|

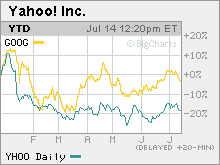

Yahoo, Google search for fans on Wall Street The two Web titans are battling for Web users. Next week the fight turns to Wall Street when both report earnings. NEW YORK (CNNMoney.com) -- The battle for search supremacy on the Web is escalating between Google and Yahoo! But as both companies prepare to release their second-quarter results, investors can't seem to decide who will be the ultimate winner...so they've sold off both stocks. Even though both companies reported strong first quarter results and have continued to unveil new features to help drive more viewers to their sites, shares of Yahoo and Google are trading at lower prices now than after their first quarter numbers were released in mid-April. However, Google (Charts) and Yahoo (Charts) do have some momentum. Since Yahoo hit a 52-week low in mid-May, at a time when the entire tech sector was in a swoon, the stock has rebounded sharply, gaining 11 percent. Google's stock has also gained ground since mid-May, rising 10.5 percent. Analysts say there's a good chance shares of both companies will keep climbing since each will probably report solid second-quarter earnings. Simply put, Google and Yahoo are still benefiting from the increased willingness of marketers to buy ads based on keyword searches. "Internet search continues to be a hot area from an advertising point of view," said Ian Campbell, president and CEO of Nucleus Research, an independent technology research firm. World Cup gives Yahoo an extra kick To that end, Yahoo is expected to report revenue, excluding ad revenue it shares with partners, a figure known as traffic acquisition costs (TAC), of $1.14 billion, up 30 percent from a year ago. Yahoo will announce its results Tuesday. Analysts are forecasting earnings of 11 cents a share, compared to 13 cents a year ago, excluding a big one-time gain from the sale of an investment. Last year's profit, however, does not include stock-options expenses, while the results for this year's second quarter do include this cost. If Yahoo had expensed stock options a year ago, its earnings for the quarter would have been 9 cents a share, according to a company filing. Google, which is the search industry market share leader, should have an even better quarter. It will report second quarter results Thursday and analysts are predicting that sales, excluding TAC, will surge 84 percent to $1.64 billion, and that earnings per share will rise 62 percent to $2.21 a share. Denise Garcia, an analyst with WR Hambrecht, said she thinks Yahoo and Google will at the very least meet, if not exceed, Wall Street's consensus estimates. Garcia points to continued strength at Yahoo in so-called branded advertising, selling banner ads, video ads and other non-search forms of online ads to big corporations. "Branded advertising at Yahoo is overlooked," she said. "Search is important for Yahoo but not as important as the Street may think." Garcia added that Yahoo also probably got a boost from its sponsorship of the official site of the FIFA World Cup. According to research from comScore Networks, Yahoo's World Cup site averaged 4 million visitors a day during the month-long tournament. that soccer fans viewed 4.3 billion pages on the site. Google searching for new growth Google, on the other hand, has solidified its lead in search. According to figures from research firm Nielsen//Net Ratings, nearly half of all Web searches in the U.S. in May were done through Google, compared to 23 percent for Yahoo and 10.6 percent for Microsoft's (Charts) MSN. But Steve Weinstein, an analyst with Pacific Crest Securities, said investors are most eager to get information from Google about how the company plans on expanding beyond Web search. In January, for example, the company bought a firm called dMarc Broadcasting, which will allow Google to place ads on radio stations. And late last month, Google unveiled a new online payment feature called Google Checkout. Many analysts have said that this is a direct threat to eBay's (Charts) popular PayPal service. "I would like to hear more from Google on newer initiatives that they are using to try and grow ad spending away from search," Weinstein said. Garcia said that investors will also be looking to see if Google can continue to post sizable sales gains in international markets. During the first quarter, Google's international revenue growth outpaced domestic growth, nearly doubling compared to 70 percent growth in the U.S. Steering clear of the rumor mill Looking forward, Weinstein said the key for Yahoo is to give Wall Street more information about when it will unveil its long-awaited new search technology. "The big thing for Yahoo is that it is rolling out the new search platform, so investors will be waiting for an update on that," he said. Garcia said she's confident that Yahoo will see an uptick in search-related revenue later in the year after the new search tools debut. Still, it might be unreasonable to expect significant improvement in the third-quarter, since the summer months tend to be the weakest for the online search business. As such, analysts currently are predicting slower year-over-year sales growth rates in the third quarter for both Yahoo and Google, with forecasts of a 28 percent increase for Yahoo and 67 percent jump for Google. But in the case of Google, Garcia said that investors really should pay the most attention to how well search is doing. She said it is easy to lose sight of just how dominant the company is in search since there is so much speculation in the blogosphere and financial community about new features and markets that the company is supposedly looking to dominate. In the past week alone, there has been chatter about Google entering the healthcare information and homeland security markets, as well as rumors that it was looking to buy Click Commerce (Charts), a supply chain software company. "There is too much noise on Google. Google gets a lot of attention right now since it's gone from nowhere to one of the largest companies in the world," Garcia said. "But you don't need to chase rumors. The good news is that the core business is still making a lot of money." -------------------------------------------------------------- Related: Google eyes homeland security market Related: eBay's "heir apparent" steps down Related: AOL as Yahoo wannabe Analysts quoted in this story do not own shares of the companies mentioned and their firms have no banking relationships with the companies. |

|