. Then came the iPod, in October 2001. Moving to MP3s

Though volumes of Macs sold have risen -- the company shipped more than a million last quarter -- the company's share of the market for computer makers has slipped to 4 percent in the U.S. and 2.3 percent globally, according to IDC. But at the same time, Apple managed to transform itself into the premier provider of MP3 players. Analysts say this is important, because as growth in the personal computer market slows, growth in the consumer electronics space is skyrocketing. "That's something a lot of PC makers are struggling with today and it's something Apple has done really well," said Nitin Gupta, an analyst with market research firm Yankee Group. But Apple will face challenges as the company seeks to keep up the momentum it has built up over the last five years. For starters, Apple will have to move beyond audio to video, something it's started to do with video iPods and content sold through iTunes, according to Yankee Group's Gupta. It will also do battle with PC makers for the control of the "digital home," a scenario where you store all your movies and music on machines in your living room. Another trend Apple will need to heed: music over mobile phones, a market that today is limited largely to consumer downloads of ring tones. Some industry analysts say Apple will launch its own "iPhone," since the ROKR phone from Motorola that features iTunes has been far from a smash. But while it's developing new products Apple will need to watch profits, said Morgan of Synovus, since profits in the consumer electronics business can be lower than in computer manufacturing. As for its flagship Macs, the company is in the midst of refreshing its entire product line to include Intel chips for the first time in its history. But whether that will help Apple gain share remains to be seen. IDC's Daoud thinks it can. He notes that Apple grew the number of computers it sold by almost 35 percent last year, while computer sales worldwide grew just 16 percent. But for Apple to continue on its successful path, it needs to keep innovating, he added. "The path for Apple going forward is to look beyond existing market models and anticipate demand in the long run," he said. ----------------------- Sonice boom: iPods go hi-fi. Get the full story from Fortune. Apple, Beatles face off in court. More here.

Plus: iPods get muzzled. Click here for that story. |

|