Despite satellite, 'old' radio still singsWhile Wall Street focuses on the Sirius-XM deal, investors should look at traditional radio broadcasters, some of which are outperforming their high-tech brethren.NEW YORK (CNNMoney.com) -- A funny thing has happened in the world of radio. Satellite radio companies were supposed to put terrestrial radio operators out of business. But on Wall Street, investors appear to have higher hopes for stodgy "old" radio firms. Indeed, the two satellite radio companies, Sirius (Charts) and XM (Charts) are trying to merge in an apparent attempt to be more competitive against free radio services.

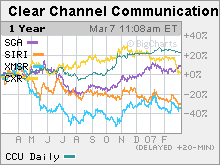

Shares of Sirius and XM, despite the merger news, are each down about 30% in the past 12 months. But shares of smaller, terrestrial radio station owners Cox Radio (Charts) and Saga Communications (Charts), for example, are up 5 percent and 9 percent respectively. And Clear Channel Communications (Charts), the nation's largest radio station owner, is up 22.5 percent. That company has agreed to sell out to a group of private equity firms for about $19 billion, with shareholders voting on the deal later this month. Despite many concerns about sluggish growth prospects in free radio, the business remains steady, if not spectacular. "I'm still not totally convinced that a big upturn for radio stocks is in the making," said James Goss, an analyst with Barrington Research. "That said, there is a reason to be paying attention to them. While the growth element has been lacking, the profitability and cash flow generating ability is still pretty strong." Terrestrial radio gets a bad rap. Yes, radio is clearly an industry that is not as important as it was a few decades ago. But it's not dying. There are also some compelling reasons to like the business. According to a study released last September by radio ratings firm Arbitron and research firms Media Monitors and Coleman, radio companies tend to hold more than 92 percent of their audience during an average commercial break. That's surprisingly strong retention considering how easy it is to change the channel and find another station that isn't airing a commercial. What's more, radio is a business that should benefit in a world where more companies are focusing on local, targeted ads. Local is a big buzzword in online search marketing as well as the nascent business of advertising on cell phones. Sure, a lot more people are probably listening to satellite radio or music from their MP3 players in their cars. But free radio is still the best way for people stuck in rush-hour drives to get updates on local news, weather and traffic. In fact, CBS (Charts) CEO Leslie Moonves touted radio's local nature as the main reason why his company still is a believer in the radio business during a presentation at the Bear Stearns Media conference earlier this week. CBS owns the nation's second largest radio network after Clear Channel. "What free radio offers and satellite radio and iPods don't do is a local business. We cash in on that, not only with news, sports and weather but even music. Radio is still a strong business that generates a lot of cash. A lot of people are down on the radio business, but satellite has not really affected us," Moonves said. The big radio station owners also may face less competition from independent Internet radio firms in the near future due to a recent ruling about Web royalty rates by a panel of three copyright judges known as the Copyright Royalty Board, which is an arm of the Library of Congress. On Friday, new royalty rates for Web radio broadcasts were put into effect and made retroactive to last year. The new rates will increase each year for the next four years, going from 8 cents a stream last year to 19 cents a stream in 2010. This ruling could make it prohibitively expensive for smaller independent Web radio operators, which, truth be told, is a shame given the cookie-cutter music formats that dominate terrestrial radio. Still, there's no denying that less competition from the Web could be good news for the larger publicly traded radio operators, which may be able to better absorb the rising royalty costs. "For typical public broadcasters, the royalty increase is not that a big of a deal," said David Bank, an analyst with RBC Capital Markets. And somewhat ironically, other advances in new technology could help the radio business. Search industry leader Google (Charts) bought privately held company dMarc Broadcasting, a firm that specializes in connecting advertisers and radio stations through an automated platform, last year. Google has yet to really make any significant headway in selling radio ads through dMarc, but Bank said that if Google does get more serious about radio, then that could be a boost to traditional radio operators. "The wild card in this sector is really Google. All else being equal, the radio sector is not likely to break out of its doldrums. There's the risk you lose listeners to new technologies. But the bullish argument is that you could bring in new advertisers through Google," he said. Finally, most radio stocks are trading at relatively reasonable valuations, so they should have little downside. Citadel Broadcasting, Cox, Saga and Entercom Communications trade in a range of about 17 to 20 times 2007 earnings estimates. So can shares of radio stations continue to bounce back during what's likely to be a lengthy regulatory review of the Sirius-XM merger? Stay tuned, listeners. Barrington's Goss owns shares of radio station operators CBS, Emmis, Entercom and Clear Channel but his firm does not have banking relationships with companies he covers. RBC's Bank does not own stocks mentioned in this piece and his firm has no banking ties to them. |

| |||||||||||