|

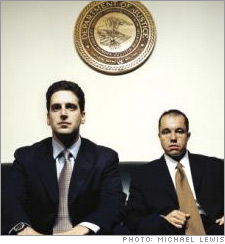

The insider trader's handbook There are lots of ways to get illegal stock tips. David Pajcin and Eugene Plotkin, authorities say, used the classics and came up with some of their own.

NEW YORK (Fortune) -- David Pajcin was a charmer and a young man in a hurry. Soon after graduating from Notre Dame, he landed a job in the commodities group at Goldman Sachs (Charts). But he quickly became impatient on the trading floor. So after only 5� months at Goldman, Pajcin left for a series of jobs, none lasting longer than a few months. He finally stopped working for securities firms in 2003, when, authorities say, a new business was brewing in his mind. (This is an excerpt from a story that ran in the October 2 issue of Fortune. Read the complete story.)

During his time at Goldman, Pajcin had become acquainted with fellow trainee Eugene Plotkin. A Harvard grad, competitive ballroom dancer, and amateur film maker, Plotkin was full of drive and loved being an I-banker. He would later use his Wall Street connections to gain insider tips on major business deals. Together the two began banking on the inside information they ascertained through various sources. They raked in millions in profits from stock and options trading. Now the two, along with 15 others, have been sued by the SEC for insider trading. 4 ways to get illegal stock tips Get the news first: The ring allegedly planted a spy in a plant where Business Week is printed to get advance word of stock market news. While the magazine has been targeted before, the most famous insider scheme involving the press was the "Heard on the Street" scam of the early 1980s, involving Wall Street Journal reporter R. Foster Winans. TOTAL TAKE: $282,573 Get an M&A mole: Plotkin and Pajcin allegedly recruited a young M&A analyst at Merrill Lynch (Charts) to tip them off to pending transactions. This method is highly reliable -- assuming the deal actually happens -- and provided the ring with their biggest score when they bought Reebok (Charts) shares and call options before news of a takeover by Adidas became public. TOTAL TAKE: $6,615,039 Get a grand juror: Authorities say a member of the panel that heard evidence of alleged wrongdoing at Bristol-Myers Squibb (Charts) told Pajcin and Plotkin that a senior executive would be indicted. As it turned out, the tip was wrong. TOTAL LOSS: $14,500 Get strippers: Pajcin and Plotkin, the SEC says, coached exotic dancers on questions to ask Wall Street customers about possible deals. They never got anything useful. TOTAL TAKE: 0 (This is an excerpt from a story that ran in the October 2 issue of Fortune. Read the complete story.) |

|