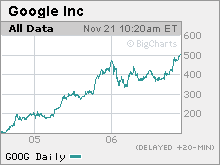

Google jumps past $500No. 1 search engine tops mark for first time, is up nearly sixfold since going public.NEW YORK (CNNMoney.com) -- Google stock jumped above $500 for the first time Tuesday, leaving the shares up nearly 500 percent since the world's No. 1 search engine went public little more than two years ago. Shares of Google (Charts) closed at $509.65 in heavy trading on the Nasdaq, up almost 3 percent for the day and just below the intraday high of $510 it hit late Tuesday afternoon.

Google is up more than 20 percent this year, far outperforming fellow Internet giants Yahoo!, eBay (Charts) and Amazon.com (Charts), whose shares have all slumped in 2006. Google went public in one of the most widely awaited IPOs in recent memory in August 2004 at $85 a share. The surge in Google's stock has made many investors and Google employees wealthy. Google's top executives, in particular, have become extremely rich as a result of the company's success. Based on the most recent regulatory filings with the Securities and Exchange Commission and using current stock prices, Google co-founders Sergey Brin and Larry Page each own approximately $15.4 billion worth of Google stock. Google chief executive officer Eric Schmidt's holdings in Google are worth about $5.7 billion. The three executives have sold some of their stakes in Google since the IPO, but Schmidt, Brin and Page also have agreed to receive just $1 in annual salary from Google. The Mountain View, Calif.-based company dominates the lucrative world of online search advertising, having steadily gained share from rivals Yahoo (Charts) and Microsoft's (Charts) MSN. According to research reports released Monday by two influential firms that track Web traffic, Google continued to maintain a commanding lead over competitors during the month of October. Nielsen//NetRatings reported that Google had a nearly 50 percent share of searches in the U.S. last month, compared to 23.9 percent market share for Yahoo and 8.8 percent for MSN. comScore Networks reported that Google's market share was 45.4 percent, compared to 28.2 percent for Yahoo and 11.7 percent for MSN. In August, the company signed a deal with News Corp.'s (Charts) popular MySpace social networking site that makes Google the exclusive provider of text-based ads on MySpace. "Investors are rewarding Google for excellent execution. They continue to gain market share and all the indications about online advertising for the fourth quarter remain nice and solid. This company is not going to mess up," said Sasa Zorovic, an analyst with Oppenheimer & Co. But investors are excited about the company's growth prospects beyond keyword text searches. Earlier this month, Google completed its purchase of YouTube, the biggest site for viewing video on the Web, for $1.65 billion. That deal could allow Google to dominate the nascent online video advertising business. One analyst said that even with Google zooming past $500, the stock still looks attractive since most analysts have yet to factor in the potential for video ads and other forms of graphical advertising, into their financial models. "There is a lot of upside to projected forecasts from the new businesses. There is just not a lot of expectation yet built in from video ads," said Marianne Wolk, an analyst with Susquehanna Financial Group. Google is also expanding into other areas. The company's new Google Checkout feature, an online payment service, is viewed by many as a direct threat to eBay's popular PayPal. Clayton Moran, an analyst with Stanford Group, added that Google services for cell phones and other mobile devices will also be a big growth opportunity for the company. Several analysts raised their price targets on Google to well over $500 and one analyst even slapped a $600 target on the stock after the company reported third quarter results in October that surpassed consensus estimates. Google has beaten Wall Street's targets seven out of eight quarters since going public. Moran argues that even though Google's stock trades at 37 times 2007 earnings estimates, a big premium to the overall market, the stock is worth it since earnings are expected to increase at a nearly 33 percent clip in 2007 and for the next few years. Still, will investors inevitably wind up suffering from sticker shock as Google's price climbs higher and higher? Google's management team has maintained since the company went public that it would not split the stock. In a stock split, companies issue more shares at a lower stock price in order to reduce the overall stock price. The company's value does not change, however. Many companies elect to split their stock when the price of one share approaches $100. In theory, the average investor may be more inclined to buy a stock if the price remains below triple-digit territory. But Moran thinks Google will continue to stick with these plans. What's more, he does not think that investors will be deterred by Google's growing stock price. "All the indications I get from the company is that they are comfortable with a stock price that implies a superiority to competitors so I don't think they are motivated to split the stock," he said. And after all, Google still has a long way to go before its stock has a price tag as rich as Warren Buffett's Berkshire Hathaway. One class "A" share of Buffett's investment company costs $107,300 while class "B" shares trade at a price of $3,584. Analysts quoted in this story do not own shares of Google and their firms have no investment banking relationships with the company. |

Sponsors

|