|

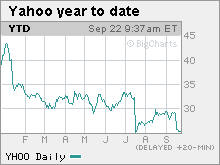

Is Facebook worth a billion bucks? Wall Street thinks social networking site would be a good deal for Yahoo, but college students are divided on its worth. NEW YORK (CNNMoney.com) -- Facebook has been getting a lot of attention from Wall Street following reports of a possible deal with Yahoo, but some students say the site is old news. Yahoo! (Charts) is said to be in serious talks to buy the social-networking site for an amount that could approach $1 billion, The Wall Street Journal reported Thursday. (Full story.)

Investment bankers said the deal could be worth it for Yahoo, which is struggling to keep up with Google (Charts) in the online search race. And Yahoo warned Tuesday that third-quarter sales would be at the low end of expectations due to softening ad sales from auto companies and financial services firms. "Yahoo is having all sorts of problems these days because their advertising revenue is coming in less than expected," said Richard Dorfman, managing director of Richard Alan Inc., a financial advisory and investment company focusing on the media industry. "What's beautiful about Facebook is that it's a great place to advertise because it generates the equivalent of online word of mouth. That's a powerful phenomenon," he added. Wall Street raves about Facebook... Closely-held Facebook, founded in February 2004, has more than 9 million registered users and ranks as the seventh-most trafficked site in the U.S., according to comScore Networks. But more importantly, it is even more popular than MySpace among college students. "I think ultimately [$1 billion] is a fair price given the example of what MySpace has been able to do in terms of partnering up on different advertising deals," said Jay MacDonald, partner of DeSilva & Phillips, a New York-based investment bank specializing in the media and digital media industries. MySpace signed an advertising deal with Google in August that should lead to at least $900 million in ad sales for MySpace over the next few years. According to Tim Boyd, an analyst with Caris & Company, $1 billion does seem like a reasonable price for the social-networking site, based on the assumption that that Facebook is approaching $100 million in annual revenues. When factoring in Facebook's number of unique visitors, Yahoo would be paying 6 to 8 times what NewsCorp (Charts) paid for MySpace last year, according to Boyd. That is a hefty premium. But Boyd said in a research note that such a premium is justified considering that Facebook's market of college kids is a very attractive market for advertisers to target. ...but college kids aren't as impressed Still, as Wall Street debates Facebook's worth, younger users are divided on how important the site is in their daily lives. Lois DiTommaso, a student at Drexel University in Philadelphia, says she has both a MySpace and Facebook account but she uses MySpace more since that site "is more for everyone" while Facebook is tailored more specifically for college campus life. "Facebook is more nerdy," she added. Recent graduate Alicia Henry signed up for Facebook in college so she could communicate with her classmates and friends. But she took down her profile soon after graduating from Boston University. "I joined because not a lot of people did it, and then when it became this big thing...and people were asking you to be your friend, it got kind of silly," Henry said. But Tufts graduate A. Cartter Evans still swears by the site, although she graduated from school over a year ago. "Many of my friends from college don't use MySpace," she said. "I love that it is very easy to post pictures in my profile. MySpace has several limitations with the number of pictures one can post as well as the amount of pictures one can post." The mixed opinions about Facebook's popularity show just how risky the fickle business of networking sites can be. It's also highly competitive, with other admittedly less-popular sites like Friendster, Classmates.com and Bebo, in addition to MySpace, all targeting younger Web users. Spokeswomen for Facebook and Yahoo declined to comment on the deal speculation. |

Sponsors

|