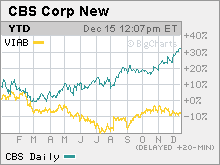

CBS faces the musicThe music industry is a tough business. So why has the Eye Network decided to jump back in?NEW YORK (CNNMoney.com) -- CBS is getting back into the record business - eighteen years after it first exited the music industry. The media giant announced Friday that it was starting CBS Records, a new label that would feature mainly up-and-coming independent musicians. CBS sold its old CBS Records label, whose roster included legends such as Miles Davis, Frank Sinatra and Bruce Springsteen, to Sony in 1988. CBS (Charts) said songs from artists on its in-house label will appear prominently in shows on CBS-owned networks such as its namesake broadcast network, the Showtime cable channel, and the CW, which CBS co-owns with Time Warner. (Time Warner (Charts) also owns CNNMoney.com.) The move is expected to allow CBS to lower its licensing expenses. Networks have to pay music companies fees to use songs in their TV shows. "Our television producers will have greater flexibility to use music as a creative enhancement in their shows and our company will be able to reduce the network and studio's music licensing cost," said Nancy Tellem, president of CBS Paramount Network Television Entertainment Group in a statement. But the decision to start a new record label struck some industry observers as an odd move. The music industry is highly competitive and controlled by an oligopoly: Sony BMG (a joint venture between Sony (Charts) and German media titan Bertelsmann), Universal Music Group, which is owned by French media firm Vivendi, Britain's EMI Group, and Warner Music Group (Charts). (EMI and Warner held merger talks earlier this year but a deal has been shelved for now because of regulatory concerns.) So it may be tough for a small label, albeit one owned by another large media organization, to be successful. "I find the decision a little strange since music is a tough business and you already have four dominant players. It's a scale business and you need a lot of different artists and genres to be efficient," said Mark Fratrik, a vice president with BIA Financial Network, a financial and strategic consulting firm for the media and communications industries. In addition, music is not exactly a high growth business. According to figures from the Record Industry Association of America, overall music sales (including digital) in the first half of 2006 totaled $4.9 billion, down 6.1 percent from the same period last year. And CBS has already shed many of its slower growth businesses. The company sold its Paramount Parks division to Cedar Fair for $1.24 billion in June and completed the sale of 39 radio stations in smaller markets to several different radio station owners this November. Investors seem to like these types of moves as well. Shares of CBS have gained more than 30 percent since the company split from former parent Viacom (Charts) in January. Viacom's stock, meanwhile, has fallen 8 percent. "It's a little surprising," said Joseph Bonner, an analyst with Argus Research. "The record business is pretty cutthroat these days. If there's any business that's worse than television, music would be it." Still, CBS apparently hopes to cash in on the growing online music market. The company said it will focus mainly on distributing music through Apple's (Charts) popular iTunes music store as well as on its own cbsrecords.com site and with other online and wireless partners. CBS added that it will issue physical CDs as well. But one analyst thinks that if CBS sticks to mainly an online music strategy, that could work out for the company. "The Internet makes it easier to sell music. The whole process of marketing and promotion has changed where they have a shot of making money from this so it does make sense," said Phil Leigh, senior analyst with Inside Digital Media, a Tampa-based independent research firm. And the company has stepped up its efforts in online media overall. It launched broadband video site innetrube earlier this year, hired Quincy Smith, a former executive with media investment bank Allen & Co., to head its digital operations in November, and also struck a content deal with YouTube, the popular online video site owned by Google (Charts), in October. What's more, curiously absent from the press release about CBS' new label was any mention about how, if at all, CBS plans to use its still very sizable radio division to promote its artists. CBS owns more than 150 radio stations nationwide, mainly concentrated in large markets. But Fratrik said it would not be a good idea for CBS to use its radio stations to get more exposure for the musicians on CBS Records. He said the radio business is now highly formulaic. So it would not be in CBS' best interest to feature relatively unknown artists while all of its competitors are playing "top 40" musicians. "Radio is so incredibly competitive that if CBS actually did favor their own artists instead of more popular ones, they would pay in terms of lost listeners. That would be a tough thing for CBS Radio to shoulder," Fratrik said. CBS is not the only media company that is trying to cash in on growth in digital music. Walt Disney (Charts) has its own record label and sells music through iTunes. And last year, News Corp (Charts). launched a MySpace-branded music label in partnership with Universal. News Corp. owns the popular MySpace social networking site, which has been used by many independent musicians as well as mainstream artists to promote their songs. The MySpace phenomenon raises another challenge for CBS though. Michael Goodman, a digital entertainment analyst with Yankee Group, a tech research firm in Boston, said artists are increasingly realizing that they don't need to sign up with big media companies to get their music distributed. "I would put CBS's decision under the header of 'What are they thinking?' It's not a good time to be starting a label. The trend is away from record labels. Digital music is the great equalizer and many new bands recognize that," Goodman said. As such, Bonner does not expect CBS Records to be that meaningful to the overall company. "I don't think CBS is going into music to be the next big record label. They are trying out new ideas, or old ideas reinvented, and saving on licensing is a justification to do it," he said. "But I don't see this moving the needle financially. Ratings points on the CBS TV network are 100 more times more important than music."

Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking ties to the companies. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|