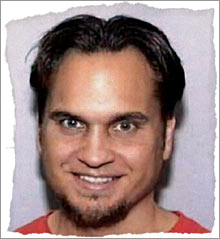

Mortgage scam suspect arrestedFortune exclusive: Alleged con artist Matthew Bevan Cox is arrested in Tennessee.NEW YORK (Fortune) -- Alleged master con artist Matthew Bevan Cox was captured within the last 24 hours at his home in Nashville, Tennessee, according to the U.S. Attorneys office in Atlanta. He was running a business called the Nashville Restoration Project. A source familiar with his domestic situation turned him into federal agents. Authorities have him in custody in Nashville, and he will likely stand trial in Atlanta, where he faces a 42-count indictment carrying a 400-year jail sentence. The Bonnie and Clyde of mortgage fraud

For the better part of the past decade, Cox has stalked his prey through MLS (multiple listing service) real estate ads. Authorities suspect he has stolen at least $15 million through fraudulent mortgages, although the figure could be much higher. His victims have been forced to pay tens of thousands of dollars to lawyers to save their property from foreclosure on unpaid fraudulent loans. In "Real Estate Scammers," Fortune chronicled the six-state crime spree in which Cox enlisted help from Rebecca Marie Hauck after they met on Match.com. Read the story. Are you at risk? Since the housing market started to soar in 2001, mortgage fraud has become the fastest-growing white-collar crime, according to the FBI. Last year, crooks skimmed at least $1 billion from the $3 trillion U.S. mortgage market. |

|