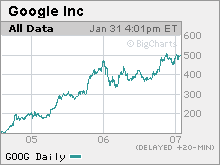

Google ad machine steamrolls onProfits nearly triple at No. 1 search engine, topping forecasts, but investors sell on the news.NEW YORK (CNNMoney.com) -- Google said Wednesday that profits nearly tripled in the fourth quarter, topping forecasts on Wall Street thanks to robust growth in online advertising. But Google (Charts) stock slipped after-hours as investors took a "sell-on-the-news" approach following the stock's recent run.

The world's biggest search engine reported net income surged 177 percent to $1 billion, or $3.29 a share. The company reported a profit of $3.18 after backing out tax adjustments, stock compensation cost and other items. Analysts were expecting Google to report earnings of $2.92 a share on that basis. Revenue jumped 67 percent to $3.21 billion. Excluding ad sales that Google shares with partners, revenues were $2.23 billion, slightly ahead of the consensus forecast of $2.2 billion on this basis, according to figures from Thomson First Call. Demand for online advertising, particularly the keyword search ads that Google specializes in, has been booming. To that end, Google's top rival Yahoo! (Charts), which is launching a new search platform in order to gain ground it has lost to Google, reported better-than-expected fourth quarter results last week. But Google maintains a healthy lead over Yahoo and other competitors in search, including Microsoft's (Charts) MSN, IAC/InterActive's (Charts) Ask.com and Time Warner's (Charts) AOL unit. (Time Warner also owns CNNMoney.com.) "Business continues to be very good here at Google," CEO Eric Schmidt said on a conference call with analysts. "We are gaining share in almost every country and we expect that to continue." To that end, Google said that nearly 44 percent of its total sales came from outside the U.S., up from 38 percent a year ago. Despite the strong results, Google stock sank about 2 percent in after-hours trading after rising 1.5 percent in regular trading on Nasdaq. Google doesn't give guidance on results for upcoming quarters. Analysts currently expect Google to report sales, excluding revenue shared with partners, of $2.45 billion for the first quarter, up 60 percent from last year, and earnings excluding certain items of $3.25, up 42 percent from a year earlier. The stock jumped 11 percent last year and is up nearly 10 percent so far in 2007 thanks to strength in search and optimism about the company's advertising partnership with News Corp (Charts). unit MySpace and Google's acquisition of online video leader YouTube last year. Google stock has jumped nearly six-fold since the company went public in 2004. During the conference call, Google executives did not give much information about the YouTube deal or other new initiatives at the company. Schmidt said that Google is focusing on increasing user adoption and advertising at YouTube but declined to give any specifics about YouTube's revenue. Schmidt also said that Google plans to work more with its advertiser customers on extending its targeting technology beyond the Internet and to radio, television and print advertising. He added that mobile advertising will become a more important part of Google's business in the years ahead as well. The most detail was about Google's new Checkout product, an online payment service that many see as a formidable competitor to eBay's PayPal service. Sergey Brin, Google's co-founder, said that nearly 20 percent of the top Web retailers are using Checkout. Online jewelry retailer Blue Nile announced Wednesday that it was working with Checkout. Analysts said that despite the after-hours sell-off, there appeared to be little for Google bulls to worry about. "The fundamentals are intact. Some people were just thinking that they would beat already heightened estimates by a wider amount," said Trip Chowdhry, an analyst with Global Equities Research. He noted that estimates for Google had been rising in recent weeks and Google still wound up beating them. Still, some investors may be concerned with rising costs at Google. During the conference call, Google chief financial officer George Reyes hinted that Google would continue to hire more people across the globe and that would lead to higher operating expenses. Reyes also said Google's capital expenditures will grow as the company invests in technology such as data centers and servers, and defended the higher spending. "Aggressively investing in our infrastructure has paid off and has been critical to our success," he said. Derek Brown, an analyst with Cantor Fitzgerald, said he was not concerned with Google's investments since the company still boasts impressive margins. He added that it would be more of a problem if Google wasn't interested in expanding and diversifying. "When you have a company growing as rapidly as they are growing with as many opportunities sitting in front of them as they appear to have, then it would be more worrisome if they chose not to invest," said Brown. Another analyst said he actually was pleased to see investors not get too enthusiastic about the results. "The market is recognizing that Google beat this quarter but is not getting too excited. That's healthy," said Tim Boyd, an analyst with Caris & Co. Boyd said the company reported a solid quarter but there are a couple of things that some investors might have concerns about. He noted the percentage of revenue that Google shares with partners is rising, which could be worrisome, and that revenue growth from Google's partner sites also cooled a bit. But Chowdhry said Google investors should be pleased to see the company's still growing rapidly given it's already a big company. Google reported sales excluding shared revenue of $10.6 billion in 2006, up 73 percent from 2005. "The most important thing that investors should be thinking about is that for any company with as much revenue as it has to be growing this rapidly is unheard of. No other company can offer that and it should have sustainable growth over the next four to five years," he said.

Analysts quoted in this piece do not own shares of Google and their firms have no investment banking ties with the company. |

Sponsors

|