|

WWE: 'Fake' sport...real earnings

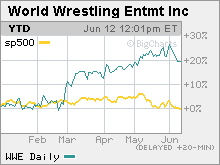

Yeah, the WWE may seem goofy with its scripted matches. But wrestling is cool again and the stock's on a tear.

NEW YORK (CNNMoney.com) - Investors may feel like they have been caught in a choke hold for the past month and a half. But shareholders of World Wrestling Entertainment have market bears pinned to the mat. World Wrestling Entertainment's stock is up more than 21 percent so far this year and has held up relatively well during the market's May and June swoon. And some Wall Street analysts think the stock still has some room to run.

The company is scheduled to report its fiscal fourth-quarter results on Tuesday June 13. Analysts are currently predicting that WWE (Research) will post revenues of $114.5 million and earnings of 13 cents a share. But if recent history is any guide, the company will likely crush those estimates. During the past five quarters, WWE has blown away consensus expectations by a wide margin. RAW growth opportunities

The WWE, which stages live wrestling events throughout the world and airs several popular TV shows, has benefited from an increase in popularity during the past year. Alan Gould, an analyst with Natexis Bleichroeder, points out that attendance at WWE events was lagging about two years ago but has been on the upswing during the past few quarters. Attendance at North American events so far this fiscal year has averaged 6,700 people, compared to 4,600 during the same quarter a year ago and just 3,800 two years ago. To that end, revenues from live and TV entertainment operations in the third quarter increased 6 percent from a year ago. This business accounted for nearly 60 percent of the company's total sales. Going forward, this business could get a boost from the addition of a third TV show this summer. Beginning in June, the WWE will air programs from its Extreme Championship Wrestling (ECW) series on the SCI FI Channel. WWE already airs its "RAW" program on USA Network, which like SCI FI, is owned by General Electric's (Research) NBC Universal unit. The WWE also airs its popular "SmackDown" show on CBS's UPN network. That show will move to the new CW, co-owned by CBS (Research) and Time Warner (Research), this fall. (Time Warner also owns CNNMoney.com.) The company gets paid a licensing fee by the broadcasters and in the case of "SmackDown" also receives a small cut of advertising sales from the TV programs. Michael Kelman, an analyst with Susquehanna Financial Group, adds that the company has been posting impressive growth in DVD sales thanks to a renewed focus on older WWE stars like Hulk Hogan. In the company's third quarter, sales from the company's home video division increased 215 percent from a year ago and accounted for 15 percent of the company's total revenue. "Home video is driving results. The company can mine this huge library they have," Kelman said. "They are bringing back old stars like Hulk Hogan to get people who were previously wrestling fans to get back into it." Gould points out that the company has also seen its popularity increase abroad and that it is also taking advantage of new trends in technology. "The WWE is doing a good job internationally and is starting to make some interesting moves in new media such as video on demand and a mobile product," he said. Some risks but a heavyweight dividend

With that in mind, analysts and investors will be looking for WWE to raise forecasts for this fiscal year. Wall Street is currently predicting that the company will generate sales of $417 million and earnings of 67 cents a share for this fiscal year, which ends in April 2007. Still, there are some risks. Kelman said the stock, trading at about 26 times next year's earnings estimates, seems fully valued. So if the company doesn't raise its earnings guidance, the stock could get pile-drived by Wall Street. Gould said he's a little worried about the WWE's plans to expand into the movie business. The company produced a horror movie called "See No Evil," starring WWE wrestler Kane in May in conjunction with independent film studio Lionsgate (Research). Gould said he thinks the company could break even on this venture but he's not so sure that the company will do as well on its next movie, "The Marine," which is due out in the fall. But the WWE could also benefit from increased exposure to wrestling thanks to another movie due out later this week. "Nacho Libre," the Jack Black comedy about a Mexican wrestler, is not associated with the WWE. But Kelman thinks that if "Nacho Libre" is a hit, it can't hurt. "It probably helps people thinking about wrestling in general," he said. Finally, these risks are slightly mitigated by the fact that in many other respects, the WWE is an incredibly fiscally conservative company. The WWE has $278 million in cash and just $6.6 million in long-term debt on its balance sheet. What's more, the company has chosen to take a huge chunk of the cash it generates and pay it back to investors in the form of a dividend that yields a whopping 5.5 percent. By way of comparison, the benchmark U.S. 10-year Treasury note only yields about 5 percent. "Investing in the WWE is better than sitting in 10-year Treasurys," Gould said. "It's a good place to be as long as business trends continue to improve." _____________________ Related: Can the CW make TV a five horse race? Related: Lionsgate is roaring in Hollywood -- and on Wall Street Analysts quoted in this story do not own shares of World Wrestling Entertainment and their firms have no investment banking relationships with the company.

The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|