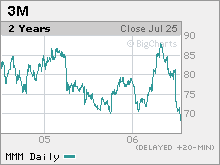

Serwer: Looking at the pride of St. Paul After a drop 3M is ripe for the picking. Hedge funds fight on THX and beware Expeditors

NEW YORK (Fortune) -- So how has the Israeli stock market held up in all this mess? Not so bad actually. Was down 4 percent initially after the shooting started, but since has made up half of the drop. Since then it's been flat. War/terror as usual.... 3M: I told you I was going to look at big cap American stocks that had backed off highs, or were undervalued, or were screaming buys. So in that light, take a look at the pride of St. Paul, Minnesota. First of all MMM (Charts) has long been one of this nation's bluest of blue chips. The company is well run, innovates, and has richly rewarded investors. Stock was in the high $80s as of early May, now she's at $68. The company dropped on earnings yesterday. Disappointing results from its TV screen business is to blame. But the stock is now back at 2003 levels. P/E is less than 16. Bet you even money this one works out over five years.

HOUSTON EXPLORATION: This is a an interesting situation. At least two hedge funds are now urging this company to sell itself, or break itself up, to "enhance value" (as they say in the biz). Jana Partners, which has worked with Carl Icahn before, and Sandell Asset Management say they are pleased the company has hired Lehman Brothers to look at ways to bring it home for shareholders. THX (Charts) is an exploration company based in Houston, mostly natural gas. Operations are in Texas, Arkansas, Oklahoma, the Rocky Mountains; and the Gulf of Mexico. Stock doubled from '03 to '05, but has basically been flat since. Watch this space..... EXPEDITORS INTERNATIONAL OF WASHINGTON: This company is in the shipping business and you would think, UPS's problems not withstanding, that this baby would be sweet-spot city. And indeed the stock (Charts) has gone from the low teens to $46 since 2001, with probably more to come. But, I'm concerned about this tidbit from a Reuters story earlier this month: Chief Financial Officer Jordan Gates said Expeditors does not provide a short-term outlook, but usually "shoots for annual growth of 15 percent. ... that remains the long-term goal." Okay, 15 percent growth over time is not sustainable, and if you have it as a target, you may get into trouble trying to achieve it year after year. It's happened before. Loose Change: Reader Deep Blue providing some great ideas today. Thanks Deep!....Holy Animatronic Rodents Batman! Did you see that Chuck E. Cheese says it it is looking into possible problems with its stock options? True!....How many of you have gone to Carrerbuilder.com to play with the monkeys?.....Like this. _______________________________ E-mail Andy Serwer at serwer@fortunemail.com |

| |||||||||||