Wrestling's 'Trump' cardThere is a lot of buzz about the Donald Trump-Vince McMahon WrestleMania 'hair' match. But is WWE's stock a bald and beautiful buy?NEW YORK (CNNMoney.com) -- Donald Trump may lose his hair after WrestleMania 23 on April 1. But World Wrestling Entertainment investors might have to worry about losing a lot more if the company's big pay-per-view event isn't a success: their shirts. WWE is having its version of the Super Bowl on Sunday at Detroit's Ford Field, where a sold-out crowd of about 75,000 people are expected to watch the marquee matchup pitting Bobby Lashley versus Umaga, fighting on behalf of Donald Trump and WWE co-founder and chairman Vince McMahon.

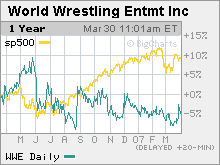

At stake in the so-called "Battle of the Billionaires"? The moguls' coiffure. If Umaga wins, Trump will have his hair shaved after the match and if Lashley wins, Vince will shed his locks. (At least that's what the company is claiming. We wonder if this won't turn out to be an elaborate April Fool's joke. It's hard to fathom The Donald parting with his trademark bouffant.) The publicity has helped lift shares of WWE (Charts) more than 5 percent in the past week - analysts say that WWE's stock typically has run up in anticipation of WrestleMania. "You have to give credit to McMahon for being a great promoter. This Trump-McMahon thing is generating all sorts of interest," said Dennis McAlpine, an independent media analyst. But the stock has been a disappointment over the past year. Shares are down 2.5 percent in the past 12 months and even with this week's rally, the stock is trading only 8 percent above its 52-week low. Could a successful WrestleMania get the stock back on track? After all, revenue from live events and pay-per-view are two key sales drivers for the company. Last year, live events accounted for a quarter of WWE's total sales and pay-per-view fees contributed 23 percent. And Michael Sileck, WWE's chief operating officer, told investors during a Citigroup (Charts) conference in Las Vegas earlier this month, that both businesses are booming. According to Sileck, attendance at WWE events in North America is up 21 percent over the past 12 months. He added that the company generated about 6 million pay-per-view buys last year, with 1 million for WrestleMania alone. (WWE has not released advance pay-per-view requests for the April 1 event.) So despite some occasional gripes from critics about wrestling being a fad, it appears that the WWE is still pretty popular. According to a recent ranking of popular Web searches from Yahoo! (Charts), WWE had the fourth most online buzz, trailing only top TV hits "American Idol" and "Dancing with the Stars" and singer/actress Beyonce, and ahead of pop culture phenomena/celebrity gossip fodder Anna Nicole Smith, Britney Spears and Lindsay Lohan. In addition, the WWE's two telecasts of its Monday night show "RAW" on GE (Charts)-owned USA have consistently ranked in the top five of all basic cable shows for the past few months, typically averaging about 6 million viewers a week, according to figures from Nielsen Media Research. WWE also airs shows on SCI FI, which like USA, is owned by GE's NBC Universal unit, and the CW, a joint venture of CBS (Charts) and Time Warner (Charts). (Time Warner is the parent company of CNNMoney.com.) Revenue from the TV telecasts accounted for 22 percent of WWE's sales last year. The staying power of the WWE brand also helps the company sell consumer products, which is another key revenue generator for the WWE, representing 23 percent of total sales last year. Two key products are video games and toys; software developer THQ (Charts) sells WWE-licensed games while toy maker Jakks Pacific (Charts) sells WWE action figures. But the area where people see the most lucrative opportunities, not surprisingly, is digital media. So far, WWE has barely tapped into the online ad market; digital media revenue accounted for only 7 percent of the company's sales last year. One investor in the company said that increased pay-per-view revenue and attendance at live events are nice but what really will drive WWE's earnings and stock is an increase in online ad sales. "The real value creation and growth will come from monetizing the presence on the Internet, where the company has a fanatic and loyal fan base," said Bobby Melnick, general partner with Terrier Partners, a New York money management firm that owns the stock. "The notion that the WWE is a product that the advertising community can't sell to is a Madison Avenue/Greenwich elitist attitude. They are rabid loyal customers." Sileck conceded during the Citigroup conference that the company still has a ways to go before it can be considered to have a successful online presence. He pointed to the fact that WWE has about 16 million unique visitors monthly and that the company's site delivers about 46 million video streams a month. But it has been a challenge to turn this into ad revenue. "Traffic is terrific," Sileck said. "The trick is how do we get paid for it?" Michael Kelman, an analyst with Susquehanna Financial Group, said that WWE should be able to boost its online ad revenue significantly this year though since the company has been beefing up its online ad sales force. Kelman said the company previously only had two people selling ads for the site and that they were executives with TV ad-selling experience. Now, the company has about a dozen salespeople dedicated to selling online ads. Melnick added that the WWE could also cash in by developing an interactive virtual world on its site. In other words, think of something like Second Life with wrestlers. Still, McAlpine thinks that the WWE needs to develop a new group of stars that can attract more viewers, such as Hulk Hogan in the 1980s and The Rock earlier this decade, and not just the hard-core base of WWE fans. He said the Trump-McMahon "feud" is a good start but it might not have a long-lasting impact. "For this stock to make real money for investors, the WWE has to create more big heroes. Its last collection of stars all brought in the incremental fan. That's what they need," McAlpine said. Kelman agreed that the WWE would benefit from having more big brand-name stars but he pointed out that the stock probably doesn't have much downside at current levels. Shares trade at 19 times earnings estimates for next year. While that's not dirt cheap, it seems reasonable, given that analysts expect earnings growth of 13 percent. What's more, WWE has rewarded shareholders with a lavish dividend. The company has boosted its dividend three times in the past five years, and with an annual payout of 96 cents a share, the dividend yield is 6 percent. To put that in perspective, the yield on the 10-year U.S. Treasury bond is about 4.6 percent. "For long-term investors, WWE is very interesting because at very least you are getting a 6 percent yield. In this market, that's not something to turn your nose up at," Kelman said. That kind of yield should also keep investors from getting stressed out and losing their hair. We'll see if the same can be said for Vince and the Donald. Analysts quoted in this story do not own shares of WWE and their firms have no investment banking ties to the company. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|