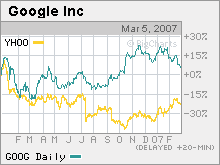

Google CEO: No big deals aheadEric Schmidt tells Wall Street to expect more growth from online video and mobile search from Google but no major mergers.NEW YORK (CNNMoney.com) -- Mobile advertising and online video advertising are going to be two big areas of growth for Google in the next few years, Google chairman and chief executive officer Eric Schmidt told investors at an tech industry conference Monday. Speaking at the Morgan Stanley Technology Conference, Schmidt also said that it was "highly unlikely" that Google (Charts) would use its more than $11 billion in cash to pursue any large mergers.

He brushed aside a question about whether Google would ever be interested in buying top rival Yahoo! (Charts) by saying that it was too early for the online advertising market to be consolidating in such a major fashion. Schmidt added that Google was not seeing any impact yet from the introduction of Yahoo's new online search platform, Panama. Yahoo's stock has surged this year on hopes that advertisers are flocking to the new system, which features improved search ranking technology that makes results for relevant for advertisers. "The fact that there is a new and interesting advertising system does not mean it will affect us negatively. People don't advertise on just one system," he said. Schmidt also addressed criticism of the company's capital spending plans. Some investors have worried that Google is investing too much on new projects and services. "If we spend more, we will in fact generate more traffic, more monetizable opportunities and more revenue. There is a direct relationship between our capital spending and our revenue and market share," he said. As for new growth opportunities, Schmidt said that one thing that he's noticed while traveling is that you can't escape the sound of cell phones. Specifically, Schmidt said that he expects Apple's new iPhone, which is expected to go on sale in June, should be a big hit that could help Google. Schmidt is a member of Apple's (Charts) board of directors. "The iPhone is going to be an incredible product. It is the first full-featured phone with Internet browsing," he said. Schmidt also said that Google has high hopes for its online video offerings. The company bought online video sharing service YouTube late last year for $1.7 billion and also operates its own Google Video service. "Sometime in the spring of last year, online video took off. I don't know if everyone got a video camera for Easter or something but everyone started posting everything they could online. We saw this," Schmidt said, adding that the company expects to see a continued increase in the amount of online video searches and video uploads. Schmidt did not directly discuss the controversy surrounding YouTube and copyrighted videos that are posted on the site without the consent of big media companies other than to say that media companies face "daunting" challenges such as Internet piracy, how to make money from online video and licensing issues. Viacom (Charts), for example, demanded last month that YouTube take down videos from Viacom-owned cable networks that were not posted with Viacom's approval. But even Schmidt conceded that although he felt the online video advertising business is "very large", he added that it is "unclear what the monetization will be like." As such, Leslie Moonves, chief executive officer of CBS (Charts), said during a presentation at the Bear Stearns Media conference earlier Monday that his company has decided to partner with YouTube. Even though online videos were not generating any meaningful advertising revenue for the company, he said they did help raise awareness for CBS shows. "We give YouTube our content. It is a huge promotional advantage," Moonves said. "Some of my competitors vehemently disagree and say this is the beginning of what happened in the music business. I don't agree with that. I think it's better to be inside the tent." |

Sponsors

|