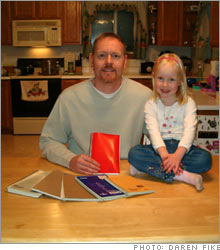

Millionaire in the making: Daren Fike38-year old widower's good financial sense positions him well for the future.NEW YORK (CNNMoney.com) -- Daren Fike, a business analyst in Colorado Springs, Colo., had always been a saver and a planner. When his wife Christie passed away suddenly from leukemia in 2003, however, Daren's goals shifted and spending time with his daughter Melody, who was 16 months old at the time, became a priority.

The father and daughter live 40 miles from Denver, in Colorado Springs, in a house surrounded by 5 acres of land. They have a horse, Cricket, that Daren is just beginning to teach Melody to ride. "My wife was big into horses," said Fike. "She showed them [competitively]." They bought their home in 1998 for $199,000 with a 30-year, 7 percent fixed mortgage. In 2003, Fike refinanced to a 15-year, 5.125 percent fixed mortgage. Fike makes payments on a bi-weekly basis and today owes $124,000 on his home. Fike thinks he can have it paid off by 2012. Fike's annual income, with death benefits from his wife's previous employer as well as Social Security survivor benefits, hovers around $100,000. Fike contributes 12 percent of his salary to his 401(k) plan. His employer, Great Western, contributes another 4 percent in a company match. Fike is fully funding his Roth IRA at $4,000 a year, which has $42,000. He puts $3,000 per year into his taxable Fidelity Brokerage account, which totals $84,000. Additionally, he has more than $98,000 in two 401(k) accounts - the second one holding funds from a rollover. Fike also has almost $32,000 in mutual funds and $34,000 in an annuity. All told, Fike has about $290,000 socked away for retirement. He also has $24,000 in an emergency fund earning 5 percent interest with online bank Emigrant Direct. "In one of my accounts somewhere I have the first dollar I was ever given. It was a dollar I received when I was first born," said Fike, who credits his parents for emphasizing how important saving is. It's not just Fike's prudent choices but his lifelong saving habits that aid him. The Notebooks For years Daren has kept track of his every expenditure in little notebooks. Every 15 days, which coincide with his pay, he totals the amounts. At that time, anything left over in his checking account goes immediately into his savings. The idea is to never have any money left in his checking account at the end of the 15 day period. When he was in the Air Force, he says, his friends called it the "Fike Strategy." Fike said he tried to use personal finance software like Quicken but found it too time consuming. "But spending $1.50 every 2 or 3 years for a notebook? It's portable, too." The simplicity of Daren's financial philosophy extends to his choice in credit cards, too. Fike has used a Discover Card since he was in college. "I've never paid one penny in interest on the card. When I put everything on that card, I'm getting about $300 back." Having a 40 mile commute and knowing that gas would be a consistent expense, Fike switched to the type of Discover card that gives 5 percent back on gas. Fike looks to shave costs off in other areas, too. He makes certain his car isn't carrying any extra weight in its trunk to save gas. His 1997 Cougar has 185,000 miles on it and he says, "I'm not looking forward to getting rid of it anytime soon. I'll drive it till the wheels fall off." In addition to the Cougar, which he drives daily, he owns a 2000 Chevy Silverado truck. Values and plans "The thing I value most in life is time with my daughter," said Fike. "I would gladly give every cent I have to spend just five more minutes with my late wife Christie so you can be sure I'm not taking the time I have with Melody for granted." In addition to time spent teaching Melody to ride a horse, Melody takes ice skating and swimming lessons. Fike, a Pittsburgh-native, follows all the Steel City's sports teams closely, too. By no means is Fike a passive observer of the world. "Since my wife's passing, my emphasis has been on having more life experiences," Fike said. These days Daren and Melody do a lot of father-daughter activities together such as visiting the park or going bowling. Last year, they went back to Pittsburgh in June and attended the Steelers Men's Fantasy Camp in Latrobe, Pennsylvania, meeting running-back Jerome Bettis of the Superbowl-winning team. Daren has also taken up television writing as a hobby. He and a friend are shopping a script around for a dramatic TV show. Regarding money, Fike says it's "almost like a necessary evil. You have to pay attention to it. The earlier you pay attention to it, the better off you're going to be." That's why he's teaching Melody about money. "She saves up the money she gets from birthdays and holidays in her piggy bank," he said. "We go together to the bank so she can make her own deposits. She already knows what 'interest' is!" ------------------------------------------- Take the job survey. We want to hear more about your career for an upcoming feature in Money Magazine. Millionaire in the Making: Sherelle Derico Millionaires in the Making: The Aroras |

|