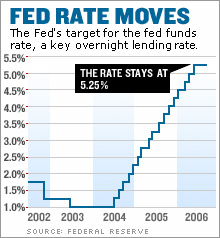

Is the Fed really done? Some think the minutes from the Fed's latest meeting clearly show that the Fed will not raise rates in September while others think another rate hike is in the cards. NEW YORK (CNNMoney.com) -- The Federal Reserve decided not to raise interest rates earlier this month. And after the minutes from that meeting were released Tuesday, investors quickly decided that the Fed's more than two-year interest rate hiking campaign may be over for the foreseeable future. Stocks, which were trading lower before the minutes came out, moved into positive territory. Bonds also rallied, sending the yield on the benchmark 10-year U.S. Treasury note down to 4.78 percent. (Bond yields and prices move in opposite directions.) And according to federal funds future contracts trading on the Chicago Board of Trade, investors are betting on just a 12 percent chance that the Fed will raise rates at its next meeting on Sept. 20. But, after 17 quarter-point hikes since June 2004, is the Fed really done? Economists are mixed since it all depends on which portion of the minutes you find most important. You can clearly make a case for why the Fed will hold pat in September or why the central bank will once again raise rates. Why the Fed will pause... David Kelly, an economic adviser at Putnam Investments in Boston, said that the fact that the Fed made several comments about the slowdown in the real estate market shows that the Fed is clearly concerned about what impact more rate hikes might have on the housing market, and hence consumer spending and the economy. "Overall, these minutes are pretty encouraging. It's a sign that the fed does get it. The significant thing is the section when they talk about the outlook and they are highlighting housing," he said. Kelly added that he was happy to see that the Fed also mentioned concerns about what effect its previous rate hikes would have on the economy. In the past, many have criticized the Fed for not considering the impact that rate hikes would have months down the road, which can lead to overshooting - namely raising rates too many times and causing an economic slowdown. The federal funds rate, which influences how much interest consumers have to pay on credit cards, auto loans, home equity loans and other types of debt, currently stands at 5.25 percent. If the Fed were to raise rates by another quarter of a percentage point in September, the fed funds rate would be at its highest level since January 2001. "The Fed recognizes the potential impact of a lag. So I think it's highly unlikely they will tighten any further," he said. ...and why it might raise rates again But not everyone who read the minutes interpreted them as a sign the Fed was more worried about an economic slowdown than inflation. Drew Matus, senior economist with Lehman Brothers, thinks the market may have been paying too much attention to the comments about housing and that the Fed may not be done raising rates yet. "Honestly, I see these minutes as somewhat hawkish and suggesting that anything is still on the table," he said. Matus said that to him, the most important portion of the minutes was when the Fed said that "all members agreed that the statement to be released after the meeting should convey that inflation risks remained dominant and that consequently keeping policy unchanged at this meeting did not necessarily mark the end of the tightening cycle." It's also worth noting that not all Fed members voted for a pause at the meeting. Richmond Federal Reserve president Jeffrey Lacker voted for another rate increase. According to the minutes, Lacker noted that even though economic growth was "likely to be somewhat lower in coming quarters...it was unlikely to moderate by enough to bring core inflation down" and that real short-term interest rates were "still low relative to rates typically associated with sustained expansions." In other words, Lacker doesn't think one more rate hike would send the economy into a tailspin. -------------------------------------------------------------------------------- |

| ||||||||