Samsung's climb to No. 2Samsung has edged Motorola aside to become the world's second-largest maker of cell phones. Fortune's Stephanie Mehta looks at the Korean giant's stealthy rise.(Fortune Magazine) -- While the wireless industry was going wild this summer over Apple's iPhone and the mere prospect of Google's foray into the business, Korean electronics maker Samsung quietly hit a milestone: It surpassed Motorola to become the No. 2 seller of mobile phones. In the second quarter Samsung shipped 37.4 million devices, compared with 35.5 million for Motorola. The low-key nature of Samsung's achievement -- the company didn't even issue a press release -- reflects its steady approach to the cellphone business, which it entered a dozen years ago.

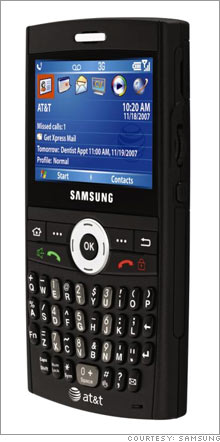

Eschewing glamour, Samsung has positioned itself as a maker of reliable, understated phones for folks who want something between the multidimensional iPhone and no-frills handsets. Samsung, says a rep for one U.S. wireless operator, is the "sensible shoe of cellphones." But Samsung isn't satisfied with being a middlebrow No. 2. At a wireless industry conference earlier this year, telecom chief Gee Sung Choi made it clear he's gunning for the market leader, Nokia, which sold 100 million mobile phones last quarter. "There is no reason we cannot catch up with Nokia," he told the conference. Choi speaks from experience. A Samsung lifer, he ran the television division from 1998 to 2003 and pushed it from sixth place to first. To increase market share, Choi wants Samsung to sell more phones in emerging economies like China. It won't be easy; Motorola (Charts, Fortune 500) and Nokia (Charts) lead the market, and the field is crowded with local brands such as Lenovo and ZTE. Instead of selling stripped-down starter phones, Choi's stated strategy is to sell slightly more upscale versions -- in essence becoming the mid-market phone provider to the developing world. At the same time Choi is going after the high-end user who wants to surf the web, listen to music, watch videos -- or do all three -- on a cellphone. Luxury phones are where profits and all-important buzz come from, a fact that is not lost on the competition. Companies from Apple (Charts, Fortune 500) to BlackBerry maker Research in Motion (Charts) to LG Electronics to Nokia and Motorola are scrambling to develop the next "it" phone. Samsung is having some success, mostly by competing on price. UpStage, a music phone that downloads songs over the air, costs about $99 with a two-year service contract from Sprint (Charts, Fortune 500), compared with the iPhone's $499 base price. BlackJack, a phone with a full keyboard, also costs about $99 with a service contract, half the price of a new BlackBerry. Fashionistas scoff at the idea of wearing high heels made by a gym-shoe maker, but consumers might just be willing to buy sexier models from this maker of sensible cellphones. |

Sponsors

|