|

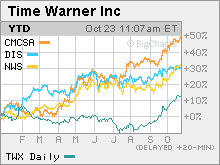

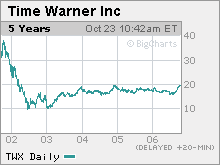

Time for Time Warner earnings Shares of No. 1 media firm are trading at a more than four-year high on high hopes for cable, AOL. NEW YORK (CNNMoney.com) -- Look who's finally joined the media stock party. Shares of Time Warner (Charts), which had lagged behind CBS, Walt Disney, Comcast and News Corp. for much of the year, have surged 23 percent since the company reported second-quarter earnings in August and are now up 15 percent in 2006. (Time Warner is the parent company of CNNMoney.com.) The stock hit a new 52-week trading high of $20.08 last Thursday following strong earnings from Comcast. Analysts say this is significant since it's the first time the stock's been above $20 since May 2002. And the stock briefly matched that high Tuesday following an upgrade of the stock to an "outperform" by Cowen and Co. "Time Warner's stock has made the move from $16 to $19 a bunch of times during the past few years. So it's news that it's broken through $19 and is nearing $20," Laura Martin, an analyst with Soleil - Media Metrics, said last week before the stock traded above $20. The company will report its third-quarter earnings on Wednesday, November 1. Analysts expect Time Warner to report sales of $11.1 billion, up 5 percent from a year ago, and a profit of 20 cents per share, also an increase of 5 percent from last year. Focus on cable and AOL What's behind the stock's move? Analysts say investors appear to be paying attention to how well Time Warner's cable business, which accounts for a quarter of the company's sales and 40 percent of Time Warner's operating income before depreciation and amortization (OIBDA), a key measure of Time Warner's profitability, is doing. Revenue at Time Warner Cable increased 15 percent in the second quarter thanks to strong increases in subscribers for digital cable, Internet phone and high-speed data services. Profits, as measured by OIBDA, were up 16 percent. What's more, the company filed for an initial public offering of Time Warner Cable last week. Time Warner will retain an 84 percent ownership stake in the unit after the sale, which is expected to be completed within the next few months. And analysts think that having a separate publicly traded stock for the division will help lift the overall value of Time Warner. "The cable IPO is obviously exciting. By putting stock out there you can get a sum of the parts valuation for Time Warner that is more accurate," said Greg Gorbatenko, an analyst with Jackson Securities. "The IPO filing is no longer lip service. They're actually doing something." Several analysts have also lauded the new strategy for AOL, which Time Warner unveiled in August. In addition, there have been some rumblings that AOL could even be sold. AOL has been steadily losing subscribers for the past few years as customers have flocked either to broadband services offered by cable and phone companies or cheaper dial-up Internet plans from the likes of United Online's NetZero and EarthLink. Many analysts have blamed the declining subscriber count, which has caused sales and profits at AOL to slip, for the weakness in Time Warner's stock price. But in August, AOL announced that it would no longer charge broadband subscribers monthly fees to use AOL e-mail and security features such as spam filters and anti-spyware software. Although this new plan is likely to result in an even steeper decline in subscription revenue for AOL over the next few years, the hope is that this will be offset by increased online advertising revenue from sites such as the flagship AOL.com site, MapQuest and celebrity gossip site TMZ.com. Companies like Google (Charts), which owns a 5 percent stake in AOL, Yahoo!, and News Corp., the parent company of popular social networking firm MySpace, have been benefiting from a surge in online advertising thanks to the millions of users that their sites attract on a daily basis. And speaking at a Merrill Lynch media conference last month, AOL Jonathan Miller said that advertising trends are improving at the company and that so far, the company had seen more users sign up for the free AOL service than it had expected. To that end, Morgan Stanley upgraded shares of Time Warner to an "outperform" late last month and Citigroup raised its price target to $24. In his report, Citigroup analyst Jason Bazinet dubbed AOL's new strategy "simply brilliant." A turnaround at AOL could also spark more speculation that Time Warner may eventually want to sell the unit. According to an article in the British newspaper Telegraph Sunday, AOL chief executive officer Jonathan Miller said that Time Warner is considering a sale of the unit. But Time Warner spokesman Edward Adler said Monday morning that Miller's remarks were misinterpreted and that AOL was not for sale. However, one analyst said the jury's still out on AOL. "Maybe the market is anticipating that AOL will turn around and that the plan will actually work," said Joe Bonner, an analyst with Argus Research. "But I think it's probably too early to tell about AOL." Movies and magazines not performing well And despite the strength in cable and increased hope that AOL's worst days are behind it, Time Warner also is having a tough time in other businesses. The company's movie studio has struggled this year. Several films, most notably "Poseidon" and "Snakes on a Plane," have disappointed at the box office. Time Warner is also seeing slowing growth in its publishing unit due to weak advertising sales and declining circulation figures at some publications. As a result, the company announced in September that it was putting 18 magazines, including Popular Science, Field and Stream and Parenting up for sale. Weakness in the movie and publishing business could have an impact on Time Warner's third-quarter results though. "If Time Warner can get a tailwind from publishing and movies and networks, then that would help. Those divisions have been a millstone," Gorbatenko said. However, he and other analysts said that for most investors, what matters most is that cable continues to do well and that AOL shows signs of improvement. "The primary focus is on cable and AOL," Martin said. "I don't think that people are paying that much attention to publishing, the studio business or the networks." Time Warner's cable networks division, which includes CNN, HBO and Cartoon Network, generates about a quarter of the company's sales and OIBDA. Stock still trading at discount to rivals Argus' Bonner said that he still thinks Time Warner is a decent value. The stock currently trades at about 19 times 2007 earnings estimates, a discount to News Corp (Charts) and Comcast (Charts). And the stock trades at just 7.6 times estimated earnings before interest, taxes, depreciation and amortization (EBITDA) for 2007, a number that many analysts use to value media companies. By way of comparison, Disney (Charts), Viacom (Charts) and News Corp. trade in a range of 10 to 13 times next year's EBITDA forecasts. "People have been saying that Time Warner is cheap for years. The stock is still undervalued," he said. Bonner added that the company has also made more shareholder-friendly moves over the past year and a half. Time Warner began paying a dividend in May 2005 and increased it by 10 percent in July of this year. The company also announced in February that it was boosting its stock buyback program to $20 billion. The latter move came about mainly because of pressure from activist shareholder Carl Icahn, who had actually suggested earlier this year that Time Warner be broken up into four separate companies. Icahn later made amends with Time Warner chief executive officer Dick Parsons and dropped his plan to seek control of the company's board after he could not get the necessary support from large shareholders for his proposal.

Analysts quoted in this story do not own shares of Time Warner. Citigroup has an investment banking relationship with the company but the firms of other analysts quoted in this piece do not. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|