|

The smoke settles for Altria Stock Spotlight: The tobacco and food giant may finally be set to split up after a big legal victory last week. NEW YORK (CNNMoney.com) -- Up until last week, there was a massive cloud over Altria - a cloud six years long and billions of dollars strong. The cigarette, food and beer maker was one of the targets of a massive class-action suit representing 700,000 Florida smokers. In July 2000, a jury awarded smokers $145 billion - the biggest punitive damage award in U.S. history. (Full story)

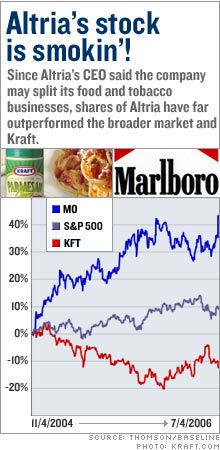

But last Thursday, the Florida Supreme Court upheld a ruling that the verdict was excessive and also ruled that future tobacco lawsuits must proceed individually as opposed to on a class action basis. The news sent Altria (Charts) stock soaring, in part because the ruling could bring about the long-awaited breakup of the company. In November 2004, Altria CEO Louis Camilleri told investors that the company was considering splitting off several of its businesses when the company's litigation troubles had settled. Investors are eager for Altria to move on with the restructuring process - and potentially get more value out of its core businesses by selling them off. Altria, which owns nearly 90 percent of Kraft Foods (Charts), has long talked about spinning Kraft off from its core tobacco business. Camilleri even hinted in 2004 that the company might divide into "potentially three, strong and independent entities" - meaning that the tobacco division might split into domestic and international. Shares of Altria are up about 7 percent this year. And now that the biggest single impediment to its U.S. tobacco business has been lifted, will Altria's stock keep smoking? Thank you for smoking While Altria has products all over the map, two-thirds of its sales still come from its Philip Morris tobacco business. But Altria, which owns the Marlboro, Parliament and Virginia Slims brands, has had to make up for slowing U.S. cigarette growth with international expansion and higher prices. There was no growth in U.S. cigarette shipments in the first quarter of this year. Christopher Growe, an analyst with A.G. Edwards, said U.S. cigarette volume may actually decline in the future but that price increases could help soften the blow. But Altria still has significant opportunities to grow abroad. International shipments jumped nearly 5 percent in the first quarter and international volume now makes up 83 percent of Altria's cigarette shipments. The company made gains in nine countries across Europe and Asia in the first quarter, though sales fell in Japan and Spain, which are vital markets. Philip Morris International should continue to grow and also post strong profits, according to Goldman Sachs analyst Judy Hong. It also doesn't hurt that the debate about smoking is less intense internationally. As a result, there are fewer lawsuits against tobacco companies outside the U.S. Letting go of Kraft Altria's other moneymaker is Kraft, the world's second-largest food company behind Nestle. The maker of Jell-O and Oreo cookies brought in a third of the company's sales in the first quarter. (Altria also owns a 29 percent stake in SABMiller, the brewer behind such brands as Miller Lite and Pilsner Urquell.) But analysts see Kraft's revenue growth slowing to 1 percent this year, and investors are eager to see the company develop new products, as private brands gain ground on its current offerings. Shares of Kraft have underperformed over the past two years, sagging 3 percent. Analysts say that's held back Altria's overall performance and is one of the reasons why a full spin-off makes sense. "A spin-off for Kraft would really force a higher valuation for the tobacco entity," said A.G. Edwards' Growe. He calculates the value of Altria in the mid-$90s after a break-up, up from about $77 now. He expects a break up could come in six months to a year. Other analysts said Altria is probably waiting to see if recent initiatives to boost lagging sales will help before going ahead with the split. Kraft has cut jobs, closed plants, and recently ousted CEO Roger Deromedi in favor of Irene Rosenfeld, the former head of PepsiCo's (Charts) Frito-Lay snacks division, who is expected to initiate and push new brands. (Full story) And earlier this week, Kraft announced it was buying the Spanish and Portuguese assets of United Biscuits for about $1 billion in order to strengthen its cookie business in Europe. A new nicotine high? Altria has long been considered a classic widow-and-orphan stock - great for its stability and big annual dividend, currently about 4.1 percent. But Growe thinks the stock is still undervalued by about 15 percent. "There's a very small value being placed on the U.S. tobacco operation," he said. "It should be valued much higher." Altria is currently trading at 14.8 times 2006 earnings estimates, a slight premium to the average P/E for other U.S. tobacco stocks like Reynolds American (Charts) and Carolina Group (Charts), as well as international cigarette makers British American Tobacco (Charts) and Imperial Tobacco Group (Charts). A larger premium might be justified for Altria since its earnings are expected to grow 7 percent next year and 8 percent annually, on average, for the next few years, slightly higher than the overall tobacco industry. Altria's more rapidly growing international tobacco business also would probably be able to command a higher valuation if the company chose to spin-off that unit. But a spin-off of Kraft is really the crucial event investors are waiting for. And now that the biggest potential legal headache for Altria is behind it, the company should be able to concentrate on shedding its slower-growth food business. A.G. Edwards' Growe and his firm own shares of Altria but A.G. Edwards has not done banking for the company. Goldman Sachs' Hong does not own shares in Altria but her firm is a shareholder and has done investment banking business with the company. Related: Altria split still seen as months off Related: All Stock Spotlight pieces |

|