Foreclosure bargain-huntingAuction sales of foreclosed properties are yielding extraordinary buying opportunities.NEW YORK (CNNMoney.com) -- Rising foreclosures will bring misery to many home owners - but bargain prices for some lucky home buyers. Real estate auction house Hudson & Marshall is currently marketing more than 500 foreclosed properties in Michigan alone from May 19 to May 24.

Mortgage Rates

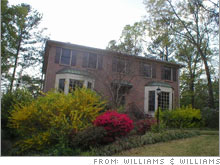

The prices will vary widely but, some people will walk away with homes for less than $5,000, according to Crystal Wright, spokeswoman for Hudson & Marshall. The company, along with dozens of others nationwide, specializes in auction sales of bank-owned foreclosure properties. Most of the properties have already gone through the entire foreclosure process. First banks took them back from borrowers who fell behind on payments. Then, they then put them through public foreclosure auctions (often held on county courthouse steps) where the homes failed to sell. The banks then cleared any title issues and put them back on the market through a traditional real estate broker. If the properties sit for 90 days or more on the market, with expenses piling up, banks get very impatient. That's when they call the auction houses, which attempt to make quick sales. The sale is usually a very simple transaction. "Unlike a foreclosure sale on the courthouse steps, all these homes are sold free and clear, no liens, no debt. The seller even pays for title insurance," said Dave Webb, one of Hudson & Marshall's owners. Business, according to Webb, is jumping; it grew 20 percent during the first quarter of 2007, usually a slow period for the company, compared with the fourth quarter of 2006. He anticipates even better times for the next year or two. Dean Williams, CEO of auctioneer Williams & Williams, said his company is also very busy. It sold 3,200 properties in the first quarter and currently offers residential properties from 36 states and the District of Columbia. Although many of the sales this year have clustered in the economically hard-hit Midwest, many of the homes coming to auction later this year will be higher-end properties from sun-belt states where the economies are generally strong, but speculative real estate investing has dried up. , such as California, Texas and Florida. "In June, we'll have 200 properties in San Diego and Los Angeles on auction," Webb said, "with an average value of around $300,000." In Detroit, Hudson & Marshall's average auction home is little more than $70,000. Other Michigan cities, such as Grand Rapids, bring higher prices, probably around $100,000 on average. The higher prices lure different kinds of buyers. "The portrait of the typical buyer has changed," said Wright. "We get a lot more young families, young single people and women now." These buyers go for houses in better condition and they intend to live in them. The less expensive homes, on the other hand, lure investor types looking to do a quick renovation and then resell or, more often, rent out the home to tenants. They look for deep discounts. Not all the auction properties are huge bargains. According to Williams, 12 percent of the houses he sells, most of which have already been marketed for an average of six months as conventional listings, sell at auction for more than the original asking prices. But most of the houses do sell for less, and about 15 percent of time "shockingly" so, said Williams. Buying a home at auction is fairly easy and straightforward but, even so, some people approach it with fear and trepidation. According to Wright, inexperienced buyers often attend one or two sales before they actually make bids. Bidders don't need to do anything special. Just, "Be there," Williams said, "Bring your driver's licence, show it to get a bidding paddle. If you win the bid you sign a contract and leave a 5 percent earnest deposit; it can be a personal check. After that, you have 30 days to close." Interested consumers can visit the Web sites of both companies to see properties that will be going under the hammer in the next few weeks. |

|