Bill Miller's streak nears an endThe legendary Legg Mason fund manager has beaten the market for 15 straight years, but a "Sweet 16" celebration probably isn't in the cards.NEW YORK (CNNMoney.com) -- Streaks were meant to be broken. Joe DiMaggio couldn't get a hit in a 57th straight game. The UCLA men's college basketball team finally lost after 88 consecutive wins. And, barring a major miracle, Bill Miller's Legg Mason Value Trust mutual fund will not beat the S&P 500 this year, bringing an end to his legendary 15-year streak of outperforming the market.

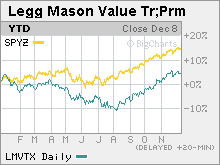

Through December 8, Miller's fund is up 4.6 percent in 2006, while the S&P 500 has returned, including dividends, 15 percent. Miller's fund has pulled come-from-behind victories in the fourth quarter for the past two years, but with only a few weeks left in 2006, it appears that a more than 10 percentage point deficit will be too big to overcome. Miller spoke along with other Legg Mason fund managers at the firm's annual investment outlook in New York City on Monday. As the final speaker, he joked about his fund's performance. "They did save the worst for last. Our results aren't that good this year." One reason Miller has lagged the market is a lack of exposure to the energy sector, which has been one of the better performers in 2006 thanks to a rise in oil prices. The S&P energy sector has gained 24 percent this year and makes up about 10 percent of the S&P 500's total market capitalization. Miller, speaking to reporters after the presentation was over, conceded that he was wrong on energy stocks. He said he thought about buying some in 2003 but felt that he would be chasing performance and decided to avoid them. However, he remarked that he still is wary of oil stocks. Even though he said many energy stocks are reasonably valued, he thinks that the price of oil will probably fall slightly in 2007. And oil stocks tend to move in tandem with oil prices, he noted. But Miller expressed optimism that his fund, and the broader market for that matter, would do well in 2007. Miller said that with the economy slowing, the Federal Reserve probably will not need to raise rates any further. He said that would be good news for stocks, particularly large-cap stocks that have underperformed in recent years. Specifically, Miller said that large tech companies like IBM, Dell, Microsoft and Cisco Systems have the potential to beat the market next year. "Broadly speaking, tech is where most people are underweight. So it is a good place to be," he said. Miller, despite having the word "value" in his fund's name, is not afraid to invest in stocks with higher growth potential that many conventional value managers would find to be too expensive. As such, big bets on several Internet companies and health insurers have also not panned out for Miller this year. A trio of high-profile Internet stocks, Amazon.com (Charts), eBay (Charts) and Yahoo! (Charts), have all fared poorly this year. Amazon, Miller's ninth-largest holding, is down 18 percent. EBay and Yahoo, Miller's 16th- and 17th-largest holdings, are down 26.5 percent and 33 percent respectively this year. Miller also owns Google (Charts), though (it is his seventh-largest holding), and that stock has gained 16 percent this year. But Miller said that Yahoo is now one of the most attractive stocks in his fund. He said that he thinks Wall Street is underestimating how much Yahoo's new search technology for advertisers will add to the company's earnings and that the stock, currently trading at about $26, could be worth a price in the mid $40s. Three health insurers have also dragged down the returns of Legg Mason Value Trust this year. Miller owns UnitedHealth (Charts), Aetna (Charts) and HealthNet (Charts). United Health, Miller's fifth-largest holding, is down 20 percent. Aetna and HealthNet, Miller's 10th-largest and 21st-largest holdings, have each fallen 10 percent. He tends to make concentrated bets on just a handful of stocks. According to fund research firm Morningstar, Miller only owns 41 stocks in his fund, and nearly 45 percent of the fund's assets are invested in his ten largest holdings. But Miller, who also tends to stick with investments for many years instead of chasing momentum, expects that this strategy will help him next year. "We like what we own," he said. "What will do best is what did worst this year." To that end, Miller said that homebuilders, which have taken a hit in 2006 as the housing market has cooled, could bounce back next year. Miller thinks the worst may be over for the housing slowdown. His fund owns Pulte Homes, Centex and KB Home. Still, Miller has had his share of winners this year. In addition to Google, Miller has benefited from investments in utility AES (Charts), telecom Qwest (Charts) and retailer Sears Holding Corporation (Charts). AES, Miller's largest holding, has gained 46 percent this year, while Qwest, Miller's third-biggest holding, is up 35 percent. Sears, Miller's eighth-largest holding, has shot up more than 50 percent. And even though Miller probably won't beat the market this year, long-term investors have no reason to be upset. According to Morningstar, Legg Mason Value Trust has had an average annualized return of nearly 12 percent over the past ten years, while the S&P 500's average return over the same period is just 8 percent. Correction: An earlier version of this story stated that the average return of the S&P 500 over the past 10 years was 3.8 percent. CNNMoney.com regrets the error. |

|