|

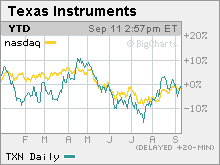

Texas Instruments narrows outlook No. 1 maker of chips for cell phones offers more precisely targeted revenue, earnings forecast for current quarter. NEW YORK (CNNMoney.com) -- Texas Instruments narrowed its revenue and earnings forecast for the current quarter Monday, keeping its guidance in line with analysts' estimates. TI (Charts), the No. 1 maker of chips for cell phones, said it expects earnings per share of between 44 and 46 cents for the third quarter and revenue of between $3.71 billion and $3.87 billion.

TI had originally forecast earnings per share for the third quarter of 42 cents to 48 cents, including expenses for stock-based compensation, and revenue of $3.63 billion to $3.95 billion. The updated guidance was just about in line with Wall Street's forecasts. Analysts were expecting sales of $3.8 billion and earnings of 46 cents a share for the quarter ending Sept. 30, according to earnings tracker Thomson First Call. "The quarter is developing consistently with prior expectations," TI vice president Ron Slaymaker told analysts during a conference call. TI said it expects revenue from semiconductors to be between $3.53 billion and $3.67 billion, versus its previous forecast range of $3.45 billion to $3.75 billion. The Dallas-based company also said sales from educational and productivity solutions are expected to be between $180 million and $200 million, unchanged from the previous forecast. TI shares were little changed in extended-hours trading after rising about 2.5 percent in regular trading. Chip shares rose across the board Monday on news that Freescale Semiconductor is close to being taken private in a $16 billion deal, which would make it the biggest leveraged buyout ever in the tech sector. Freescale Semiconductor (Charts) surged 19 percent, while Qualcomm (Charts) and STMicroelectronics (Charts) both posted smaller gains in regular trading. |

Sponsors

|