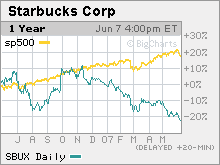

Starbucks needs a shot of caffeineStock Spotlight: Shares of the coffee chain have been ice cold lately, but they could start to percolate again soon.NEW YORK (CNNMoney.com) -- Forget the foam and make that latte skim, and sugar-free. Right now, Starbucks stock is really out of shape. Over the past year, shares of the Seattle-based coffee chain have been one of the worst performers in the S&P 500, tumbling about 20 percent.

But other than a recent sales hiccup, Starbucks (Charts, Fortune 500)' business has been pretty reliable, meeting or topping Wall Street earnings forecasts for the past eight quarters. And after years of rapid expansion, Starbucks still has aggressive store openings planned - and it's expanded its offerings beyond macchiatos and chai tea to breakfast sandwiches, books and music. Just this week, Starbucks released ex-Beatle Paul McCartney's newest album, making him the first artist released on the company's new Hear Music record label. But with the company facing higher commodity prices and growing competition, is Starbucks stock even worth a sip? As of last month, Starbucks had about 9,800 stores in the United States and some 4,000 in 39 other countries. Over the next four years, the company aims to add another 10,000 locations, relying on international growth in countries such as China. This fiscal year, Starbucks plans to open roughly 1,700 domestic stores. But growing pains have come with the expansion. Starbucks reported recently that the number of transactions at U.S. stores open at least a year did not grow during the latest quarter. Investors had become accustomed to low single-digit growth. And in February an internal memo was leaked in which company founder and Chairman Howard Schultz remarked he was worried that the company's rapid expansion was diluting the brand experience for its customers. Schultz has since defended his comments and reaffirmed expansion plans for the company, but analysts worry that the coffee chain may not have much more room to grow. Investors are also worried the costs of opening new stores, such as distribution expenses and commercial rent, are weighing on profit margins. Or worse, the new stores could start cannibalizing sales at existing locations. "At some point this is going to be a mature market," said Bill Hulkower, an analyst with the retail research firm Mintel International. "The big question is when does that occur." Feeling the heat Even though Starbucks towers over U.S. competitors such as Caribou Coffee (Charts) or Peet's Coffee & Tea (Charts) in number of stores, sales and profits, more formidable competitors have emerged on the landscape. Closely held Dunkin' Donuts, Starbucks' closest rival, has been ramping up its expansion at home and in Asia, and marketing itself as a Starbucks alternative with its "America runs on Dunkin'" ad campaign. Meanwhile, McDonald's (Charts, Fortune 500) announced last year it would sell gourmet coffee at its stores, hoping to win a bigger piece of the retail coffee market, which is estimated to be worth over $12 billion, according to the Specialty Coffee Association of America. "If [consumers] see McDonald's has a good cup of coffee, you are going to find some people who will switch," said Howard Penney, an analyst with Prudential Equity Group. Even though coffee bean prices have cooled lately, Starbucks has also been feeling the pinch of rising commodity prices for things like milk, which raises costs, and gasoline, which can crimp consumer spending. Just last week, the company said it would switch to 2 percent milk, rather than whole milk, in its espresso-based coffee drinks in North America by year-end, a move some analysts say was an attempt to ease the sting of record-high milk prices. Two percent milk is generally cheaper than whole milk. And if average gasoline prices stay above $3 a gallon, that's a headwind for Starbucks too, as consumers tighten their belts and cut their daily $4 lattes out of their budget - if they haven't already. A tasty stock Despite the numerous risks Starbucks faces, Wall Street's expectations for the company still remain pretty high. The stock trades at more than 25 times analysts' earnings forecasts for the fiscal year ending in September 2008. That may seem expensive but considering that earnings are expected to grow about 22 percent a year on average for the next few years, the valuation isn't that frothy. Plus, Starbucks actually is cheaper than Peet's Coffee and Tea, which trades at about 31 times estimates despite a long-term projected earnings growth rate of only 18 percent. Caribou is expected to lose money this year and next. Donut and coffee chain Tim Hortons (Charts) trades at a discount to Starbucks, at just 20 times earnings estimates for 2008. But earnings are only expected to grow 13 percent a year for the next few years. The consensus on Wall Street is that after the recent swoon, Starbucks shares have become much more attractive lately. According to Thomson First Call, 17 of the 21 analysts following the company have either a "strong buy" or "buy" on the stock and the consensus 12-month price target is $40.91, nearly 50 percent higher than its current price of about $27.50. "(We) believe the roughly 28 percent sell-off since mid-November has created an attractive entry point for long-term investors," Glen Petraglia, an analyst with Citigroup, wrote in a recent research note. Assuming Starbucks can adjust to rising commodity prices and maintain the extraordinary brand loyalty it has with customers, even as it adds more stores worldwide, it could be a good bet that Starbucks will deliver to investors with "Venti"-sized expectations. The analysts quoted in the story do not own shares of Starbucks, except Mintel International's Bill Hulkower. None of their firms have an investment banking relationship with the company. |

|