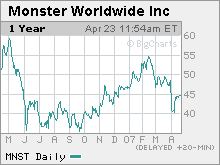

Wall Street bets on a Monster of a mergerShares of Monster Worldwide have surged as investors hope the new CEO - who sold the last company he was at - will do the same with the online job recruiter.NEW YORK (CNNMoney.com) -- Shares of Monster Worldwide, one of the Web's top online recruitment companies, have surged 11 percent in the past week and a half. But given that the company, which owns the Monster.com site, warned earlier this month that its first quarter sales would miss forecasts, analysts say that it's takeover chatter, not optimism about earnings, that's the most likely culprit behind the stock's rise. Monster (Charts) will report its first quarter results on April 26.

The company has faced tough competition from Yahoo!'s (Charts, Fortune 500) HotJobs and CareerBuilder - which is owned by newspaper publishers Gannett (Charts, Fortune 500), Tribune (Charts, Fortune 500) and McClatchy (Charts) - lately and has seen its stock plunge nearly 20 percent within the past 12 months. In addition to concerns about pressure from rivals, Monster is one of many companies that wound up announcing last year that it would need to restate earnings due to the backdating of stock options. As a result of the options scandal, chairman and CEO Andrew McKelvey stepped down in October. He was replaced by COO William Pastore. But Monster announced on April 12 that Pastore was leaving Monster and that the company hired Sal Iannuzzi, previously the head of Symbol Technologies, a maker of bar code scanners and radio frequency identification (RFID) tags, to be the new CEO. So investors appear to be hoping that Iannuzzi will do the same thing at Monster that he did at Symbol: sell the company. Like Monster, Symbol was facing accounting problems when Iannuzzi took over in January 2006. (Several Symbol executives were charged with securities fraud.) But only a few months later, Motorola (Charts, Fortune 500) agreed to buy Symbol for $3.9 billion, a nearly 20 percent premium. That deal, announced last September, closed in January. "Right before the management change, Monster announced that sales would be lower than its original target," said James Janesky, an analyst with Stifel Nicolaus & Co. "So I do believe the recent strength in the shares has to do with investors betting on a possible change in the strategic direction of the company with the new CEO." Ashish Thadhani, an analyst with Gilford Securities, added in an e-mail to CNNMoney.com that he felt that even before the most recent management shakeup, Monster was looking like an intriguing takeover target because of the departure of McKelvey, who owns stock that gives him about 30 percent of the company's voting power. And based on Iannuzzi's track record, Thadhani thinks that is yet one more reason why Monster could wind up being sold. Takeover rumors surrounding Monster are not new. During the past few years, there has been speculation that Monster could be a target for the likes of Yahoo and Google (Charts, Fortune 500) as well as newspaper publishers. More recently, private equity firms have been mentioned as possible suitors. But Monster has remained independent. With this in mind, another analyst said investors should not buy Monster merely because of takeover talk. "I've been covering Monster for a long time and every year there is a rumor that they are going to be acquired," said Steve Weinstein, an analyst with Pacific Crest Securities. "So I don't think that should be the motivation for buying the stock." But Kevin Steinke, an analyst with William Blair & Co., said he thinks that only a "modest" takeover premium is built into the stock price since Iannuzzi's hiring. He argues that the stock's drop after its revenue warning was too steep. Still, Weinstein added that it is just going to get tougher in the years ahead for Monster to grow its U.S. business. Yahoo has been aligning itself more closely with newspaper publishers and announced last week that its partnership with newspaper companies now includes more than 264 papers posting listing on HotJobs. What's more, several privately held job search engines, including Indeed.com, Jobster and Simply Hired, have cropped up to challenge Monster and other recruitment sites. "It is going to be more difficult for Monster going forward," Weinstein said. "We are entering a period where the market is gong to be more challenging and competition is getting tougher." Janesky agreed that Monster will likely find it harder to grow in the U.S. And he's also not convinced that a takeover is in the cards. So he thinks Monster's best course of action is to focus on international markets. Monster generated 27 percent of its total sales from outside North America in 2006. International revenues increased 64 percent in 2006, compared to sales growth of 26 percent in North America. "Monster needs to focus more on international segments. The markets are largely untapped and Monster has a first mover advantage in a couple areas of the globe, mainly in Europe," Janesky said. But international expansion could come at a price, Weinstein said. He points out that even though there are more opportunities for Monster abroad, it's currently a lot less profitable operating outside of the U.S. To that end, operating profit margins in Monster's international business were just 5.7 percent last year while the North American business generated an operating profit of 34.5 percent. Tobey Sommer, an analyst with SunTrust Robinson Humphrey, said, however, that the main reasons margins are so low abroad is because the company is spending heavily in order to boost its market presence and because other fixed expenses are relatively high now, given how small the company's operations are. As Monster ramps up outside the U.S., Sommer thinks costs as a percentage of sales will come down and Monster's profit margins in international markets should increase to the high 20 percent range over the next couple of years. So Monster would be wise to scare up some more sales growth by focusing abroad. But if the company's new CEO doesn't put Monster on the sales block soon, Monster might just frighten away those investors who've been bidding up the stock lately. Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking ties with the companies. |

Sponsors

|