|

Viacom unbound

In one bold stroke, Sumner Redstone undid two decades of empire building. What now?

NEW YORK (FORTUNE) - The media industry was shaped by moguls who wanted more of everything -- more newspapers, more radio and TV stations, more studios, more power. The great empire builders included William Randolph Hearst and Al Neuharth, David Sarnoff and William Paley, Steve Ross and Lew Wasserman, Walt Disney and Michael Eisner, Rupert Murdoch and -- yes -- Sumner Redstone. Now listen to Redstone. "The world of the conglomerate is over," he says. "Divorce is better than marriage."

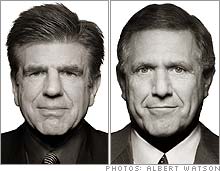

It's quite a turnabout for the 82-year-old, twice-married billionaire. Redstone has always been a buyer, beginning with his hostile takeover of Viacom in 1987 for $3.4 billion. He outbid Barry Diller for Paramount, swallowed Blockbuster Entertainment, and merged with CBS in 1998 -- his biggest deal, at $34 billion. Today, of course, Wall Street has turned against big media. Viacom, No. 69 on last year's FORTUNE 500, has seen its stock price go nowhere for four years. So Redstone divided his empire in January. The new Viacom (Research), run by CEO Tom Freston, kept the MTV group of cable networks and the Paramount studio. CBS Corp. (Research), run by Leslie Moonves, took the CBS and UPN broadcast networks, Showtime cable, TV stations, radio, billboards, and publishing. The idea is that Viacom will be a growth engine while CBS Corp. throws off lots of cash and pays dividends. Redstone controls both, as chairman and a majority owner of their voting shares. Here are Sumner's successors -- the two unorthodox leaders of Viacom and CBS -- and their strategies for success in the digital world. Mr. MTV grows up

Tom Freston has gone from Kabul to cable and beyond. Now he has to keep Viacom hip, happy and hot. Freston is confident that investors will learn to love the new Viacom. "I've never been as jazzed or as excited or as optimistic as I am right now," he says. Freston says the company is ideally positioned to grow, not just on television but on the Internet and on cellphones, here and around the world. But Viacom has big worries too. Cable is a maturing business. Advertising dollars are shifting to the Internet. Paramount has been a disaster lately, and the new studio chief, Brad Grey, is off to a rocky beginning. All Freston has to do is keep the company's creative juices flowing, manage its transition to new media, and turn around skeptics on Wall Street. Leslie Moonves's role of a lifetime

The conventional wisdom is that Moonves got the worst of the deal when Viacom CEO and controlling shareholder Sumner Redstone decided to split the company into two parts (New Viacom CEO Tom Freston certainly seems to feel that way). Even so, Moonves is determined to dispel the notion that CBS is the new Viacom's uncool stepsister. His strategy is to turn CBS from a broadcasting company into a "content provider" that sells hit programs like Survivor through a variety of old- and new-media distribution channels. Investors have reason to be wary. Outside of the pornography industry, nobody's making much money selling conventional content on the Internet yet. So for now, CBS must depend on its traditional assets. But the audience for broadcast television is eroding, and radio faces threats of its own. Next: See the 2006 FORTUNE 500FORTUNE 1000 Companies in Your State |

|