Put up or shut up time for Yahoo!After a rough 2006, Yahoo must reassure Wall Street that new search tool Panama will be a success and that it has a plan to compete with Google and MySpace.NEW YORK (CNNMoney.com) -- Will Yahoo's fourth-quarter earnings and guidance for 2007 be smooth or chunky? That's the question on investors' minds in the aftermath of the now infamous Peanut Butter Manifesto - a memo by a Yahoo (Charts) executive leaked to the media last November that took the online media firm to task for spreading itself too thin - and a subsequent management shake-up.

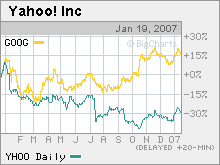

The company will report its fourth-quarter results, and give investors their first taste of how 2007 is shaping up, on Tuesday January 23. Wall Street expects the company to post revenue (excluding ad sales it shares with affiliates) of $1.22 billion and earnings of 13 cents a share in the quarter, according to figures compiled by Thomson Financial. For the full year, analysts are predicting that Yahoo will report revenue of $5.5 billion, an expected increase of 20 percent from 2006, and profits of 59 cents a share, an anticipated jump of 28 percent. Yahoo typically does not provide earnings per share guidance, however, so analysts and investors will be paying close attention to what the company's forecast for earnings before interest, taxes, depreciation and amortization (EBITDA) is. Analysts are predicting that Yahoo's 2007 EBITDA will be $2.2 billion. Yahoo, the world's second most popular search engine behind industry leader Google, had a rough 2006. Shares of Yahoo plunged 35 percent due to concerns that the company was falling further behind Google (Charts) in search and was at risk of losing users and advertising dollars to the likes of popular social networking kingpins MySpace and Facebook as well as online video upstart YouTube. Compounding matters, the release of Yahoo's much-anticipated new search platform, dubbed Project Panama, was delayed by a couple of months. (Yahoo is rolling Panama out to advertisers now, however). And in September, Yahoo told Wall Street that third-quarter revenues would be at the low end of the company's expectations, news that stunned investors and sent the stock reeling. Yahoo blamed weak demand for online advertising from auto companies and financial services firms. All this culminated in a management shuffle at the top of Yahoo in December. Chief financial officer Susan Decker was promoted to a new role - heading a unit dealing with advertisers - a position that many analysts said puts her in line to eventually succeed Yahoo chief executive officer Terry Semel. Now investors are hoping that Yahoo's nightmare year is behind it. Analysts say they are looking for reassurance from the company about the adoption of Panama, which is meant to improve the relevancy of keyword results for advertisers and users and therefore boost the amount of revenue per query that Yahoo receives from its search business as well as Yahoo's market share in search. Investors do seem to be betting that the worst may be behind the company. Shares of Yahoo have gained more than 10 percent so far this year, a possible sign that investors care more about what will happen in 2007 than how Yahoo did in the fourth quarter. "The stock has definitely bounced nicely. The dirty laundry is out in the open," said Tim Boyd, an analyst with Caris & Co. "I don't think investors are too interested in the fourth quarter results. The 2007 guidance, which should be given on this call, will be vital because everyone will read into that what management's expectations for Panama are." And Yahoo could clearly use a lift from Panama. According to figures from Web research firm comScore Networks released earlier this week, Yahoo trails Google by a fairly wide margin, with Google commanding 47.3 percent of the U.S. search market in December 2006 and Yahoo coming in second with 28.5 percent market share. But Yahoo's market share did increase slightly from November and some analysts are optimistic that Panama will help Yahoo get back on track. "The feedback we've gotten from agencies and advertisers about Panama is that it's a vastly improved product that is similar to Google. It allows advertisers to buy a greater breadth of keywords so there is strong enthusiasm for Panama," said Stewart Barry, an analyst with ThinkEquity Partners. The company will also need to signal to investors that the weakness it cited last year in auto and financial services advertising was just temporary. There is already some skepticism about how real this slowdown was. Jim Lanzone, chief executive officer of IAC/InterActive (Charts)-owned Ask.com, the number four search engine behind Google, Yahoo and Microsoft's (Charts) MSN, said that Ask.com did not see any weakness in online advertising at the end of 2006. And Yahoo has to do more than just improve its search business to get investors excited again. Yahoo has been criticized by many investors and analysts for not being as aggressive as competitors in the burgeoning world of social networking. Media giant News Corp. (Charts) bought MySpace in 2005 and Google acquired YouTube last year. Although the company has made acquisitions in the social networking arena, including photo sharing site Flickr and Web bookmarking site del.icio.us, some have argued that this isn't enough. To that end, there has been on-and-off speculation that Yahoo could buy Facebook in order to boost its presence in social networking. "Aside from worries about search and Panama, the biggest concern is Yahoo's relative lack to exposure in social networking. One of the strongest assets Yahoo has is its enormous traffic base but if it doesn't find new ways to drive growth, that advantage will rapidly deteriorate," said Boyd. The risk for Yahoo is that sites like MySpace and YouTube could begin to steal some of the so-called display advertising dollars from Yahoo. Display ads, which include banners, online video and other non-text based forms of ads, are an important part of Yahoo's business since it is area where it still has a lead over Google and other rivals such as MSN and Ask.com. "Yahoo is known for being a leading company in display. But with the emergence of properties like MySpace, Facebook and YouTube, to what extent do those companies and similar offerings result in a degradation of the value proposition that Yahoo offers to advertisers?" said Scott Kessler, an equity analyst with Standard & Poor's. "Right now it's being concluded that Google and others will be the winners when it comes to social networking." But before Yahoo can make bigger forays in social networking, it's probably going to need to find an executive to lead this push. When Yahoo announced its management changes in December, the company said it was also forming a new division that would be in charge of building Yahoo's audience base but it did not name a head of that unit. Kessler said it is crucial for Yahoo to hire a new executive for this position soon, as well as find a replacement for Decker, who will give up the CFO spot to focus full-time on working with advertisers once her successor is hired. "There are still a lot of questions about the new management structure. Last I checked you have important positions still open," Kessler said. "Investors are looking for details about a new CFO and a new head of the audience business. The lack of news frankly can't be construed as anything but problematic." So it's clear that Yahoo quickly needs to prove to Wall Street that it has a plan to fend off challenges from new online media rivals like MySpace as well as get its growth back on track in search. If Yahoo doesn't deliver, Boyd said that the company may be forced to make more management changes or even look for a merger partner. "This will definitely be a make or break year for Yahoo. If it's not a successful year then Semel, rightly or wrongly, would be gone," he said. "And if Panama does not succeed in improving Yahoo's search revenue growth, Yahoo could be an attractive buy for somebody like Microsoft." Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking relationships with the companies. |

Sponsors

|