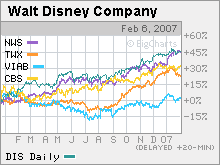

The year of the Mouse and FoxWalt Disney and News Corp. were the hottest media stocks of 2006. Can they repeat that performance this year?NEW YORK (CNNMoney.com) -- So far, 2007 is looking an awfully lot like last year for major media companies. Walt Disney (Charts) and News Corp. (Charts) were two of the best performing media stocks in 2006 thanks to strong ratings for their broadcast and cable networks as well as big box office sales from their movie divisions.

News Corp's stock shot up 35 percent last year while shares of Disney surged 44 percent. Disney's stock is up nearly 3 percent so far this year while shares of News Corp. are up 9 percent. Both stocks are trading just a touch below their 52-week highs. Disney owns ABC and ESPN and the Buena Vista movie studio, which had big hits with the second movie in the "Pirates of the Caribbean" trilogy as well as "Cars," the computer animated movie produced by Pixar, which Disney bought last year. News Corp. owns the Fox television network, which won the ratings battle for 18-49 year-olds for the second season in a row thanks to its runaway hit "American Idol," the Fox News cable channel and the Fox movie studio, which released box office blockbusters "X-Men: The Last Stand," "Night at the Museum", and "Ice Age: The Meltdown." The two media giants are set to report their latest quarterly results on February 7. And analysts expect both companies to post strong numbers. According to estimates from Thomson First Call, Wall Street expects Disney to report fiscal first-quarter sales of $9.55 billion, up 8 percent from a year ago, and earnings per share of 39 cents, an increase of 11 percent. News Corp. is expected to report fiscal second-quarter revenue of $7.4 billion, 11 percent higher than the same period last year, and earnings of 26 cents per share, up 24 percent. Alan Gould, an analyst with Natexis Bleichroeder, said that Disney and News Corp. should benefit from healthy DVD sales during the holidays. Disney released a DVD of "Cars" and "Pirates of the Caribbean: Dead Man's Chest" during the quarter while Fox released "X-Men: The Last Stand" and "Ice Age: The Meltdown" during the quarter. Gould added that Disney also should see a boost thanks to solid ratings on ABC as well as on ESPN, which broadcast "Monday Night Football" games during this past football season. News Corp.'s broadcast business may have had a rough quarter since Fox did not do well in the prime-time ratings race during the fall. But Gould said most investors will probably overlook that since "American Idol" returned to the Fox lineup in January and its season premieres had record-ratings. That bodes well for the company's fiscal third-quarter, which ends in March. "Ratings in December for Fox were not good. But people won't overly dwell on that given the ratings for 'American Idol,'" he said. "Investors will look forward." David Joyce, an analyst with Miller + Tabak & Co., added that News Corp. also should experience strong growth in its cable TV business this year since cable companies will be paying increased rates to carry Fox News this year. Still, both companies could face some tough comparisons this year, particularly in their movie studio divisions since they each had their fair share of blockbusters in 2006. Laura Martin, an analyst with Soleil -- Media Metrics, said Disney should be able to hold up well though since it has the third "Pirates" movie coming out this summer as well as another Pixar film, called "Ratatouille." Disney has the added burden, however, of trying to match strong results from its theme park division last year. The theme parks business, which accounted for about 30 percent of sales and nearly a quarter of operating profits in its last fiscal year, benefited from the continuation of an eighteen month-long celebration of the 50th anniversary of the opening of Disneyland. Special events tied to the event took place at all of Disney's parks beginning in May 2005 and running throughout last year. But for both companies, investors may be most interested in their burgeoning online media businesses. Traditional media companies are finding that they are increasingly competing with the likes of Google (Charts), Yahoo! (Charts) and other online media firms for viewers and advertising dollars. Other big media companies are fighting back online though. Time Warner (Charts), which reported fourth-quarter earnings last week, said that online advertising sales from its AOL unit surged 49 percent from a year ago. (Time Warner also owns CNNMoney.com) Disney and News Corp., however, are widely acknowledged to be among the most aggressive when it comes to embracing digital media. Disney was the first major media firm to partner with Apple (Charts). The company now sells TV shows and movies through Apple's popular iTunes store. "The relationship with Apple and willingness to adapt to new technologies is key for Disney," said Martin. And for News Corp., which acquired the parent company of the popular social networking site MySpace in 2005, this should be the year when the company sees its investment in digital media really begin to pay off. MySpace struck an ad partnership with Google last year in which Google will pay MySpace a minimum of $900 million over the next few years. As such, Gould said that he believes Fox Interactive Media, the division that MySpace is a part of, could generate $500 million in sales this fiscal year, which ends in June, and $750 million in revenue in fiscal 2008. With all this in mind, analysts said both stocks still looked fairly attractive since they are trading at valuations that are roughly in line with their peers. Disney trades at about 20 times earnings estimates for this fiscal year, which ends in September, while News Corp. trades at 22.5 times fiscal 2007 earnings estimates. By way of comparison, media rivals Time Warner and Viacom (Charts) trade at about 21 times 2007 earnings estimates. "Disney is not yet priced to perfection. I still think there is upside," said Joyce. "And News Corp. is a fairly solid stock that, on a percentage basis, could even have more upside than Disney." Natexis Bleichroeder's Gould owns shares of News Corp. but his firm has no investment banking relationships with it or Disney. Other analysts quoted in this piece do not own Disney or News Corp. and their companies do not perform investment banking for them. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|