|

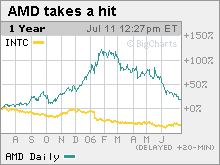

The AMD-Intel battle gets hotter Scrappy chip maker took business from Intel but now its archrival is hitting back. NEW YORK (CNNMoney.com) -- Call it the chip wars, part two. When AMD started grabbing customers from Intel last year, no one expected the No. 1 chipmaker to just sit around and sigh. Indeed, Intel (Charts) hit back: Its steep price cuts forced Advanced Micro Devices (Charts) to follow suit, sparking a broad selloff in AMD stock.

Intel slashed prices on its chips for desktop computers by 60 percent, and in addition announced a slew of new chips to compete with AMD. Now, for the first time in a number of quarters, AMD is being forced to respond to moves by Intel, and not the other way around. "AMD doesn't have a new lineup coming out until some time in the middle of 2007. We believe the new products will put (Intel) back on equal footing," said Cody Acree, an analyst with the brokerage Stifel Nicolaus. The first new chip from Intel, dubbed Woodcrest and introduced last month, is aimed at the market for servers, the computers that power corporate networks. That's exactly where AMD took customers from Intel, and analysts and investors say the new chips appear to have closed the technology gap between the two companies. The combination of price cuts and new products means Intel will likely take back some of the market share it lost to AMD in the last few quarters, according to Sunil Reddy, senior portfolio manager for Fifth Third Asset Management. The funds Reddy manages don't own AMD or Intel. Shares of AMD, which is set to report earnings next week, have tumbled 46 percent from their February high while Intel has dropped 14 percent over the same period. AMD warned last week that it expects sales for the current quarter of $1.2 billion, which is a 52 percent increase from the year-ago quarter but a 9 percent decline from the first quarter and below analysts' forecasts of $1.3 billion. Getting it together Intel's new products are its most competitive in at least three years, putting AMD in a tough spot, Acree said. In addition to Woodcrest, Intel is launching processors for desktops and laptops later this month and next month. The new desktop chip, called Conroe, is a "dual core" processor, meaning one processor with two brains. The technology is meant to make PCs run more efficiently, and Intel has already launched some dual-core processors for laptops. With Conroe, Intel is aiming to make dual core processors available for desktops at a price that most consumers can afford, according to Christopher Caso, analyst for Friedman, Billings, Ramsey & Co. "AMD is no longer enjoying clear technical superiority on servers, and Intel now has a very good desktop product at a price point AMD can't touch," said Caso. AMD is also dealing with sluggish PC sales during the slow summer months, analysts said. That tends to hurt chipmakers since chips for PCs account for 35 to 40 percent of the semiconductor industry, according to Reddy. But if the economy slows and consumers pull back, PC makers could follow, and sluggish chip sales could continue in to the next quarter. Steer clear for now Because of Intel's defensive moves as well as broader economic concerns, Wall Street analysts are no longer bullish on AMD, with only eight rating the stock "buy" or "strong buy" and 25 calling it a "hold." Acree of Stifel Nicolaus said Intel's price cuts and new products may not be fully reflected in AMD's stock price, and notes there are too many uncertainties for investors to dive back in. AMD also needs to invest in manufacturing to stay competitive with Intel, pressuring profits, he said. But Acree says AMD is a sound investment over the long run, as does Caso of Friedman, Billings, Ramsey & Co., who believes AMD will be able to hang onto a good deal of the market share it won at Intel's expense. Chris McHugh, a senior money manager at Turner Investment Partners, alluded to Dell's announcement last quarter that it will use AMD chips in one of its servers for the first time, noting AMD shares could get a boost in 2007 and 2008 if Dell becomes a bigger customer. Still, his concerns about the current environment for chips as well as the impact of Intel's price cuts caused him to sell AMD - before AMD's warning. Caso of Friedman, Billings, Ramsey & Co. does not own shares of Intel or AMD but his firm does or seeks to do business with both companies. Acree of Stifel Nicolaus does not own share of AMD or Intel but his firm makes a market in shares of Intel. Related: Why IBM attracts value investors Related: Dell's new blog boring as...Dell |

|