|

Big media: Adapt or die

Executives from top media firms discuss how they need to embrace new technology sweeping the industry.

NEW YORK (CNNMoney.com) - The media business is getting hit by massive technological change, and executives from top media companies said industry executives had better get used to it. "The challenge is pretty clear. It's the digital transition. We would like to say we look at it as an opportunity. Every single part of our business is going through extraordinary technological change," Peter Chernin, president and chief operating officer of News Corp., said at a media conference in California monitored by Webcast.

Chernin was the first of four executives from leading media companies to speak at the Deutsche Bank Media and Telecom conference in Santa Monica, Calif., on Tuesday. The chief financial officers of Time Warner and Walt Disney also gave presentations Tuesday, and Les Moonves, CEO of CBS, spoke during a luncheon event. (Time Warner owns CNNMoney.com.) Embracing online media

News Corp. has been one of the most aggressive companies in the so-called "new media" landscape. The company owns the popular social networking Web site MySpace.com as well as controlling stakes in DirecTV (Research), the satellite TV firm, and NDS Group (Research), which makes digital video recorders. Chernin said during his presentation that News Corp. hopes to make more money off of My Space and other Internet sites it owns during the next few years. He said that the company plans to redesign MySpace to make its Web search function more prominent in order to keep more users from leaving MySpace to go to Google (Research) and Yahoo! (Research) for searches. He added that the company was likely to partner with Google, Yahoo or Microsoft's MSN for search results rather than build or buy its own search engine. (Yahoo currently powers the search results on MySpace.) Chernin also said that MySpace is currently testing an instant messaging product. Tom Staggs, CFO of Disney, said during his presentation that his company also expected to continue to experiment with new technology. Disney was the first major media company to sell downloads of TV shows on Apple's iTunes store. The company's ABC unit also began to stream versions of several of its hit shows for free on the network's Web site last month. "The most important thing that technology is doing is increasing consumer choice," said Staggs. "We're not going to be shy about new modes of distribution. We're going to make sure we are responding to consumer demand." Still, Staggs emphasized that the Internet is a small portion of Disney's overall business. Excluding Internet bookings for the company's theme parks, he said that revenue from Disney's online operations currently only generate about $500 million in annual sales. DVRs don't equal the death of TV?

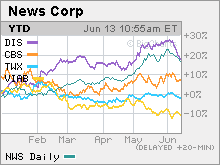

Turning to the impact that technology is having on the traditional TV business, Chernin said his company has learned to realize that it cannot resist change. He conceded that digital video recorders hurt the company's Fox broadcasting business since many DVR users are fast-forwarding past commercials. But he said that the popularity of DVRs helps increase demand for its satellite TV business since DirecTV offers a DVR product, made by its own NDS unit, to its customers. So DVRs are not necessarily a negative for News Corp., Chernin said. "The broadcast business has to learn to live with DVRs. You shouldn't hurt the growth prospects of one business to protect another one," he said, adding that News Corp. thinks one way to combat the commercial skipping is to invest more in sports and news programming, since more viewers are likely to watch sports and news live as opposed to recording it with a DVR and watching it later. Staggs agreed, calling DVRs a "mixed blessing." He said that people with DVRs tend to watch more TV and that because of that, the company sees DVRs as more of an opportunity than a threat. Disney, in addition to ABC, owns several cable networks including ESPN, ABC Family and the Disney Channel. But other media companies are taking a slightly different approach to the DVR conundrum. During his comments, Time Warner chief financial officer Wayne Pace touted the company's new Start Over service, which allows Time Warner Cable customers to hit a button to watch a show from the beginning if they missed the start of it. Consumers cannot fast forward through commercials with this service. Time Warner is currently testing Start Over in select markets and Pace said the company plans to roll it out to more users later this year. (Time Warner also offers a standard DVR that allows users to zoom past ads.) Pace also reaffirmed Time Warner's free cash flow and adjusted operating income before depreciation and amortization targets for 2006. He highlighted the continued ad sales growth at the company's AOL unit, and stressed that increasing Web traffic and ad revenue was the priority for AOL. But many analysts on Wall Street are focused on the fact that despite AOL's increasing ad sales, it is still losing subscribers from its core Internet service provider business. It has been a mixed bag for media stocks this year. News Corp. (Research) and Disney (Research) are both up more than 20 percent, while Time Warner (Research) and CBS (Research) are flat. Shares of Viacom (Research), which CBS split off from in January, have fallen nearly 10 percent. But all media stocks have taken a hit lately due to concerns about a sluggish start to the so-called upfront ad buying season for next fall's TV season. Chernin said Tuesday that about 70 percent of upfront ads for its Fox network have been sold and that rates should increase about 2 to 3 percent from a year ago. Staggs said that for ABC, the upfront was "slow to develop" and that advertisers were "holding back." CBS's Moonves added that advertisers were "playing a cat and mouse game." In addition, media stocks took a hit following a downgrade of Disney by Citigroup Monday after the company's animated movie "Cars" debuted with a slightly lower than expected box office take this past weekend. _____________________ Related: Don't believe the MySpace hype Related: CBS: Cheap Broadcasting Stock Related: Disney: The magic is back

The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|